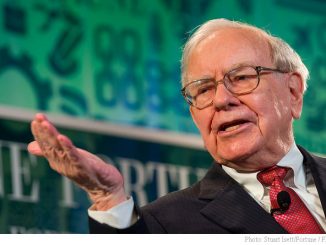

Sitting in a Nebraska Furniture Mart, a Berkshire (BRK-A) (BRK-B) retailer – billionaire investor Warren Buffet – arguably the world’s most successful investor, told CNBC in an interview that aired on the network’s Squawk Box early Monday – that the “economy has fallen off a cliff.” [CNBC]

Buffett acknowledged the fact that if the Federal Reserve hadn’t stepped in last September, the overall economic situation would indeed have been worse. At the same time Buffett pointed out that “not only has the economy slowed down, people have changed their behavior.”

Buffett said during his interview that the current economic climate is at the worse end of the scale he expected and that he hadn’t seen consumers, or Americans in general, as fearful as now. “Consumers are scared and confused. American people feel they don’t know what’s going on so they’ve pulled back.”

According to Buffett, the message from the government has been so far “muddled.” He mentioned the government’s importance in playing a big role in turning the economy around, though he said it won’t happen fast. “You can’t turn around on a dime. Many people are scared about losing their jobs and it is affecting their behavior, even if they wind up not losing their jobs”, Buffett said.

He added that inflation “has the potential” to be worse than the double-digit rates of the 1970s when demand returns. But, “it depends”, he said, “on the wisdom of our policies and what we do with new government spending.”

Buffett also stressed the FDIC’s role as a “huge factor” in boosting confidence in U.S. banks and touched on the subject of failing banks. ” A bank that needs to go broke should be allowed to go broke. Shareholders in banks can lose their money, but depositors should not”, said the Oracle of Omaha.

Buffett’s interview however, wasn’t all doom and gloom or more economic apocolypse. After an emailer asked: “will everything be all right?” Buffett gave a rather strong answer:

“Yes, everything will be all right”, he said. “We have a free-market system that unleashes human potential and we are far from done. The machine gets gummed up from time to time, but we go forward.”

“Five years from now”, said Buffett “the economy will be running fine. The strength of the American system will pull it through, just as it has many times in the past.”

Let’s make sure though next time around we don’t allow deregulation to take place to such levels where regulators have a free hand in incentivizing bankers and mortgage lenders to provide as much bad paper as they can write.

Leave a Reply