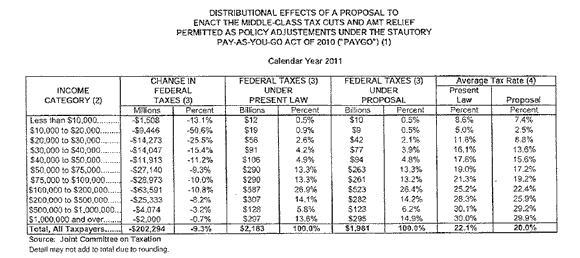

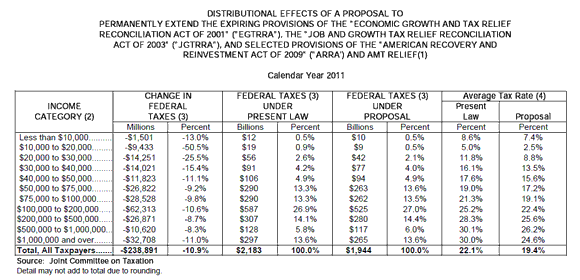

Tuesday, House Ways and Means Democrats presented Jackie Calmes of The New York Times with tables from the Joint Committee on Taxation showing the average income tax cuts of extending the Bush tax cuts for those under $250,000. Taxpayers in all income groups would receive large tax cuts, even those with incomes over $1 m. Here’s her article from yesterday.

Where’s the tax increase on those over $250,000? That’s the magic of averages. Extending all of the Bush tax cuts would cost approximately $3.8 tr. over the next 10 years, and about $700 b. of that would be lopped off from those over $250,000 under President Obama’s proposal. However, the remaining $3.2 tr. of tax cuts (rounding error), mostly the 10% bottom bracket, the $1,000 child credit, and the marriage penalty relief, benefit all taxpayers regardless of income. Those offset the increased top rate to 39.6% and other tax increases on many, but not all, of those over $250,000.

Ways and Means did not release tables showing the breakout of the change in federal tax liability between those with a net tax cut and those with a net tax increase. That would show the increase. Also be aware that the attached tables show only the calendar 2011 change in liability, $202.3 b. for the President’s proposal and $238.9 b. for extending all of the Bush tax cuts, not the 10-year $3.8 tr. and $3.2 tr. change in receipts.

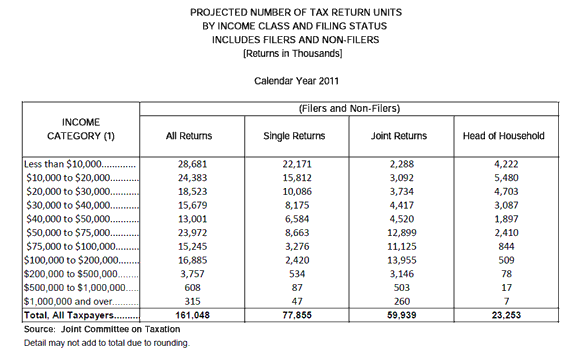

Households that earn between $58,200 and $68,000 will actually be hit the hardest if all the tax cuts expire. Taxes on these households will increase from 15% to 28%, because they'd be placed in a higher tax bracket. **This is an increase of 86.67%, by far the largest increase on any tax bracket.** (Under Obama’s proposed plan, the federal taxes would increase from 15% to 25%, again because these households would be in a higher tax bracket.) Why are middle class families like this facing such a massive increase in taxes? And why is no one talking about it?