The ECB calmed the markets—will China act next?

After Mario Draghi announced the European Central Bank’s new bond buying program, I was the first guest on CNBC Asia’s Squawkbox to weigh in on this decision. I reiterated my stance that the endgame for Europe would be to print money, which will eventually lead to currency wars. These actions are positive for gold and also for increased economic activity.

China too has kept investors on the edge of their seats, as we wait for some monetary or fiscal action. Everyday that goes by with no significant policy decisions from the Asian giant causes the market to lose confidence in its ability to steer its ship. Even the most optimistic bull can be vulnerable to a loss of confidence.

It often helps to gain a different perspective, which is what a business trip halfway around the world can provide.

I’ve been traveling in Singapore (and then onto Hong Kong) and I continue to be amazed by the juxtaposition of the vibrancy of the Asian continent compared to investor sentiment in the States. It’s a subtle difference, but you can see it in the faces of people walking the cities, you can feel it when talking with local entrepreneurs and you can read it in a speech from local government leaders.

Singapore’s Prime Minister Lee Hsien Loong provided a beam of light to a Beijing audience only days ago. During his speech at the Central Party School, the prime minister discussed China’s significance in the world as it relates to political relations, government policies, and world trade. He also touched on his country’s role in facilitating a solid relationship between the Asian giant and the world’s largest economy.

Singapore’s Prime Minister Lee Hsien Loong provided a beam of light to a Beijing audience only days ago. During his speech at the Central Party School, the prime minister discussed China’s significance in the world as it relates to political relations, government policies, and world trade. He also touched on his country’s role in facilitating a solid relationship between the Asian giant and the world’s largest economy.

By nature, public speeches are meant to be uplifting, as they tend to reflect on a long period of history and focus on positive solutions. However, I believe new opportunities cannot be found when all hope is believed to be lost. You can read his speech here.

The prime minister acknowledges China’s “serious and complex challenges” that it is facing after decades of significant growth. He says that its economic, social and political reforms are difficult for any nation to handle, “let alone one the size of China.” He believes it’s to be expected that “China’s leaders are preoccupied with these domestic priorities.”

However, China will not be tackling this alone, as the world has become so “inter-connected and inter-dependent,” with growing world trade, interlinked financial markets, and the growth of the Internet bringing one third of the world online today.

You can see how synchronized world economies are today by comparing manufacturing output. In August, China’s Government Purchasing Manufacturing Index (PMI) crossed below 50 for the first time since November 2011. (Remember that a reading of 50 marks the critical line delineating expansion from contraction.)

The U.S. ISM Manufacturing PMI also crossed below 50, with a reading of 49.6 in August. JP Morgan’s Global PMI came in at 48.1, and its been below 50 for the last three months.

Over the past decade, China has experienced incredible growth because of globalization. On one measure alone, the prime minister pointed out that more than one billion line workers, engineers, scientists and entrepreneurs are joining the international economy to develop, serve and produce goods for markets around the world.

Stephen Roach, a senior fellow at Yale University and author of The Next Asia, says China’s “grand plan” is to move from the “producer model, which worked brilliantly for 30 years” to one that needs to provide higher-paying, less labor intensive jobs, in new fully functional cities to the 350 million who are estimated to move to an urban area in China over the next 15 years. To paraphrase Marshall Goldsmith’s self-improvement book for business executives, what got China here, won’t get China there.

The Asian giant can take a few lessons from its developed neighbors, says BCA Research. China has already experienced a tremendous population shift from its farms and rural areas to the cities in search of higher paying jobs. But there comes a tipping point when labor supply in the cities goes from “feast to famine,” says BCA.

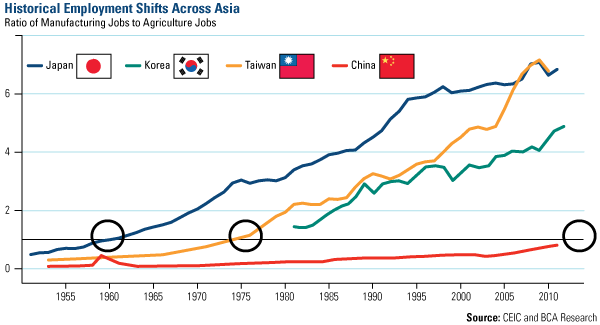

The research firm says in the previous cases of Japan, Korea and Taiwan, there have been similar employment phases. First, when industrialization just begins, “demand for labor is strong, but wages are low because of plentiful supply.”

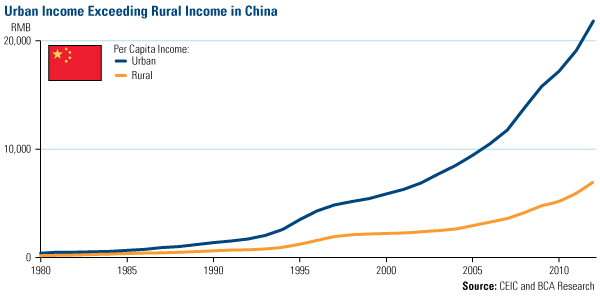

Then, wages grow faster than labor demand. This is what we have been seeing in China today, as urban per capita income far exceeds rural incomes.

The last stage of this development that other Asian nations have experienced is when “wage growth accelerated and the wage gaps between the manufacturing and agriculture sectors disappeared,” according to BCA. Their research shows that cheap labor in manufacturing ends while growth of wages accelerates in both cities and farms.

It’s only a guess when China will make that labor shift to the stage where manufacturing sector competes with agriculture for jobs. BCA compared manufacturing employment to agriculture employment of Japan, Korea and Taiwan, looking at when these countries’ ratio rose above 1. In Japan, manufacturing labor shortages started in the early 1960s, for South Korea, it was around 1975-1976. Taiwan began experiencing this phenomenon around 1970.

Based on this ratio, it’s estimated that labor shortages could become more common around 2014-2015 for China, says BCA.

Until that tipping point is reached, China “will continue to need higher value-added, less labor-intensive production to sustain exports; policy and productivity will be critical to a continuation of the ‘growth miracle,’” according to BCA.

The way China will accomplish this is through good relations with the U.S., as well as taking an interest in making sure Asia is stable and prosperous. Loong believes the Chinese economy “depends on an open, inclusive and fair global trade system to thrive. It needs a stable external environment, and good relations with other countries, so that it can focus on economic development,” says Singapore’s leader. In Loong’s view, “China is no longer an isolated, self-sufficient Middle Kingdom.”

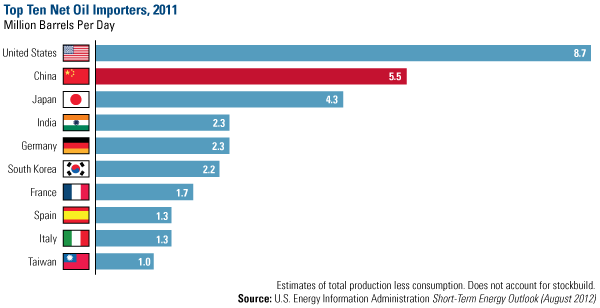

One example of how China will be engaging the world in its future growth is through its current energy policies. While 70 percent of the country’s energy consumption is coal, oil is the second source of energy, at nearly 20 percent of total energy consumption, according to the U.S. Energy Information Administration (EIA). In 2010, the country consumed an estimated 10 million barrels per day.

China only produces about 4 million barrels per day, and imports the remaining amount, making the Asian giant the second largest importer of oil, says the EIA. The largest importer of oil in the world has been the U.S., with an intake of 8.7 million barrels per day, according to the EIA. Japan imports the third most oil, at 4.3 million barrels per day.

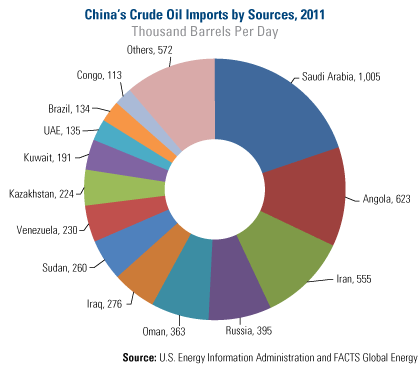

The country currently has a diverse variety of sources from which it receives its oil, with most of the crude oil imports coming from Saudi Arabia, followed by Angola, Iran and Russia.

The country’s energy policies appear to be focused on three goals: 1) fulfill its growing demand for oil and reliance on oil imports, 2) diversify import sources to reduce its risk of supply disruption, and 3) develop technical expertise in unconventional resources. One way to accomplish these goals is through overseas acquisitions, which we’ve previously discussed. “China is taking advantage of the economic downturn to step up its global acquisitions and use its vast foreign exchange reserves (estimated at over $3 trillion in 2012) to help purchase equity in projects or acquire stakes in energy companies,” says the EIA.

A Hint of Action Arrives

World markets may not have to wait much longer for Chinese policymakers to act, as the government recently announced new infrastructure projects. According to Bloomberg, China approved 25 new subway construction projects, with related investments estimated to be more than 840 billion yuan. Railway, subway and construction stocks in China increased on the news.

Stephen Roach concludes his discussion about China this way: “A growth slowdown is hardly shocking for an export-led economy. But China is in much better shape than the rest of the world. A powerful rebalancing strategy offers the structural and cyclical support that will allow it to avoid a hard landing.”

Leave a Reply