Macro Man is having fun with acronyms today. It started with a visit to the hospital this morning, where he got an MRI scan on his injured knee.

Upon his return, he saw his email inbox full of comments on currency weakness in Russia, India, Brazil, and even China; it seems as if the Big Bad Wolf has managed to huff and puff and blow down even the House of BRICS.

And what of the four little PIGS? German finance minister Peer “there’s no crisis in Europe” Steinbrueck admitted this morning that Germany and France may have to bail out entire countries, rather than just dodgy banks.

If the periphery of Europe is looking like a vegetable, it should come as no surprise. One analyst that clearly has too much time on his hands recently suggested grouping Russia, Hungary, Ukraine, the BAltics , Romania, and Bulgaria together into one big RHUBARB pie. Needless to say, the pie is looking badly burned at the moment.

All of this got Macro Man thinking. Regular readers will know that one of his favourite themes of the past several months has been the collapse in global trade, and particularly its impact upon Asia. It would be nice to come up with a snappy, apt acronym for vulnerable Asian nations, wouldn’t it?

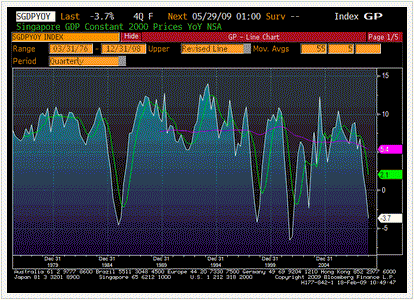

Just look at Singapore, where all manner of statistics, including y/y GDP growth (pictured below) have fallen off a cliff.

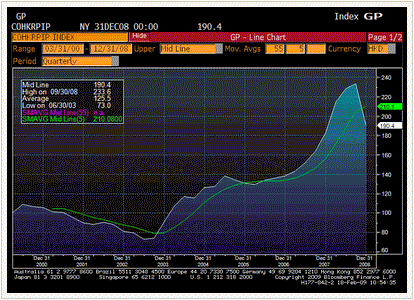

And what of Hong Kong, which has benefited from liquidity, property, and China bubbles over the past few years? Prime real estate on the Peak has already fallen some 20% from the…er….peak, but could easily drop another 30% if not more. Ouch!

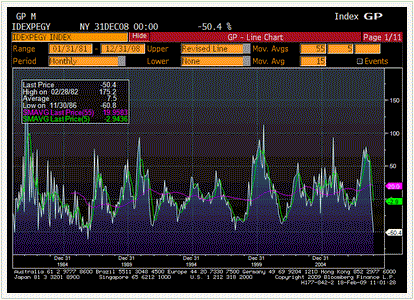

Indonesia is rarely too far from any regional tempest, and this time is no exception. Overall economic activity has started to tail off badly, local currency asset markets look vulnerable, and Indonesian trade has collapsed. Exports (pictured below) have fallen 50%, but the trade balance has actually improved, because imports are falling close to 60% y/y. Observe how the export figures are worse than anything observed during the last recession, or even the Asian crisis.

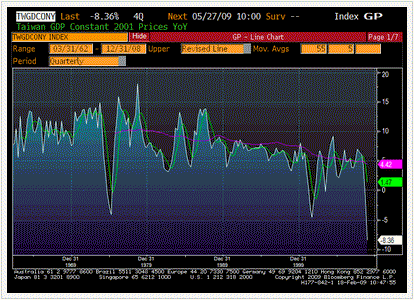

And finally, special mention should be made of Taiwan, which this morning released Q4 GDP figures showing an 8.36% y/y decline. Not only is that the world’s worst (non-Zimbabwe division), it’s also the worst that Taiwan has seen since at least 1962, the first year of Bloomberg data. (In fairness, there’s only another baker’s dozen of possible years in any event!) It’s amazing to think that it was only three quarters ago that market punters, including Macro Man, were bullish on Taiwan’s growth prospects as economic ties to Beijing strengthened. It seems like half a lifetime ago….

So there you are: Singapore, Hong Kong, Indonesia, and Taiwan. Four Asian economies in a world of hurt. But for the life of him, Macro Man cannot think of any sort of acronym that could possibly highlight the state of the economy in SE Asia. Gee, maybe some things just aren’t meant to have an acronym. Then again……

Leave a Reply