Himax Technologies, Inc. (HIMX) shares are up 3.13% to $7.90 in mid-day trading Thursday after the company reported its fourth quarter earnings results.

The Taiwan-based display manufacturer reported in line earnings of $0.09 per share on revenues of $227.2 million, up 16.4% from a year ago, and the highest quarterly revenue since Q4 2008. As mentioned, the Street was expecting EPS of $0.09 on revenues of $227.1 million. Gross profit came in at $56.0 million vs. $54.4 million year-over-year [yoy], up 3.1%. Full year 2014 revenues increased 9.1% yoy to $840.5 million.

For Q1’15, Himax Technologies provided EPS guidance of $0.07-0.09 versus consensus of $0.09 per share. The company also issued revenue projection of $177 to $193 million, compared to the consensus revenue estimate of $214.5 million.

On valuation measures, Himax Technologies Inc. ADS shares, which currently have an average 3-month trading volume of 3,5 million shares, trade at a trailing-12 P/E of 20.15, a forward P/E of 16.31 and a P/E to growth ratio of 0.66. The median Wall Street price target on the name is $9.00 with a high target of $12.51. Currently ticker boasts 5 ‘Buy’ endorsements, compared to 4 ’Holds’ and 2 ‘Sell’.

Profitability-wise, HIMX has a t-12 profit and operating margin of 8.26% and 8.42%, respectively. The $1.35B market cap company reported $147.67M in cash vs. $137.50M in debt in its most recent quarter.

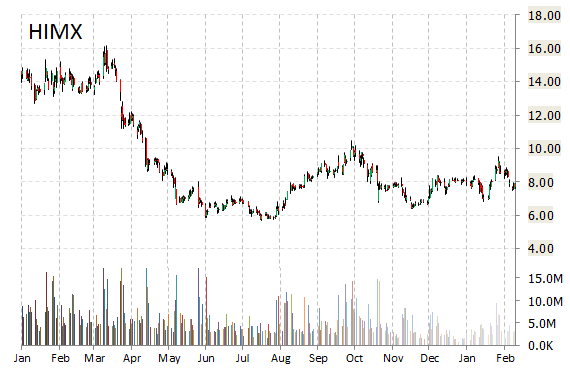

HIMX currently prints a one year loss of about 45%, and a year-to-date loss of around 5%.

The chart below shows where the equity has traded over the last 52 weeks.

Himax Technologies, Inc., is a fabless semiconductor company, providing display imaging processing technologies to consumer electronics worldwide. The firm was founded in 2001 and headquartered in Tainan, Taiwan.

Leave a Reply