Shares of DryShips Inc. (DRYS) are off sharply in early Monday trading after the dry bulk carrier was cut to “Underweight” from “Overweight” at Morgan Stanley (MS). The bank says it is bearish on the shares following news of an order for 12 newbuild tankers. The deal, which was valued at $770 million, could lead according to Morgan Stanley’s analysts to a further asset discount for the stock.

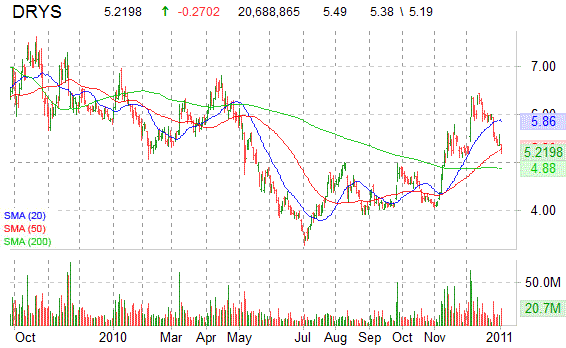

Shares of DryShips are currently down -4.9 percent to $5.22 after hitting $5.19 earlier, the lowest intraday price since December 2. Volume has exploded with more than 20 million DRYS shares already trading hands compared to a daily average volume of 17.1 million. The day’s trading range for the ticker has been between $5.19 and $5.38 per share. DRYS has a 52 week low of $3.28 and a 52 week high of $6.95. The stock has a market cap of $1.62 bln, a 50-day and a 200-day moving average of $5.30 and $4.88, respectively.

Morgan Stanley, which maintained its $9.50 price target on the shares, also said it sees 2010 EPS of $0.89 and 2011 EPS of $0.94.

DRYS currently trades at a trailing P/E of 24.60, a forward multiple of 4.94 and a P/E to Growth ratio of 0.57.

Disclosure: No Position

Leave a Reply