Hospira, Inc. (HSP) just hit a new 52-week high just shy of $60 ahead of its July 29, Q2 results. The company has been consistent over the last year, with an average earnings surprise of 27%. Estimates are on the upswing too, with the next-year estimate projecting 17% growth for this Zacks #1 rank stock.

Company Description

Hospira, Inc. is a specialty pharmaceutical and medication delivery company that operates both domestically and internationally. The company was founded in 2003 as a spin off from Abbot and has a market cap of $9.9 billion.

The recent passage of healthcare reform has been at the center of many conversations about companies operating in the healthcare sector, and that definitely holds true for device makers like Hospira.

On the plus side, the addition of an estimated 30 million healthcare recipients into the healthcare system should provide a long-term boost, whereas the $40 billion tax over ten years set to begin in 2014 is clearly a drag.

How the new legislation will effect each individual medical-device maker remains to be seen, but for the time being, it hasn’t slowed Hospira, which reported another solid quarter on April 27 that included a 31% earnings surprise.

First-Quarter Results

Net sales for the period was up 17% from last year to $1 billion. Earnings also came in strong at 94 cents, 31% ahead of the Zacks Consensus Estimate. The company’s average earnings surprise over the last four quarters is now 27%.

The company’s results were driven by strength in its Specialty Injectable Pharmaceuticals, which typically accounts for about 2/3 of its revenue, and continued progress with its Project Fuel, a strategy implemented in 2009 in the eye of the recession to limit costs and expand margins.

Cash Up, Debt Down

Hospira has also made considerable progress with its balance sheet over the last year, with cash and equivalents up $117 million to $646 million while its total debt declined $521 million to $1.736 billion for a debt-to-equity ratio of .60%.

Estimates

We have seen a bit of movement in estimates over the last few months, with the current year adding 14 cents to $3.50 and the next-year estimate adding 11 cents to $4.10, a bullish 17% growth projection.

Valuation

In spite of the recent gains, HSP still has value, trading with a forward P/E of 17X against the industry average of 21X.

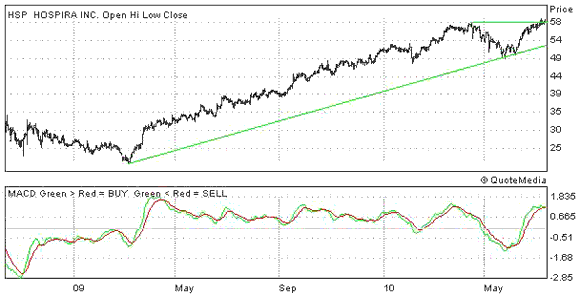

2-Year Chart

HSP recently hit a new all-time high just short of $60 after posting a major rally over the last year. Moving forward, look for support from the trend line on any weakness, take a look below.

HOSPIRA INC (HSP): Free Stock Analysis Report

Zacks Investment Research

Leave a Reply