Recent short interest data for the 10/31/2014 settlement date shows a surge in short interest for shares of Xilinx Inc. (XLNX). As of October 31, the short interest for the programmable logic devices supplier totaled 8,468,989 shares, as compared to 5,885,186 shares since October 15, a jump of 43.90%. Average daily volume [AVM] for the same period rose by 448,698 to 5,673,630 shares from 5,224,932 shares. It is worth mentioning that ticker’s short interest has spiked by more than 4.7M shares, or 130%, from the 5/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.49 days. Days-to-cover for XLNX increased to 1.49 for the October 31 settlement date, as compared to 1.13 days at the October 15 report.

Recently, a number of equity research firms have assigned a rating to the stock. Analysts at Deutsche Bank (DB) maintained their ‘Hold’ rating and $43 price target in a research note on October 17th. Jefferies analysts also maintained their ‘Hold’ rating and $44 price target in a research note to clients on October 17. Finally, analysts at Pacific Crest maintained their ‘Outperform’ rating and $50 price target on Xilinix in a research note on August 13th. Overall, there are 8 analysts that rate Xilinix a ‘Buy’, while 13 rate it a ‘Hold’. No analyst rates it a ‘Sell’. XLNX has a median Wall Street price target of $47 with a high target of $60.

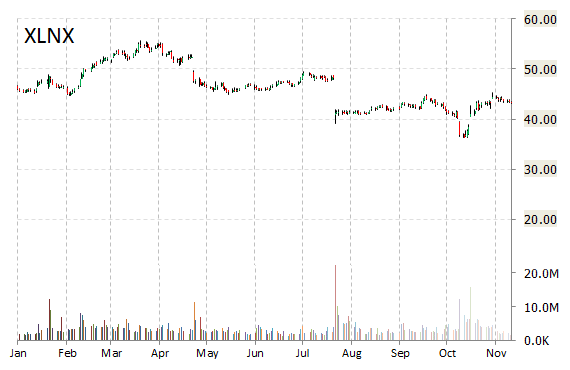

Xilinx Inc. has a beta of 1.50 and a short float of 3.22%. In the past 52 weeks, shares of San Jose, California-based company have traded between a low of $36.24 and a high of $55.59 and are now at $42.98. Shares are down 0.82% year-over-year, and 3.75% year-to-date.

Leave a Reply