Macro Man’s a bit pressed for time this morning, as he has an appointment with his physiotherapist at a time when he’s usually pushing the “publish” button to send another edition of his witterings into the cyber-sphere.

It occurred to him this morning that, at the risk of boring readers with another self-indulgent foray into his physical condition, that the global economy and financial system are really quite like a knee with a torn ACL. Consider:

The Problem:

Knee: When Macro Man took his tumble last month, he fell and couldn’t get back up. Actually, he did manage to get his skis back on at one point, but when he tried to ski off he knee collapsed and he fell over again.

Economy: When the credit market took a tumble in 2007, the global economy took a long tumble and has yet to get back up. Actually, people did believe the de-coupling Kool-Aid at one point, but then Lehman Brothers collapsed and it all fell over again.

The Current State of Play:

Knee: Macro Man is undergoing a battery of exercises in a rehabilitation program, the goal of which is to allow the joint to regain maximum flexibility and to straighten itself out.

Economy: The global economy is undergoing a battery of programs and stimuli in a rehabilitation program, the goal of which is to give lenders and borrowers maximum flexibility, thereby allowing the economy to straighten itself out.

Treatment Options:

Knee: Macro Man can continue with the rehab program and hope for the best, or opt for a full reconstruction, which will entail a more thorough rehab program and a modest lifestyle adjustment.

Economy: The global economy can continue with the current rehab program and hope for the best, or opt for a fuller, coordinated reconstruction (IMF, WB, bank regulation, etc.) which will likely entail some lifestyle adjustment for all concerned.

Post-operative Rehab:

Knee: A long, hard slog that will require a lot of effort and, most importantly, time.

Economy: A long, hard slog that will require a lot of effort and, most importantly, time.

To continue the analogy, the weekend G20 meeting was a lot like Macro Man’s last consultation with the ortho: it resulted in a vague action plan for the future, but no immediate solutions.

So for now, focus shifts to the Fed announcement on Wednesday. Despite being the first central bank to ease policy in September 2007, the Fed has now fallen behind the BOE and the SNB in terms of its prosecution of policy. So the million-dollar question will once again be, as it was in January: Will the Fed announce any specific measures, or merely continue offering vague assertions of intent at some point in the future:

“The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability…the quantity of such purchases and the duration of the purchase program as conditions warrant. The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets.”

Delaying the beginnign of the TALF by two days, so that it falls after, rather than before, the FOMC announcement has raised a few eyebrows: are we in for some shock and awe after all?

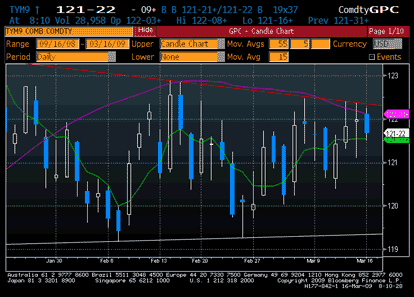

The June 10 year contract has been caught in an ever-narrowing wedge for the last couple of months; perhaps we’ll get some resolution one way or the other, depending on the outcome of Wednesday’s announcement.

Regardless of what the Fed does or does not do, it’s important to remember that neither the economy nor the stock market can be fixed with one wave of a magic wand. From Macro Man’s perch, both he and the market still have a long way to go yet before we’re back to our best.

Leave a Reply