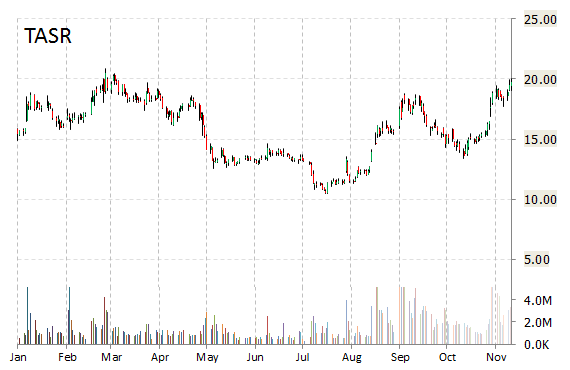

Taser Int’l Inc. (TASR) continues to trade below the $20 level. Ticker hasn’t been able today to consolidate a move intraday above that level despite news that Texas state Senator Royce West wants every patrol officer in the state to wear a body camera. The ambitious plan would put cameras on roughly 54,000 patrol officers across various law enforcement agencies.

On Thursday, Taser International Inc. is printing a higher than average trading volume with the issue trading 2.9M shares as of 1:14 p.m. Est., compared to the average volume of 2.88M. The stock began trading this morning at $19.80 to currently trade down 35 cents from the prior days close of $19.75. On an intraday basis it gotten as low as $19.45 and as high as $20.36.

TASR shares are currently priced at 53.05x this year’s forecasted earnings, which makes them expensive compared to the industry’s 11.53x earnings multiple. The company’s current year and next year EPS growth estimates are 2.70% and 23.70%, compared to the industry growth rates of 35.60% and 23.80%, respectively. TASR has a T-12 price/sales ratio of 6.58. EPS for the same period registers at $0.37.

Taser shares have advanced 39.08% in the last 4 weeks and 55.39% in the past three months. Over the past 5 trading sessions the stock has gained 6.30%. Shares of TASER International Inc. are up 24.37% this year, and 19.99% year-over-year.

The Scottsdale, Arizona-based company, which is currently valued at $1.03B, has a median Wall Street price target of $22.00 with a high target of $24.00.

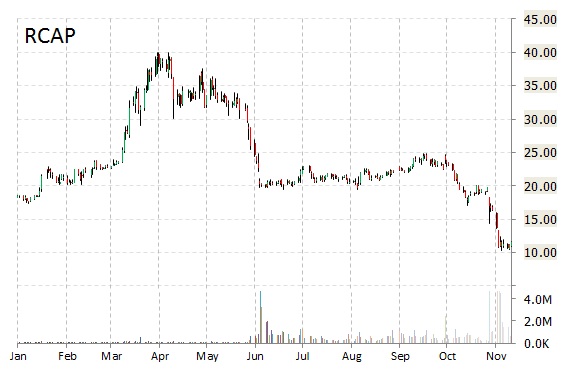

Shares of RCS Capital Corp (RCAP) are down 12% in mid-day trading on heavy trading volume, as the holding company misses Q3 by $0.03. The losses have also been aided on news [via Bloomberg] that real estate investment trust American Realty Capital Properties (ARCP) sued investment partner RCS Capital Corp., alleging it wrongly terminated an agreement to buy a business.

“We continue to believe that RCS’s attempt to terminate the Purchase Agreement constitutes a breach of the Purchase A greement. Under the circumstances, the independent members of the ARCP Board of Directors and ARCP had no choice but to file this litigation in order to preserve and protect the interests of ARCP’s shareholders under the Purchase Agreement. ” the New York-based company said in a statement.

RCAP shares recently lost $1.37 to $10.22. The name has a median consensus analyst price target of $22 with a high target of $31.00, and a 52-week trading range of $8.94 to $39.98.

The T-12 profit margin at RCS Capital Corporation is 4.05%. RCAP‘s revenue for the same period is $1.33B.

RCS Capital has market cap of $656M.

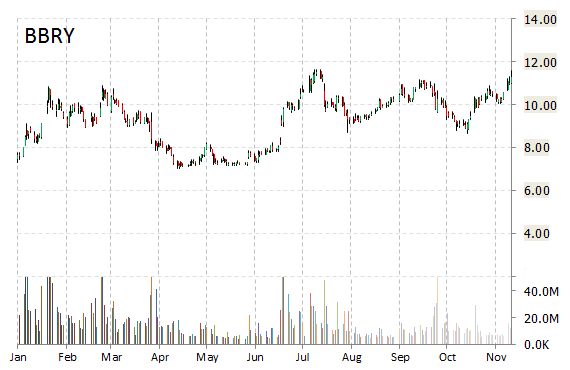

BlackBerry Limited (BBRY) is seeing a big move Thursday, as the company’s shares are surging by over 6% on the day on news that the smartphone maker has entered into a partnership with South Korean tech giant Samsung Electronics to market the companies’ phone-management services and compete against an alliance of IBM (IBM) and Apple Inc. (AAPL).

Citron Research said in a tweet that John Chen’s “New deal with Samsung makes us feel confident about our near term $15 target. New 52 week high.”

BlackBerry also announced an agreement with Salesforce (CRM) to connect its No. 1 customer relationship management platform to BlackBerry’s enterprise mobility management solutions.

BBRY shares recently gained $0.69 to $11.97. In the past 52 weeks, shares of Waterloo, Canada-based firm have traded between a low of $5.44 and a high of $11.85. Shares are up 73.92% year-over-year, and 51.48% year-to-date.

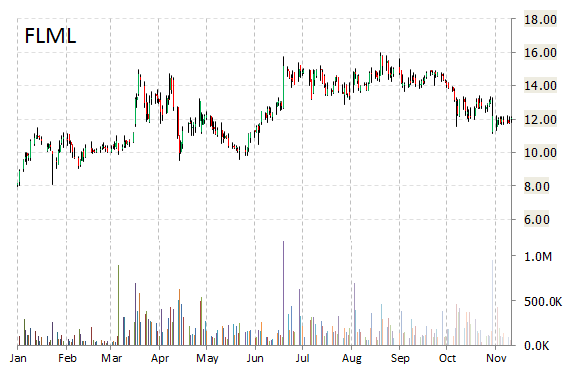

Flamel Technologies SA (FLML) is trading at unusually high volume Thursday with 372K shares changing hands. It is currently at 2x its average daily volume and trading up 12.44% at $13.57. Not seeing any news or rumors to account for the move.

Flamel Technologies is a France-based specialty pharmaceutical company. Its stock has a 52-week trading range of $6.42 to $15.96. The T-12 operating margin at Flamel Tech is (86.53%). The name‘s revenue for the same period is $30.46 million. Flamel’s price/book is 8.04.

Shares in the 520.84 million company are up 101% year-over-year, and 49.81% year-to-date.

Leave a Reply