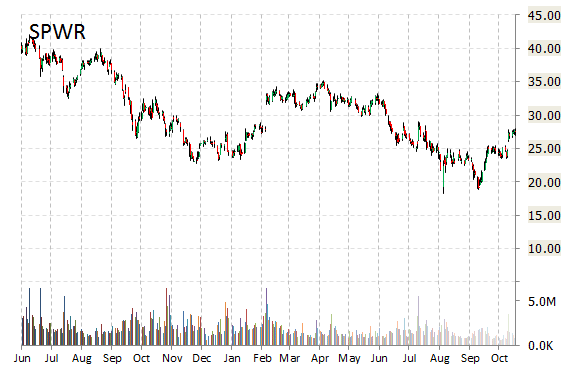

In a report published Friday, Macquarie analysts initiated coverage on SunPower Corporation (SPWR) with an ‘Outperform’ rating.

On valuation measures, SunPower Corp. shares currently have a PEG and forward P/E ratio of 0.81 and 14.13, respectively. Price/sales for the same period is 1.58 while EPS is $0.55. Currently there are 10 analysts that rate SPWR a ‘Buy’, 3 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. SPWR has a median Wall Street price target of $33.00 with a high target of $45.00.

Over the past year, shares of San Jose, California-based company have traded between a low of $18.25 and a high of $35.11 and are now at $27.69.

Shares are down 10.56% year-over-year ; up 6.23% year-to-date.

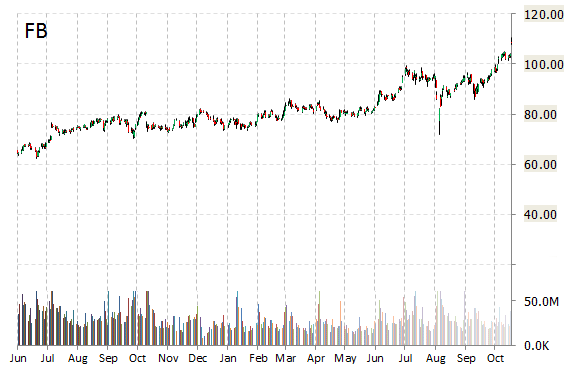

Facebook, Inc. (FB) was reiterated as ‘Buy’ with a $130 from $115 price target on Friday by Argus. The firm notes that with the two most popular smartphone apps in the U.S., the company has successfully made the transition from desktop to mobile. Firm expects FB to remain the dominant social media site.

Facebook shares recently lost $1.00 to $107.76. The stock is up 45.34% year-over-year and has gained 39.40% year-to-date. In the past 52 weeks, shares of Menlo Park, California-based social networking giant have traded between a low of $72.00 and a high of $110.65.

Facebook Inc. closed Thursday at $108.76. The name has a total market cap of $303.62 billion.

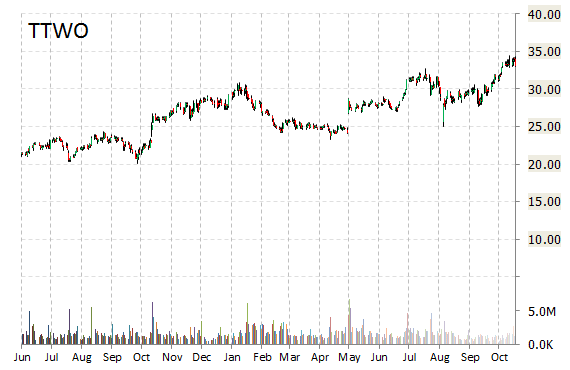

Take-Two Interactive Software Inc. (TTWO) was reiterated a ‘Buy’ by Mizuho analysts on Friday as the company reported strong second-quarter 2016 earnings results that beat top-line and bottom-line expectations. For Q3, TTWO provided EPS guidance of $0.40 to $0.50 versus consensus of $0.45 per share. The company also issued revenue projection of $400 to $450 million, compared to the consensus revenue estimate of $443.25 million. Take-Two said it expects full-fiscal 2016 EPS in the range of $1.00 to $1.15 per share, with revenue ranging from $1.33 billion to $1.43 billion. Mizuho raised its price target on TTWO to $37 from $33.

Take-Two Interactive Software Inc. shares have a forward P/E of 19.67 and t-12 price-to-sales ratio of 2.22. EPS for the same period is ($3.83).

In the past 52 weeks, shares of New York-based company have traded between a low of $23.30 and a high of $37.00 and are now at $36.01. Shares are up 26.77% year-over-year ; up 17.91% year-to-date.

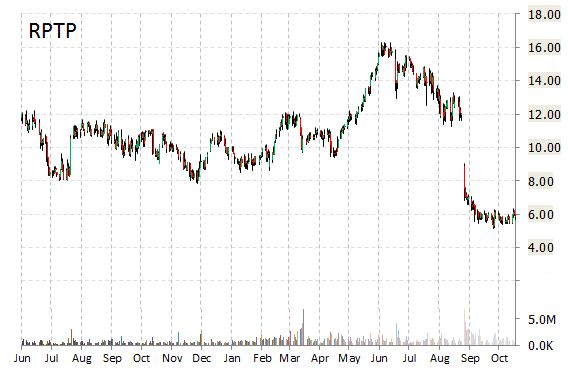

Analysts at Wedbush upgraded their rating on the shares of Raptor Pharmaceuticals Corp. (RPTP). In a research note published on Friday, the firm lifted the name with a ‘Neutral’ from ‘Underperform’ rating.

Currently there are 3 analysts that rate RPTP a ‘Buy’, 3 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. Raptor Pharmaceuticals has a median Wall Street price target of $12 with a high target of $18.

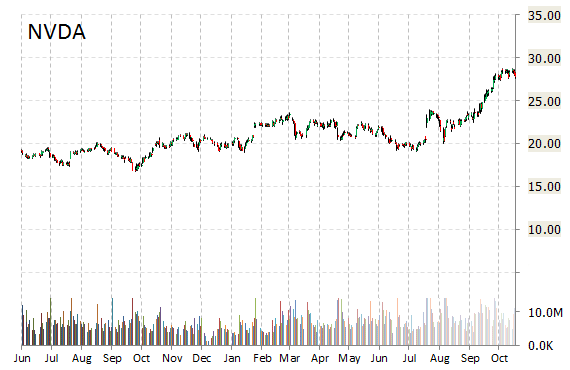

Nvidia Corporation (NVDA) rating of ‘Hold’ was reiterated today at Topeka Capital Markets with a price target increase of $32 from $24 (versus a $27.71 previous close).

NVDA is currently printing a higher than average trading volume with the issue trading 4.14 million shares, compared to the average volume of 9.37 million. The stock began trading this morning at $30.45 to currently trade 13.10% higher from the prior days close of $27.71. On an intraday basis it has gotten as low as $29.82 and as high as $31.39.

Nvidida shares have advanced 6.49% in the last 4 weeks and 21.09% in the past three months. Over the past 5 trading sessions the stock has gained 0.11%. The Santa Clara, California-based company, which is currently valued at $16.89 billion, has a median Wall Street price target of $24.00 with a high target of $35.00.

NVDA is up 40% year-over-year, compared with a 3.35% gain in the S&P 500.

Leave a Reply