Calculated Risk directs us to an LA Times story identifying the possibility that rising gasoline prices will undermine the recovery. He also reminds us that James Hamilton recently wrote on the subject as well, concluding:

I could certainly imagine that an abrupt move up in gasoline prices from here could hurt the struggling recovery of the domestic auto sector and dampen overall consumer spending. I do not think it would be enough to give us a second economic downturn, but it could easily be a factor reducing the growth rate.

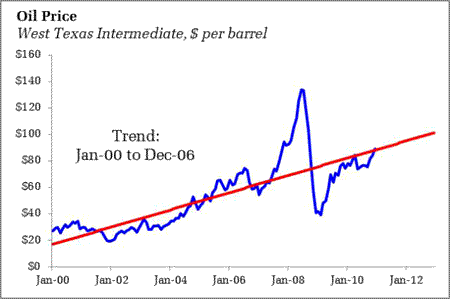

I would add that the current price appears inline with the general upward trend since the beginning of last decade. Here I extrapolated on the 2000-2006 trend:

The sudden rise in oil in 2007, a clear deviation from the trend in the first half of the decade, led to substantial demand destruction, a severe blow to the US economy which at the time was struggling under the weight of the housing meltdown and the financial crisis (and arguably still is). The recent rise in oil appears different, more a reestablishment of the previous trend.

From this point on, I tend to think the issue is less of will oil continue to rise, but at what speed will it rise. The trend over the last decade appears to make a lie of recent claims that we have entered into a period of plentiful energy (see also James Hamilton), and while higher oil prices will tend to crimp growth, a gradual price increase should allow for non-disruptive adaptation on the part of economic agents.

What I more concerned with is the possibility of another sharp spike in prices, such as occurred in 2007-08. A repeat of that incident would once again cripple households, who, after 18 months of recovery, are just barely starting to see the light. The most obvious channel to trigger such a spike is monetary, that the Federal Reserve’s large scale asset purchases trigger a disruptive decline in the Dollar. Federal Reserve Chairman Ben Bernanke was not buying that story last week. From the Wall Street Journal:

Mr. Bernanke says his quantitative easing policy is not to blame for the sharp increase in the price of oil. Instead, oil’s rise is the result of strong demand from emerging markets. The dollar, he notes, has been “quite stable” in the past few months. One worry in the run up to the Fed’s $600 billion bond-buying announcement in November was that it was going to cause the dollar to fall sharply, which would in turn put upward pressure on commodities like oil priced in dollars. The stable dollar, which has risen since the program’s announcement, implies the Fed isn’t the problem in commodities markets, Mr. Bernanke notes.

Movements in commodity prices have not been sufficiently disruptive to suggest a Fed-induced cause is at hand, and have tended to be more consistent with indications of general economic improvement.

In short: Energy prices are yet another thing to keep an eye on. Still, recognize the increase to date appears to be more of a return to the recent trends than a disruptive price spike. Not that rising prices won’t have consequences, but the trend of the past decade may simply be something we need to learn to live with. Rather than watching the trend itself, be watching for upward spikes from that trend – those would almost certainly translate into something nasty for the still struggling US economy.

Leave a Reply