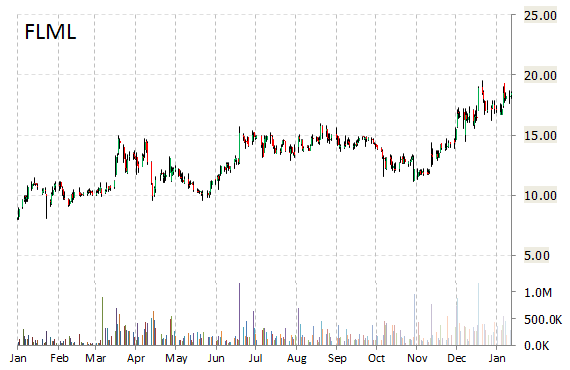

Shares of Flamel Technologies SA (FLML) are down by 41% to $11.08 in late trading on Wednesday, as the stock continues to see loses following the FDA’s approval of Fresenius Kabi’s New Drug Application for neostigmine methylsulfate, a drug which Flamel currently markets as Bloxiverz. Another news that is putting more pressure on Flamel’s shares is a Jazz Pharmaceuticals‘ (JAZZ) favorable patent ruling from the US Patent and Trademark Office in a case brought by Par Pharmaceutical, Roxane Laboratories, and Amneal Pharmaceuticals against Jazz in regards to four Xyrem (sodium oxybate) patents. Xyrem is Jazz’s approved drug for the treatment of narcolepsy. The ruling concludes, “We are not persuaded that the information presented in the Petition establishes that any claim in the ‘730, ‘059, ‘988, and ‘182 patents qualifies as a covered business method patent under Section 18 of the America Invents Act. Petitioner, therefore, has failed to satisfy the jurisdictional requirements of Section 18.”

FLML shares recently lost $8.17 to $10.30. The stock is up more than 69.61% year-over-year and has gained roughly 7.82% year-to-date. In the past 52 weeks, shares of the specialty pharmaceutical company have traded between a low of $8.06 and a high of $19.50.

Flamel Technologies closed Tuesday at $18.47. The company currently has a total market cap of $399.79 million.

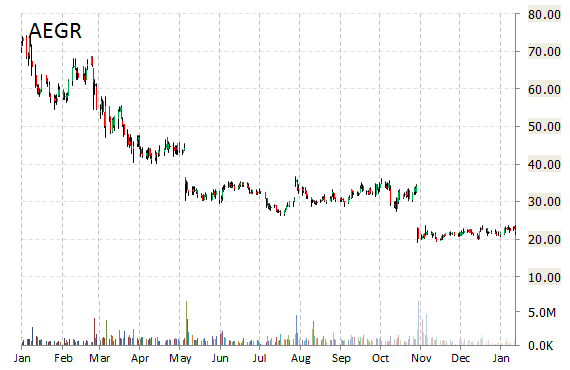

Aegerion Pharmaceuticals, Inc. (AEGR) shares jumped more than 10% to $24.15 in late trading following a Reuters report suggesting that several of the company’s top 10 investors are pushing the company to oust Chief Executive Marc Beer and consider selling itself.

Cambridge, Massachusetts-based Aegerion, which make drugs for rare diseases, has seen its share price plunge 64% in the last 52 weeks, trading between a low of $19.10 and a high of $68.76.

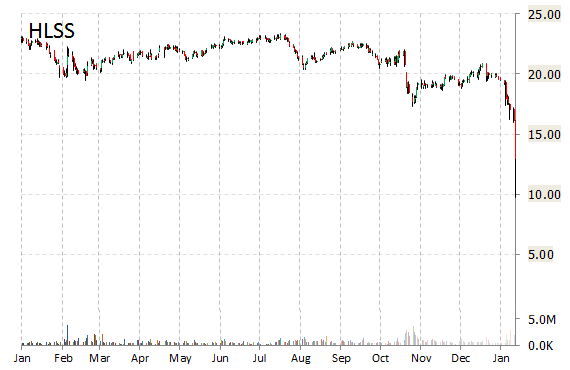

Home Loan Servicing Solutions, Ltd. (HLSS) shares are up 8.88% to $14.10 in late trading. The move comes on a big volume too with the issue currently trading more than 5 million shares, well above the average of 1.3 million for a full session over the past 3 months. Not seeing any news or rumors to account for the move.

Today’s gains comes one day after the stock plunged in sympathy with peer firm Ocwen Financial (OCN).

Ocwen tumbled 38% Tuesday on reports that the state of California may soon suspend OCN’s mortgage license because the payment collection firm has failed to turn over documentation showing that it complies with California laws protecting homeowners, according to the LA Times.

Shares of HLSS gained $1.18 on Wednesday, giving it a market capitalization of roughly $1 billion. The stock traded as high as $23.38 in July 18, 2014.

Leave a Reply