Monetary policy responsibility cannot substitute for government irresponsibility – Jean-Claude Trichet

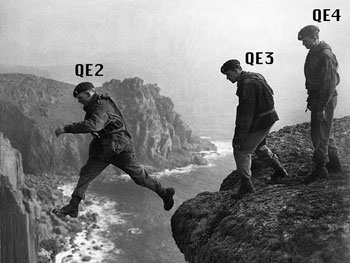

A funny thing happened on the way to QE2: rates rose rather then fall. It appears The Ben Bernank has now redefined the mission from keeping long rates down to pushing stock prices up. He says he wants to create a “wealth effect” among investors that pulls the economy out of the slump. Never mind that rising commodities prices (especially oil) create a corresponding “poverty effect” for the middle class. How will this end?

A funny thing happened on the way to QE2: rates rose rather then fall. It appears The Ben Bernank has now redefined the mission from keeping long rates down to pushing stock prices up. He says he wants to create a “wealth effect” among investors that pulls the economy out of the slump. Never mind that rising commodities prices (especially oil) create a corresponding “poverty effect” for the middle class. How will this end?

John Mauldin’s latest, Thinking the Unthinkable, is a must read. (Also available here.) He notes how Bernanke in 2002 believed that the Fed could target an inflation rate such as 2%, raising short rates to stifle inflation and lowering long rates to fight deflation by buying forward in the Treasury curve. This buying forward is what Ben means by Quantitative Easing (QE). John’s comment on QE2:

Then a funny thing happened on the way to QE2: long-term rates began to rise all over the developed world. As Yogi Berra noted, “In theory, there is no difference between theory and practice. In practice, there is.” It’s got to be driving Fed types nuts to see the theory of QE, so lovingly advanced and believed in by so many economists, be relegated to the trash heap, along with so many other economic theories (like that of efficient markets). The market has a way of doing that.

So, Liesman asked Bernanke about one minute into the clip (link here) about the little snafu that, following QE2, both interest rates and commodity prices have risen. How can that be a success? Ben’s answer (paraphrased):

“We have seen the stock market go up and the small-cap stock indexes go up even more.”

Really? Is it the third mandate of the Fed now to foster a rising stock market? I wonder what the Fed’s target for the S&P is for the end of the year? That would be an interesting bit of information. Are we going to target other asset classes?

So isn’t rising stocks goodness? What could go wrong? Richard Fisher of the Dallas Fed has been plainspoken about the risks:

The new Congress and the new staff in the White House have their work cut out for them. You cannot overstate the gravity of their duty on the economic front. Over the years, their predecessors — Republicans and Democrats together — have dug a fiscal sinkhole so deep and so wide that, left unrepaired, it will swallow up the economic future of our children, our grandchildren and their children. They must now engineer a way out of that frightful predicament without thwarting the nascent economic recovery.

So far the new Congress does not appear serious. Only three House members joined the Tea Party Caucus. The first major action is to try to repeal ObamaCare – a futile and symbolic effort at best. The stated goal is to reduce $100B from spending – a drop in the bucket.

What has gone wrong for Bernanke is the rise in rates. The 10 yr is approaching a record spread with the 2 yr: 273 bp where the record is 283 reached in Feb 2010. Normally this spread is goodness for banks, as they can borrow short and lend long in the spread; but most of their mojo would come from mortgage lending, and new mortgage applications are “plumbing” 15 year lows. So instead of profiting, they are seeing the value of homes drop, pressuring the asset values for their carried mortgage base. At this point either he has to reconsider steps to reduce long rates, or hope Mother Market takes care of it for him.

What may go wrong next for Bernanke is a drop in stocks. A stock fall would show that the Fed Emperor has no clothes, that his justification for QE2 is baseless. A serious correction eradicates the wealth effect, and the continuing rise in commodities extenuates the poverty effect from high oil prices. In any event, the purported wealth effect has been studied and found wanting – not much there, and very little trickle down to the middle class.

The biggest risk comes from theory hitting reality. Niall Ferguson (economic historian) decries the economic theorists for believing in some form of neo-classical equilibrium, that things tend to stay in balance. Neo-classicists, including Bernanke, completely missed the 2008 crisis because it was outside their view of how the world works. They thought markets were self-correcting and changes incremental. The history of booms & busts, however, says that change can be rapid and dramatic – crashes not slow slides.

In other words, QE could spiral out of control. Already it is not working as Bernanke expected. As Niall concludes:

Complex systems look like they are in equilibrium, but they are not: they are constantly adapting, highly decentralized, interdependent systems and this process of adaptation can continue for quite a long time. And you think to yourself when you look at it, that’s in a wonderful equilibrium. That’s how we think about the economy. That is how economists teach economics. They talk about it in terms of equilibrium.The bad news is that in fact we inhabit a complex system that has virtually nothing to do with the neoclassical model that you are taught in Econ 101. And that’s why the economists failed to predict the financial crisis …

For me American power if you generalize beyond the realm of finance through the geopolitical system is a perfect example of a highly complex system which looks like it is in equilibrium but like all the great empires of the past is quite close to the edge of chaos. And our nightmare scenario should be that something happens to us like happened to the Soviet Union… It suddenly just falls apart.

And I think the trigger, the catalyst if you want to switch to chaos theory the butterfly in the tropical rainforest that flaps its wings and posits the distant thunderstorm is going to be the credibility of fiscal policy. That just seems to me like the obvious place where things can turn nasty, and they turn nasty with amazing speed.”

The constant redefining of reasoning behind QE2, coupled with the lack of real need for it and lack of evidence that lower rates or higher stock prices actually fulfill the employment mandate leads me to believe this is a desperate Fed that is trying to continuously recapitalize the banks and fund our country’s deficit. Of course that sales pitch won’t fly with the public…so we get the “lack of inflation” and “higher stock prices will inspire confidence which will lead to hiring” bill of goods sold to us.