Lululemon Athletica Inc. (LULU) printed a new 52-week high on Thursday, the highest intraday pps since the company went public in July 2007. The the yoga-inspired retailer offered e strong outlook for the fourth quarter with earnings expected to be in the range of at least 46 cents a share, topping the 41 cent – average estimate of analysts.

During its third-quarter, the co. reported earnings of $25.7 million, or 36 cents a share, an 82% spike from $14.1 million, or 20 cents, in the year-ago period. Analysts were calling for a profit of $0.25 a share.

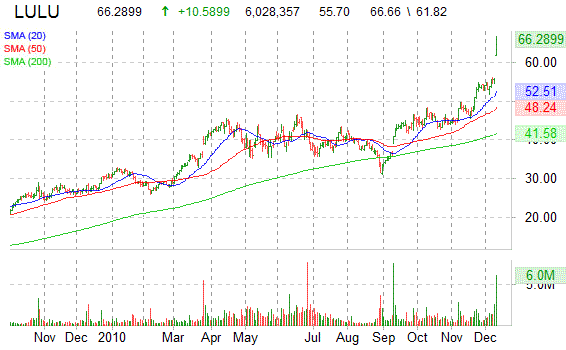

Technically speaking, the shares of Vancouver, Canada-based LULU have added 18.5% in electronic trading, with the shares returning year-to-date 101.30% as of today’s hod price of $66.22. The equity is experiencing massive volume; mid-way through the session the ticker has already traded 6 million shares, well above the daily average volume of 1.2 mln shares.

LULU is currently trading above its 50-day moving average of $48.24 and above its 200-day moving average of $41.58. The security recently started pulling back to test the $45.00 support area, which since late October has acted as a springboard to launch LULU higher.

Looking at the ticker’s 1 year chart, as LULU continues its upward trajectory, a capitulation by the bears (short % of 45.81 million float is at 25.70%, or 9.11 million) could send the shares rallying even higher.

LULU currently trades at a trailing P/E of 56.08, a forward P/E of 44.71, and a P/E to Growth ratio of 1.62.

At last check [11:59 a.m. EST], LULU shares were up over $10.50 in trading on the Nasdaq. The 52 week trading range for shares of Lululemon Athletica Inc. has been between $25.75 and $56.12 per share.

Leave a Reply