We have known for sometime that our Social Security system [SS] is in real trouble. Currently there are more than three workers for every retiree; by 2040, that ratio is projected to drop to 2 to 1. But demographics is the least of the problems facing SS. It is estimated that by 2017 Social Security will pay out more in benefits than it will take in ; eventually causing a depletion in the next twenty years or so of the trust fund. Well, one may say: at least we still have time to correct the problem and hopefully avoid insolvency. Not so. According to Chris Martenson “the difference between Social Security income (taxes) and outlays (benefits payments), which is known in Washington-speak as benefits payments”, would shrink to zero next year.”

From Chris Martenson.com….[I]t was only last year that I was writing about the impeding fiscal calamity that was awaiting us all in 2017 when the outlays for Social Security were slated to exactly match receipts. Now that date could be as early as 2010, apparently.

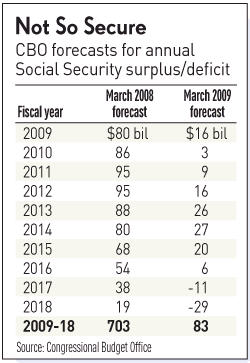

In the chart (right), I want you to note the extreme deterioration in surplus funds between the 2008 and 2009 forecasts. Can you spot the trend?

Here’s a prediction – these too will be revised to the worse in about 6 months. I base this prediction on my belief that more people will opt for retirement than are currently projected and that entitlement program tax receipts will be below current projections. Also, nearly every prediction by the CBO has been revised to the worse over the past year so I am “riding the trend” with this prediction.

In the projections for the table [on the right], the CBO has assumed no cost of living adjustments (COLAs) in 2010, 2011, or 2012 and a return to economic growth next year. If either of those assumptions proves wrong, the table above gets smoked to the downside. I give that a better than 90% chance of happening.

From a budget-busting perspective, last year where the US government had a $73 billion Social Security surplus to spend, this year it will be a paltry $16 billion and next year it will be a number indistinguishable from zero. It is hard to overstate the importance of this shift.

emphasis added

For those decades away from retirement, as unfair as it may sound, Martenson’s analysis reinforces the reality that there will not be any type of SS left to receive from the so-called retirement benefits. The payroll tax revenue that finances Social Security benefits for nearly 51 million retirees and other recipients is falling, according to Wapo, citing a report from the Congressional Budget Office. As a result, the trust fund’s annual surplus is forecast to all but vanish next year — nearly a decade ahead of schedule.

Personally, I think Social Security is the biggest Ponzi scheme in the history of western civilization. And the best part is: it is legal.

From Chris Martenson.com

From Chris Martenson.com

Leave a Reply