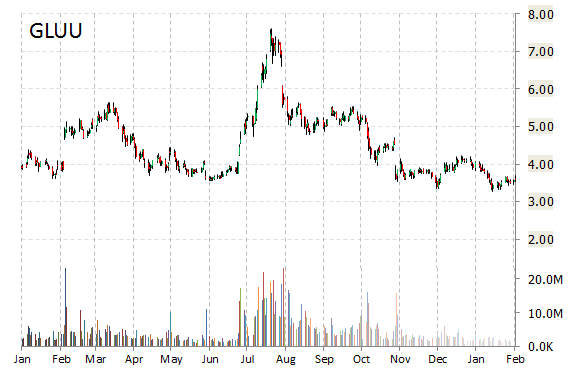

Shares of Glu Mobile, Inc. (GLUU) are up 22% to $3.84 in early trading Thursday after the San Francisco-based mobile game developer beat Q4 expectations and said it will develop a new game featuring the pop singer Katy Perry. Glu said it expects to launch the game worldwide in late 2015 on iOS and Android.

Glu posted Q4 adjusted EPS of $0.11 p/sh on adjusted revs of $76.2 million vs. Street forecasts of adjusted EPS of $0.02 p/sh on revenue of $63.8 million. Net income came in at $1.4 million vs. a loss in the same period a year earlier. The company also guided full-year earnings and revenue ahead of analyst estimates.

Following upside Q4, FY15 guide and the Katy Perry deal, Glu Mobile’s price target was raised this morning to $7.50 from $7 at Northland Capital. The firm said additional celebrity deals could serve as incremental catalysts.

On valuation measures, Glu Mobile, Inc is currently valued at $493.03M. The name has a median Wall Street price target of $6.50 with a high target of $10.00. In the past 52 weeks, shares of San Francisco, California-based company have traded between a low of $3.27 and a high of $7.60 with the 50-day MA and 200-day MA located at $3.76 and $4.54 levels, respectively. Additionally, shares of GLUU trade at a P/E ratio of 3.88 and have a Relative Strength Index (RSI) and MACD indicator of 74.35 and +0.13, respectively.

GLUU currently prints a one year loss of about 3%, and a year-to-date loss of around 1.60%.

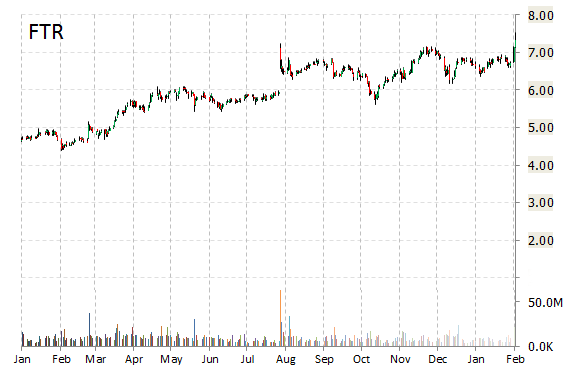

Shares of Frontier Communications Corporation (FTR) are higher by 7% in early trade Thursday, as the stock continues to see gains following a WSJ report that says Verizon (VZ) is close to selling a package of wireline assets to Frontiert for about $10 billion.

Frontier shares recently gained $0.51 to $7.79. In the past 52 weeks, shares of Stamford, Connecticut-based regional telecom company have traded between a low of $4.46 and a high of $7.90. Shares are up 72.10% year-over-year, and 9.15% year-to-date.

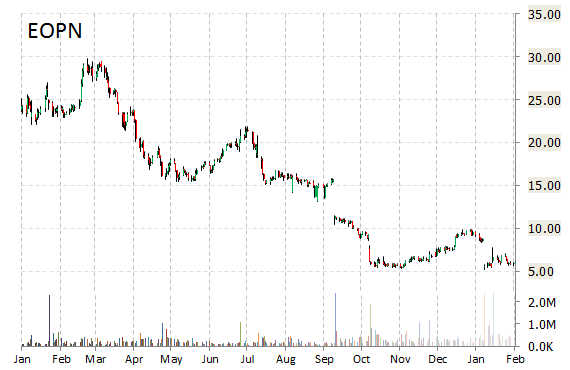

E2open, Inc. (EOPN) has been a solid gainer in early trading, up more than 39% to $8.53 from Wednesday’s close of $6.11. The gains have been aided by the company’s announcement that it has entered into a merger agreement whereby Insight Venture Partners, a private equity and venture capital firm, will acquire E2open in a transaction valued at approximately $273 million.

Under the terms of the agreement, an affiliate of Insight will commence a tender offer for all the outstanding shares of E2open common stock for $8.60 per share in cash, representing a 41% premium over E2open’s closing PPS on Feb. 4th, 2015.

EOPN shares are down more than 74% year-over-year and has lost roughly 37% year-to-date. In the past 52 weeks, shares of Foster City, California-based company have traded between a low of $5.21 and a high of $29.82.

E2open, Inc. has a total market cap of $249.91M.

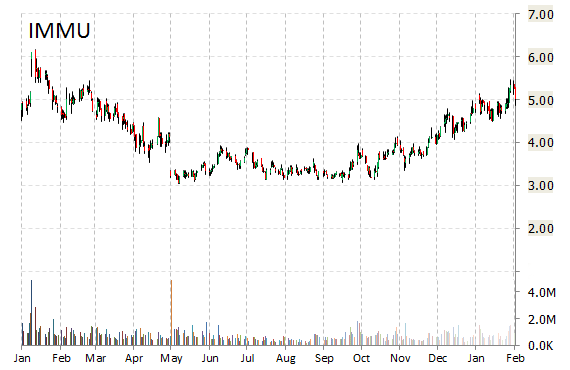

Immunomedics Inc. (IMMU) shares tumbled 15% in early trade Thursday, after the company announced proposed offering of $85 million of convertible senior notes due 2020.

Immunomedics said it intends to use a portion of the net proceeds from the offering to fund its operating expenses, the ongoing Phase 3 clinical trial for clivatuzumab tetraxetan, and the Phase 2 clinical trials for IMMU-132 and IMMU-130, and further the advancement of clinical trial programs in fiscal 2015 and beyond.

IMMU shares recently lost $0.72 to $4.17. The stock is up more than 4% year-over-year and has gained roughly 1.70% year-to-date.

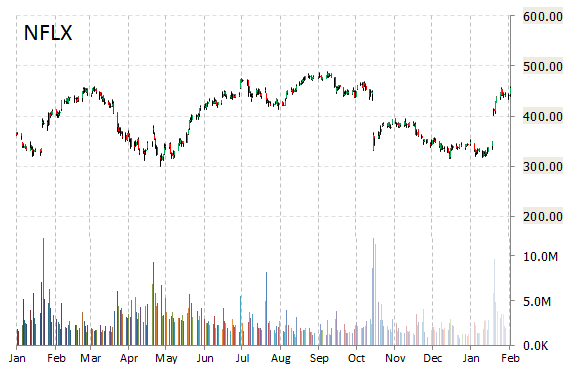

Netflix, Inc. (NFLX) shares are fractionally higher this morning following the company’s announcement late yesterday that it will expand its streaming service into Japan this fall.

To facilitate close partnerships with consumer electronics makers, and to work with Japanese film and TV creators, Netflix will soon open a regional office in Tokyo, the company said in a statement.

This will be the moving streaming firm’s first foray into the Asian market.

On valuation measures, Netflix, Inc. shares are currently priced at 104.05x this year’s forecasted earnings compared to the industry’s -0.18x earnings multiple. Ticker has a PEG and forward P/E ratio of 5.20 and 76.72, respectively. Price/Sales for the same period is 4.93 while EPS is $4.32. Currently there are 18 analysts that rate NFLX a ‘Buy’, 19 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. NFLX has a median Wall Street price target of $450.00 with a high target of $550.00.

In the past 52 weeks, shares of Los Gatos, California-based company have traded between a low of $299.50 and a high of $489.29 and are now at $449.48. Shares are up 10.54% year-over-year, and 31.35% year-to-date.

Leave a Reply