Endo Pharmaceuticals (ENDP) recently announced a major acquisition which will push earnings significantly higher in 2011. The company has good value fundamentals to go along with the growth, as it has a PEG ratio of just 0.80.

Endo Pharmaceuticals provides healthcare solutions to healthcare professionals to help them manage the needs of patients in areas such as pain, urology, oncology and endocrinology.

The company develops and commercializes branded and generic pharmaceutical products to manage pain.

Acquiring Qualitest for $1.2 Billion in Cash

On Sep 28, Endo announced it had entered into an agreement to purchase Qualitest Pharmaceuticals, the 6th largest generics company, for $1.2 billion in cash. The company will use $500 in cash, $300 in a revolving credit facility and $400 million in secured financing.

40% of Qualitest’s portfolio is controlled substances with 17% being liquids. Qualitest has 175 product families. 40% of Qualitest’s revenues were derived from pain products.

Endo expects significant revenue and earnings growth from the combined companies. It will be immediately accretive to earnings in the first full year after the close by adding $400 million in revenue and 40 cents in EPS.

The deal is expected to close in late fourth quarter 2010 or early in 2011.

Reaffirmed 2010 Revenue Guidance

Endo also reaffirmed its 2010 revenue guidance eon Sep 28, of between $1.63 billion and $1.68 billion.

Earnings per share are still expected in the range of $3.30 and $3.35 per share.

Zacks Consensus Estimates Already Higher

1 estimate has moved higher for 2010 in the last week. The 2010 Zacks Consensus Estimate is up 13 cents to $3.34 in the last 60 days. This is at the high end of the company’s guidance range.

Given that Endo just recently reaffirmed, we’ll have to wait and see if there are revisions to the current estimates.

Right now, analysts expect earnings to grow 17.6% compared to 2009. They also expect 10% earnings growth for 2011 but clearly that will change due to the acquisition announcement.

Endo is expected to report earnings on Oct 28.

Still a Value Stock

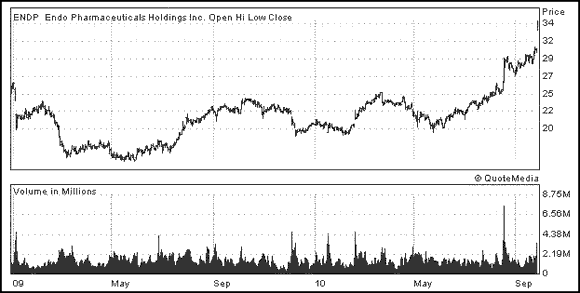

Share of Endo jumped on the acquisition announcement, pushing the stock to a new 2-year high.

However, Endo is actually cheap compared to its peers, trading at just 9.2x forward estimates versus its peers at 14.6.

The company’s price-to-book ratio of 2.3 is also under its peers at 2.7.

It also has a stellar return on equity (ROE) of 23.6%.

Endo Pharmaceuticals is a Zacks #1 Rank (strong buy) stock.

Leave a Reply