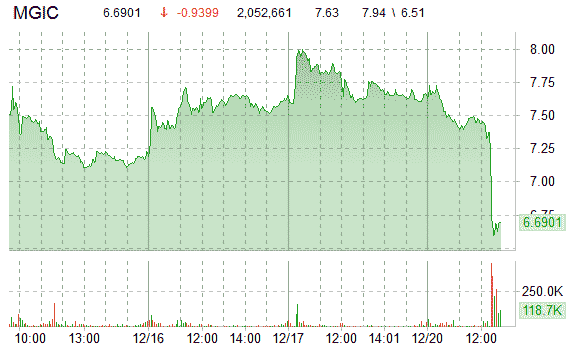

Magic Software (MGIC) today announced that it entered into definitive agreements to sell securities to institutional investors in a private placement for aggregate gross proceeds of approximately $21.2 million. The co., which will use Rodman & Renshaw (RODM) as the exclusive placement agent for the offering, said it will sell an aggregate of approx. 3.26 million ordinary shares at a price of $6.50 per share (MGIC’s close on Friday afternoon was $7.63/sh).

Technically speaking, MGIC is currently above its 50-day MA of $4.61 and above its 200-day of $2.96. The security, which continues challenging its 20-day EMA located at $6.50, trades at a trailing P/E of 22.06, EPS of 0.30 and a mrq Price/Book of 3.80. More than 2 million MGIC shares have already traded hands compared to a daily average of around 682K.

In the past year, Magic Sofware has hit a 52-week low of $1.55 and 52-week high of $8.43.

At last check, MGIC shares were down $0.96 to $6.65, a loss of 12.84%.

Leave a Reply