Ezra Klein writes an interesting article asking some economists what the revenue maximizing tax rate is.

The answer from the conventional wisdom of public-finance economics is about 60-70%. This is based on relying on current estimates of the short term estimates elasticity of taxable income, measured in micro-studies where different people get different tax changes. This is also what I have been taught. However as the work of Raj Chetty has shown, due to costs of adjusting to tax rate these comparisons probably underestimate the responsiveness to taxes. I think if Ezra Klein asks the same question 10 years from now the answer will have changed somewhat.

What strikes me most however is the answer by Bruce Bartlett. At one point, Bartlett was on the right. But people occasionally change ideology. Currently Bartlett is best described as a European style Social Democrat. Most of what he writes are attacks on the American right, demands that taxes be raised, defense of President Obama, meanwhile pretending he is on the right in order to get more media attention (a Social Democratic attacking free market policies is not news, someone pretending to be a “right-winger” doing so it).

Ezra Klein knows this perfectly well, and is therefore quite dishonest in classifying Bartlett as on the “right”.

Bruce Bartlett thinks the revenue maximizing tax rate may be 83%, higher than any of the leftist economists Klein interviewed.

The important paper from Uhlig that Bartless cites is interpreted by most economists as a strong case in favor of lower taxes, not higher taxes. Harald Uhlig is a brilliant U-Chicago macro-economists. As a rule of thumb macro-economist conventional wisdom believes in higher responsiveness of economic activities to taxes than micro-economists and therefore that taxes are more distortive than micro-economist think.

Uhlig believes that Europe on a whole is quite close to the top of the Laffer curve, especially on capital taxes.

He also thinks that taxes in the United States can only go up by less than one third before the U.S. hits the revenue maximizing rate. This is not enough to fund the massive new welfare state that the left is trying to build.

Now, remember always that the criteria for an optimal tax rate is not to maximize revenue. Long before the revenue maximizing rate is reached, the government is destroying 2 dollars or more from the private sector just to collect 1 dollar for the public sector.

The marginal government expenditure it is quite unlikely to produce twice or several times as much social good than what is spent.

Uhlig thus concludes that “In the EU-14 economy 54% of a labor tax cut and 79% of a capital tax cut are self-financing.”

A 54% self-financing tax cut means that if the state puts more than 2$ in the pockets of the tax-payers, government spending only has to go down with less than 1$. Sounds like to pretty sweet deal to me.

A 79% self-financing tax cut means that the state can give 5$ to the private sector with only a loss of 1$ for the public sector. Only fools or committed socialists would defend this rate of taxation.

This is evidence of a deeply dysfunctional system, not something the United States should emulate, as Bartlett wants to do.

We can rank the social value of everything the state spends on from best to least necessary. Sure, there are some public expenditure items that may be worth 5 times what they cost, such as (say) police and cancer research. But in countries where 40-50% of national income is public (the United States is getting close to this as well), there are lots and lots of marginal forms of public expenditure, such as subsidies to leisure activity, subsidies to weak sectors and agriculture, various forms of unemployment and sick leave expenditure.

The social benefit of these activities are hardly worth 2-5 times what they cost.

Many people do not not really understand the Laffer curve. They think as long as we are to the left of the revenue maximizing point, everything is fine. The left seems to think that preferably we should be exactly on top, maximizing revenue as a share of GDP.

But getting close to the top of the Laffer curve means that we are exponentionally getting closer to an infinite marginal cost of government activity. At the top, that is the cost of government activity. After the top we are in negative region, every tax dollar destroys lots of private activity as well as lowering public sector activity.

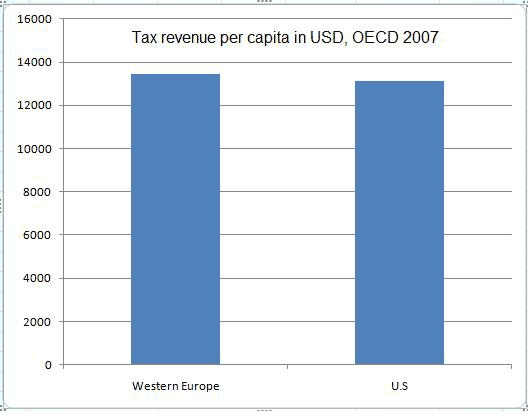

Let me also give you a simple graphic illustration of tax rate and tax revenue in the U.S and western Europe (defined as the EU-15 minus Luxembourg that Trabandt and Uhlig provide data for, and assuming that workers on average spend all what they earn).

We all know that tax rates are higher in Europe than in the United States. But we also know, or should know, that the U.S is far richer than Europe. Tax revenue is a function of tax rates and of per capita income.

The OECD provides data on taxes as a share of GDP, and on per capita GDP. This gives us the relevant variable for determining public expenditure, which is tax revenue per capita.

In the latest available year, 2007, per capita tax revenue for Western Europe was 13.440$ .

For the United States, it was 13.140$, or only about 2% less. You can see this in the figure below.

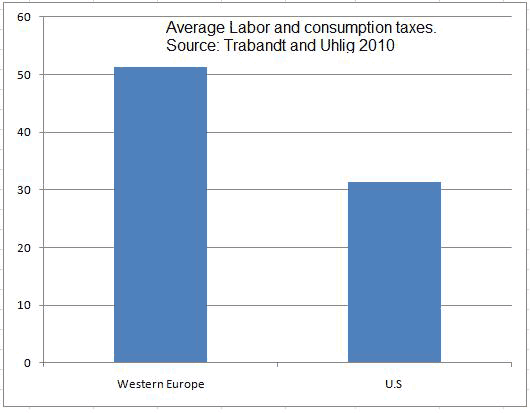

However according to Uhlig the average of labor and consumption taxes are 51% in Europe and only 31% in the U.S, as seen in the second figure.

American tax revenue per capita is thus only 9% lower than for example France, even though the average French worker pays 50% of their income in combined labor and consumption taxes compare to 31% for the average American worker.

Which society do you think should want to emulate the other one? Or are we supposed to think high tax rates have intrinsic value, even if they only give rise to mediocre tax revenue?

Leave a Reply