I am drawn to this topic like a moth to a flame.

In this week’s Congressional testimony, Federal Reserve Chairman Ben Bernanke notes:

Both U.S. exports and U.S. imports have been expanding, reflecting growth in the global economy and the recovery of world trade. Stronger exports have in turn helped foster growth in the U.S. manufacturing sector.

Typical of policymakers, Bernanke ignores the negative impact of rising imports on US growth. In reality, as global trade has recovered, the external accounts have weighed on US GDP growth. Putting that aside for a second, officials are also quick to point out that the export recovery is aiding manufacturers. It is worth considering how far they can continue to push that argument given the path of manufacturing capacity this decade.

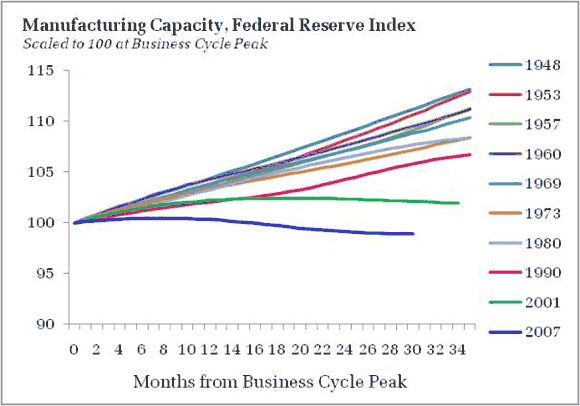

To illustrate the anomalous pattern of manufacturing capacity growth, I focus on the path of capacity for thirty months after the peak of each business cycle, scaling capacity to 100 at each peak:

Note that although the pace of capacity growth slowed since the 1940’s, capacity continued to grow even during the typical post WWII recession. This pattern changes dramatically this decade, with very little capacity growth in the wake of the 2001 recession and actual capacity declines after the most recent recession. Arguably, the traditional increases were at risk in the 1990’s as well, but the technology revolution intervened.

One interpretation of this data is that the failure to add capacity is actually a good thing, as a more rapid absorption of excess capacity will speed economic healing and provide the incentive to add additional capacity, providing a desperately needed boost to investment spending. Of course, this interpretation is completely at odds with history. Typical post WWII recessions experienced V-shaped recoveries even as capacity grew. Now we get jobless recoveries and no capacity expansion.

Another interpretation is that US firms have no intention of adding net new capacity, planning instead to source any excess demand from overseas. This implies that the manufacturing recovery will not be a net positive to US growth. It also implies that the trade deficit will widen further and that the challenge of global imbalances will remain unresolved. The rise of Dollar assets abroad will with either force a fall in the US dollar which would then create more incentive for export and import-competing industries or, more likely, encourage the accumulation of reserve assets among foreign central banks.

In short, I continue to worry that policymakers are ignoring the possibility that increasing reliance on external production to satisfy US demand has contributed significantly to the jobless recoveries we have seen this decade. Something is very different this decade. I think it is a mistake to write off this decade’s shift in manufacturing as simply a repeat of the agricultural experience. At least agricultural output continued to rise as its relative employment importance fell. The capacity numbers are telling us the same can not be said of manufacturing any longer. And in the past, the relative decline in manfacturing jobs was matched by a more than corresponding increase in service sector jobs. No longer the case; job growth is flat for a decade. If we intend to ignore this issue, the supposed reality of tradable services had better get a lot more traction very quickly. Otherwise, we are further solidifying a permanent underclass of citizens who require the constant support of fiscal authorities.

Leave a Reply