Macro Man is back in the saddle after being bed-ridden with the flu yesterday. He’s not really sure what to make of the fact that he had the most site hits in more than a month on a day on which he wrote nothing. Perhaps word got round that the site was more insightful than usual yesterday…

Regardless, he’s back, and it seems as if little has changed over the past few days. Equities still trade dreadfully, bonds are still unimpressive given equities and the economic data, and EUR/USD is still 1.27 +- two and a half cents. This is market that’s tailor-made for topping and tailing one’s self. so Macro Man is trying very hard to avoid falling into that trap.

The first snippets of February economic data are beginning to emerge from Asia, and for a China sceptic like Macro Man, the figures are decidedly unimpressive. In Taiwan, exports fell 28.6% y/y, worse than the expected 26.2% decline. “But wait!” he can hear you exclaim. “They were down 44% last month! Surely that’s an improvement!”

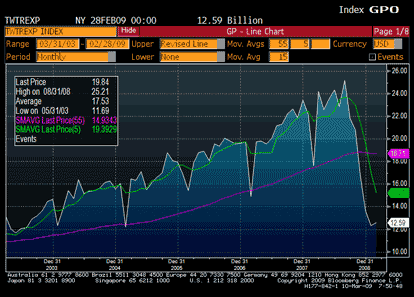

Welcome to the wonderful world of seasonally adjusting Asian data early in the year. In most years, including 2008, the Lunar New Year (when many Asian countries have a full week’s holiday) falls in February. This year, however, it was the last week of January. So this “improvement” in the February export data came in comparing February 2009, with 20 working days, against February 2008, which had but 16, despite being a leap year. And exports were still down by more than a quarter. You can clearly see the “New Year bounce” on the chart of export data below, including in 2004, the last year that the New Year week fell solely in January. However, the bounce is conspicuous by its absence this year, even though February had 5 more working days than January.

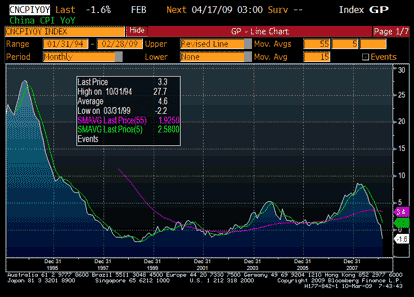

Also telling was China’s CPI data, which crashed to its lowest level (-1.6%) since the inflationary aftermath of the Asian crisis. Some of this is of course down to base effects; nevertheless, those effects are set to last for another 5 months, so risks are heavily skewed to more negative prints.

And so, might China accelerate its deflation-fighting policies? One obvious thing would be to weaken the currency; however, letting USD/CNY drift higher is fraught with political peril, given America’s sensitivity to the rate. (And not without cause, mind you; near-record trade surpluses are hardly suggesting the RMB is anythign but weak.)

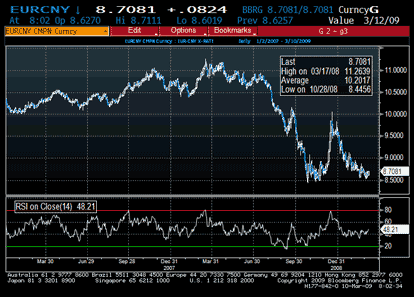

Then again, the RMB has appreciated most against the euro over the last couple of quarters. Given that a) Europe is just as important to Chinese trade as the US, and b) for whatever reason, the Europeans like to moan more about the EUR/USD rate than what China does, might it make sense for China to try and weaken the RMB against the euro?

Perhaps that’s why Voldemort was once again fingered as the euro buyer in Asian time overnight. At the very least, it’s probably why 1.25 has been such a tough nut to crack. Not that the level might not fall eventually; de-leveraging flows could and probably will overwhelm the Voldemort bid eventually.

In the meantime, however, market price action is likely to remain as noisy as one of the rockets they shoot off to celebrate that Chinese New Year.

Leave a Reply