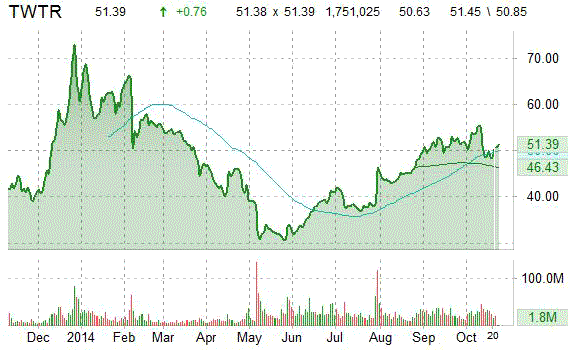

Shares of Twitter, Inc. (TWTR) are up almost 1% to $51.10 in pre-market trading Wednesday after the company was upgraded to ‘Hold’ from ‘Sell’ at Hudson Square. Currently there are 18 analysts that rate TWTR a ‘Buy’, while 14 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. The micro-blogging platform has a median Wall Street price target of $58.00 with a high target of $65.00.

On valuation measures, Twitter has a PEG and forward P/E ratio of 6.22 and 136.84, respectively. Price-to-sales is 31.54 while EPS is ($2.04). The San Francisco, California-based firm has a market cap of $30.72 billion.

In the past 52 weeks, shares of Twitter have traded between a low of $29.51 and a high of $74.73. Shares are up 12.76% year-over-year ; down 20.46% year-to-date.

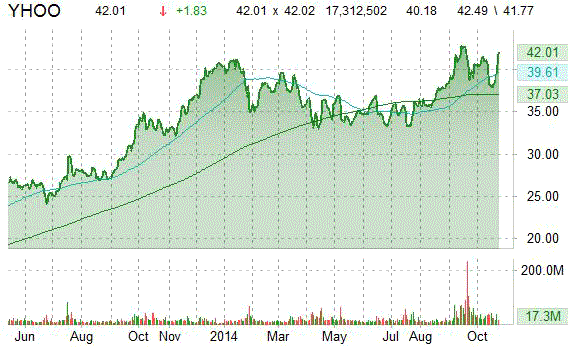

Yahoo! Inc. (YHOO) had its rating upgraded to ‘Outperform’ from ‘Market Perform’ by analysts at FBR Capital on Wednesday, who cited the company’s solid Q3 results as the basis for the upgrade. The analysts raised the price target for YHOO shares to $50.00 implying 18% expected return. Separately, Bernstein came out with a report this morning, saying it sees limited downside and 30% potential upside in Yahoo’s stock over the near-term. The firm keeps a ‘Market Perform’ rating on the web portal shares.

Yahoo’s shares recently rose $2.30, or 5.72% to $42.56. The stock is down 0.64% this year ; up roughly 20% over the past 12 months.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

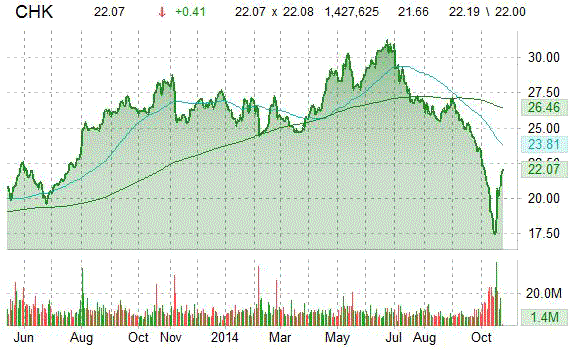

Chesapeake Energy Corporation (CHK) was upgraded by UBS from a ‘Neutral’ rating to a ‘Buy’ rating in a research note issued on Wednesday.

Chesapeake Energy Corporation shares are currently priced at 27.35x this year’s forecasted earnings compared to the industry’s 17.15x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.98 and 11.28, respectively. Price/sales for the same period is 0.72 while EPS is $0.79. Currently there are 7 analysts that rate CHK a ‘Buy’, while 19 rate it a ‘Hold’. No analysts rate it a ‘Sell’. CHK has a median Wall Street price target of $30.00 with a high target of $37.00.

In the past 52 weeks, shares of Oklahoma City, Oklahoma-based company have traded between a low of $16.69 and a high of $29.92 and are now at $22.07. Shares are down 17.20% year-over-year and 14.42% year-to-date.

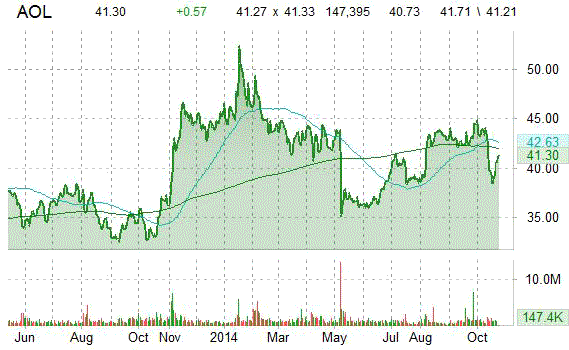

Analysts at Evercore upgraded their AOL Inc. (AOL) rating to ‘Buy’ from ‘Hold’ in a research report issued to investors on Wednesday.

AOL shares recently gained $0.23 to $40.73. In the past 52 weeks, shares of the New York-based company have traded between a low of $32.31 and a high of $53.28. Shares are up 16.34% year-over-year ; down 12.63% year-to-date.

Leave a Reply