On Friday, we got the big employment report for October. It showed that a net of 151,000 jobs were created in the economy. (for much more detail see Employment Report In Depth, pt. 1 and pt. 2). However that is a very small fraction of the total number of jobs that were actually created. It subtracts out the number of jobs that were also destroyed in the month.

In any economic environment, there will always be jobs being created, and jobs being lost. The difference between them is what gets the headlines. However, with a month’s delay we get to look a little bit deeper and see not just the net number of jobs created or lost, but the totals on each side of the equation. It also tells how many job openings there were in the economy. This is in the “Job Openings and Labor Turnover Survey,” or JOLTS. Today we got the JOLTS for September.

JOLTS in September

In September, the total number of job openings fell by 5.27% from August, but is still 11.6% above year-ago levels. If just private-sector jobs openings are considered, the number of job openings fell by 5.74% on the month and is up 11.19% year over year.

While the trend is still upward, the dip in openings in September is disappointing. Recall that the September employment report was a bit on the disappointing side, although it was subsequently revised higher from a loss of 57,000 total jobs (including Census layoffs) to a loss of just 41,000. While there is always a little bit of statistical noise between the two surveys, it looks like the September numbers will again be revised to the better, based on the JOLTS numbers.

In September, the total number of people finding new jobs rose 0.82% from August to 4.190 million, and the total number of people losing their jobs (for whatever reason) fell by 0.48% to 4.190 million, so the net number of jobs for the month should have been unchanged (although 41,000 would be within the margin of error for such a survey). Relative to a year ago, the number of total new hires is up 2.42% and the total number of job separations is down 1.97%.

On just the private-sector side, the number of people getting hired rose 1.54% on the month and 2.87% on the year, and the total number of job separations is up 0.29% for the month but down 4.59% year over year. On a year-over-year basis, that is real progress.

People leave their jobs for three reasons, they quit, they get fired or laid off or what the JOLTS report describes as “other,” but is mostly retirements. When you dig down a little deeper, the news gets substantially better, particularly when just looking at private industry. There is a very big difference between getting a pink slip and telling your boss to “take this job and…” In the latter case, most people already have another job lined up. If they do, it shows at least some confidence in the economy.

Jobs Activity Breakdown

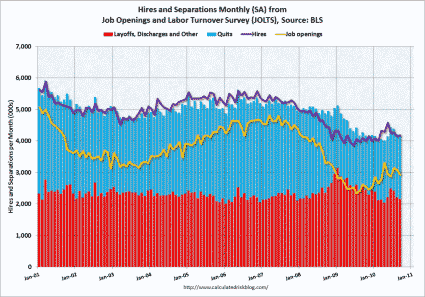

The graph below shows the number of job openings (yellow line), the number of people being hired (purple line), the number of people being laid off (or being fired or retiring — red bar) and the number of people quitting (blue bar). The difference between the purple line and the top of the stacked blue bar corresponds (roughly) to the number of net jobs gained or lost in the economy in that month as reported in the big employment report.

While the total number of job separations rose only slightly on the month, the number of people leaving their jobs involuntarily fell by 3.71% for the economy as a whole. Partly that was due to the fact that there were far fewer people being laid off in September from temporary Census jobs than there were in August. Government layoffs were down 15.06% on the month, but on a year-over-year basis they have soared 41.96%.

Looking at just the private sector, the number of layoffs is down 2.09% on the month, and year over year they are down 24.2%. The number of people getting laid off was not particularly high from a historical perspective. It is down by roughly a million per month since the worst days of the financial crisis and its aftermath.

Unfortunately, the JOLTS survey only goes back to 2001, so it is of limited usefulness in comparing where we are relative to coming out of other recessions. One thing, though, that jumps off the chart is that both the rate of new hiring and the total number of job losses are well below historical averages. In other words, the key reason so many people are out of work is a lack of hiring, not an excessive amount of firing.

Another thing to note is that during the worst of the economy losing net jobs in late 2008 and early 2009, the total number of layoffs soared much more than did the total number of job separations. When it looked like the entire economy was coming apart at the seams, the last thing you wanted to do was quit your existing job.

That is changing fairly dramatically. The number of people who told their boss to “take this job…” rose by 2.20% on the month and is up 19.0% year over year. As a percentage of all people leaving their jobs, it rose from 40% a year ago, to 47% in August, to 49% in September. That is a significant difference, and is real evidence of more confidence in the economy and the overall job picture.

Job Openings & Geographic Mismatches

One thing that is a bit troubling is that the number of job openings has risen much faster than the total number of new hires. This also appears to have happened following the 2001 recession as well, although it was a slower process and not as dramatic.

Since the JOLTS report is relatively new, it is not possible to say if that relationship is normal coming out of recessions, or if it really is different this time. There is a concern out there that some of the unemployment that we are seeing in the economy is turning into structural unemployment rather than just cyclical unemployment.

Structural unemployment occurs when there are mismatches between the jobs available and the abilities and locations of the work force. A job opening for a nurse in Seattle does not do much good for a construction worker who is out of work in Phoenix. I see no particular reason why the skills mismatch would have increased dramatically over the past two years.

The one area where there has probably been a big increase in skills mismatches is in the construction industry. That industry has traditionally been a source of relatively high-paying jobs for those without a lot of formal education. Construction workers account for about a quarter of all job losses in the Great Recession, and they might have a particularly hard time finding work in other parts of the economy.

There is a good reason though why the geographic mismatch would have increased. Historically, one of the great strengths of the U.S., especially relative to Europe, has been the geographic mobility of its labor force. Americans have always been a mobile people. If there are no jobs in Boston, we historically have pulled up stakes and moved to Austin. Europeans are far less likely to move from Athens to Amsterdam in search of a new job.

However, moving usually involves selling your current home. If you are $50,000 underwater on your current place, it means that you have to bring a check for $50,000 to the closing when you sell your house (actually more when you factor in the realtor’s cut). If you have been out of work for several months, chances are it is going to be hard to scrape up that 50 large. Still, most of the high unemployment levels we are seeing stems from cyclical unemployment (a lack of aggregate demand) not from structural factors.

Encouraging Report (for September)

Overall, this report is encouraging, although it does deal with September, not October of November data, and it thus a bit stale. The economy will always have jobs being created and jobs being destroyed, and at much, much higher levels than the net number between the two that everyone tends to focus on.

In a healthy economy, most people who leave their jobs will be doing so of their own accord, because they think they can do better elsewhere, not because the office is shutting down or drastically reducing the work force. Over the last year we have made substantial progress in that direction.

Leave a Reply