DryShips Inc. (DRYS) continues to squeeze higher this morning as the company’s stock retests new intraday highs and the current resistance zone surrounding the $5. 50 – $6.00 area. The ticker rallied as much as 12 percent to $5.79, the most intraday since July 27, 2009, after the Greek deepwater drilling firm reported a 57% rise in third-quarter profit.

DryShips said yesterday that drilling rig revenues came in higher than expected — which is what’s driving the stock in today’s session — while operating expenses across the board were lower than expected. Net income for the Athens – based company came in at $49.3 million, or 18 cents per share (13 cents better than expected), in the three months ended September 30, compared to $31.4 million, or 11 cents per share on a Y/Y basis. Revenue from drilling contracts advanced to $110.4 million from $101.7 million. The company also reported a net income excluding some items of $99 million, or $0.38 cents a share vs consensus of $0.25. Revenues rose to $225.5 million — up 1.5% — vs the $216.9 million consensus.

Looking ahead to FY2011, DryShips CEO George Eonomou said the company was primed to outperform the spot market for dry bulk vessels next year, with 80% of the co.’s fleet time chartered at around $37K per day. On the company’s deepwater drilling business, Eonomou remarked, “The ultra deepwater market has turned a corner in the last couple of months and we believe that current enquiry from operators matches or may even exceed the supply available in 2011”.

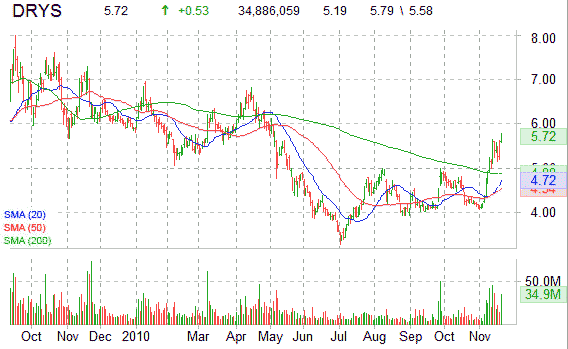

Technically speaking, the shares of DRYS are down more than 27% since the start of 2010. However, since the stock found a bottom in the $4 region in late August, the equity has displayed a relative narrow range intraday throughout the last several months along the $4.00 – $5.00 area. Next area of interest lies around the April highs in the $6/$6.75 area.

DRYS currently trades above its $4.54, 50-day MA and $4.88, 200-day MA. The security has a trailing twelve P/E of 36.55, a forward multiple of 5.24 and a P/E to growth ratio of 1.15.

DryShips gained 53 cents, or 10.21%, to $5.72 at 1:09 a.m. in Nasdaq composite trading after rising as high as $5.79.

Today’s volume is massive: more than 34.5 million DRYS shares have already traded hands compared to a 12-week day average volume of 12 million shares.

Leave a Reply