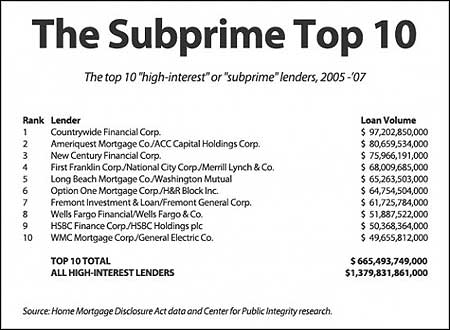

A report released today from the nonprofit ‘Center for Public Integrity’ found that many of the banks now collecting billions of dollars in taxpayer bailout money owned or bankrolled subprime lenders that directly contributed to the meltdown of the global economy.

From WaPo: The group analyzed federal data on 7.2 million mortgages made from 2005 through 2007, a period that covers the peak and collapse of subprime lending.

Banks that received federal bailout money financed at least 21 of the top 25 subprime lenders, the investigation found. They owned these lenders, extended them credit, or bought their loans and then sold them as securities.

Wells Fargo, JP Morgan, Citigroup, Regions Financial Corp., GMAC, Capitol One and the insurance company AIG all owned subprime lenders, according to the center’s tally.

The center’s report also maintains that government officials were slow to react to warnings about the subprime crisis. And it said the top 25 subprime borrowers spent at least $280 million on lobbying during the past decade. Overall, the financial services sector has spent $3.5 billion lobbying Congress since 1998, it said.

I guess we are not exaggerating when saying this is a massive government regulatory failure of catastrophic proportions.

Image: Public Integrity

Leave a Reply