Shares of Radian Group Inc. (RDN) are down 0.70% to $16.58 in mid-day trading Thursday following the company’s fourth quarter earnings results.

The mortgage insurer reported revenues of $295.1 million, up 37.3% from a year ago. Analysts were expecting revenues of $289 million. Net income for the quarter ended December 31 , 2014, came in at $428.3 million, or $1.78 per diluted share. This compares to net income for the year ago quarter of $36.4 million, or $0.21 per share. Net income for the full year 2014 was $959. 5 million, or $4.16 per share. Revenue was reported as $916 million.

“We made significant progress in 2014 with full year profitability and by reducing Radian’s overall risk profile,” said in a statement CEO S.A. Ibrahim. “ By focusing on our core strengths in mortgage insurance and mortgage and real estate services, we are driving long – term value from our existing and growing portfolio while diversifying our future revenue sources.”

On valuation measures, Radian Group Inc. shares, which currently have an average 3-month trading volume of 2,4 million shares, trade at a trailing-12 P/E of 6.16, a forward P/E of 10.89 and a P/E to growth ratio of 0.40. The median Wall Street price target on the name is $20.00 with a high target of $26.00. Currently ticker boasts 7 ‘Buy’ endorsements, compared to 1 ’Hold’ and no ‘Sell’.

Profitability-wise, RDN has a t-12 profit and operating margin of 44.57% and 51.98%, respectively. The $3.16B market cap company reported $4.29B in cash vs. $1.29B in debt in its most recent quarter.

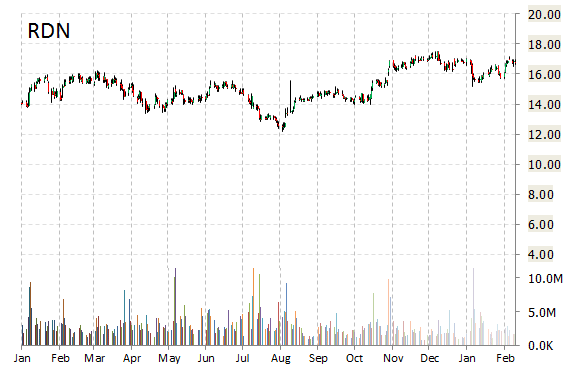

RDN currently prints a one year return of 6.98%, and a year-to-date loss of less than one percent.

The chart below shows where the equity has traded over the last 52 weeks.

Radian Group Inc operates as a credit enhancement company in the United States. The firm was founded in 1977 and is headquartered in Philadelphia, Pennsylvania.

Leave a Reply