Tekmira Pharmaceuticals Corp (TKMR) is a big mover this pre-market session with its shares spiking 15%. The move comes after the company said it has commenced limited GMP manufacture of a new therapeutic specifically targeting the Ebola — Guinea variant, which is the viral variant responsible for the Ebola epidemic currently prevalent in West Africa. Tekmira said supply of this new product will be available in early December, 2014, for potential use by various collaborators.

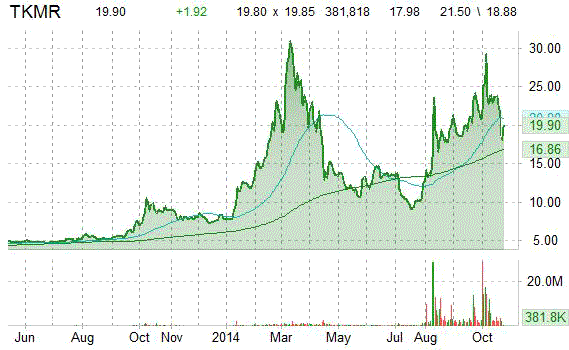

TKMR shares recently gained $2.37 to $20.35. In the past 52 weeks, shares of the biopharmaceutical company traded between a low of $7.17 and a high of $31.48. The stock is up a 99.56% year-over-year and 125.60% year-to-date.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

Shares of Blue Earth Inc. (BBLU) are up almost 34% to $1.72 in pre-market trading Wednesday following a response by Johnny R. Thomas, the company’s CEO, to false statements and allegations made by the Pump Stopper in Seeking Alpha.

Highlights:

“This posting compiles selective information in a false and misleading manner to maliciously advance, we believe, a “short agenda” for personal gain. Responding to all of the falsehoods and innuendos would dignify the author with more credibility than deserved.”

“Fraud Allegations at ABTX: A class action suit was filed against ABTX and management. The lawsuit was DISMISSED with prejudice. The law firm that spearheaded the lawsuit, Milberg Weiss, was disbanded and certain principals went to jail for their illegal activities in initiating and pursuing such lawsuits…”

“BBLU has hired multiple stock promoters: Investor Relations outreach is an important and critical fiduciary duty of management. There is a difference between investor relations and “stock promoters” as implied by the author. Investors should be aware that the Company provided the exchanges with every investor relations contract as part of a full disclosure during the up listing process…”

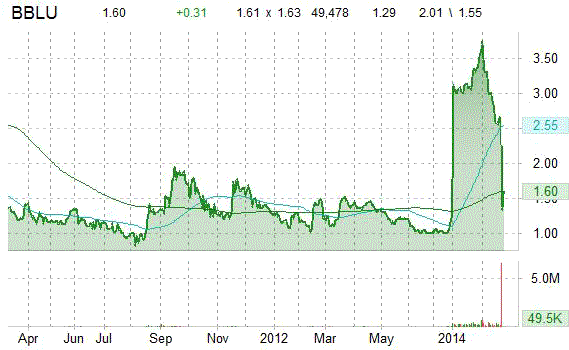

In the past 52 weeks, Blue Earth, a Henderson, Nevada-based energy efficiency solutions company has traded between a low of $1.00 and a high of $3.93. Over the past 5 trading sessions the stock has declined 49.81%. Ticker is down 58.65% year-over-year and 52.57% year-to-date.

The stock of the manufacturer of display drivers and other semiconductor products Himax Technologies, Inc. (HIMX) is having a bad day, nosediving nearly 15% in pre-market trade on news that Google (GOOG), (GOOGL) has decided not to exercise its previously issued purchase option to make an additional investment into Himax’s subsidiary, Himax Display Inc. (“HDI”). Himax said it has been authorized by Google to make the following statement: “Google continues to work closely with Himax as a strategic partner on future technologies and products and will remain a board observer.”

Himax Technologies shares are currently priced at 20.15x this year’s forecasted earnings compared to the industry’s 11.49x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.58 and 14.07, respectively. Price/Sales for the same period is 1.91 while EPS is $0.40. Currently there are 7 analysts that rate HIMX a ‘Buy’, while 2 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. HIMX has a median Wall Street price target of $11.00 with a high target of $12.00.

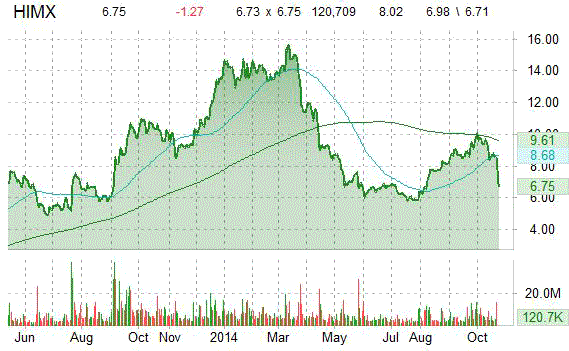

In the past 52 weeks, shares of Tainan, Taiwan-based company have traded between a low of $5.70 and a high of $16.15 and are now at $6.85. Shares are down 19.48% year-over-year and 43.04% year-to-date.

Shares of 3D Systems (DDD) plunged 10% in premarket trade Wednesday, after the company announced it expects its Q3 adjusted EPS and revenue to be in the range of $0.16 to $0.19 and $164 million to $169 million, both below the Street’s estimates, respectively.

“We are disappointed that we failed to fully capitalize on the robust demand for our direct metal and consumer products during the quarter,” Avi Reichental, President and CEO of 3DS said in a statement. “While we worked very hard to deliver these products sooner, achieving manufacturing scale, quality and user experience targets took significantly longer than we had anticipated.”

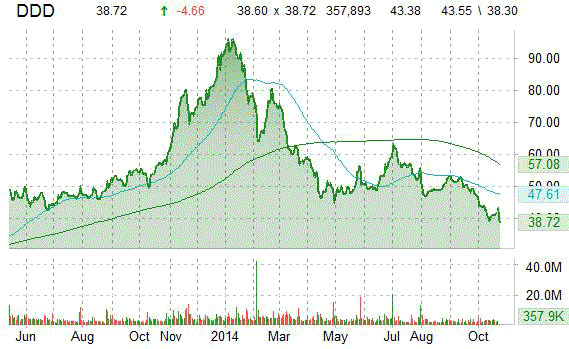

In the past 52 weeks, shares of Rock Hill, South Carolina-based company have traded between a low of $38.70 and a high of $97.28 and are now at $39.01. Shares are down 24.82% year-over-year and 53.32% year-to-date.

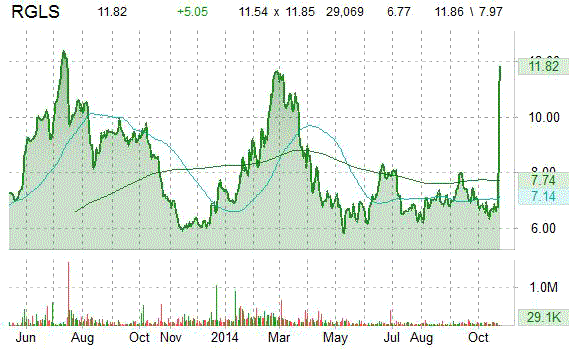

Regulus Therapeutics Inc. (RGLS) is a big mover this pre-market session, as its shares are up a staggering 66%. The surge came after the biopharmaceutical company reported that it has demonstrated human proof-of-concept with a microRNA therapeutic from an ongoing clinical study evaluating RG-101, a wholly-owned, GalNac-conjugated anti-miR targeting microRNA-122 (“miR-122”), for the treatment of hepatitis C virus infection (“HCV”).

Regulus said interim results from the ongoing clinical study demonstrate that treatment with a single subcutaneous dose of 2 mg/kg of RG-101 as monotherapy resulted in significant and sustained reductions in HCV RNA in a varied group of patients, including difficult to treat genotypes and patients who experienced viral relapse after a prior IFN-containing regimen. Additionally, RG-101 was safe and well tolerated and has demonstrated a very favorable pharmacokinetic profile to date, which may allow for combination with oral direct-acting antiviral (“DAA”) agents to treat HCV.

RGLS shares recently gained $6.94 to $13.71. The stock is down more than 16% year-over-year and has lost roughly 8.39% year-to-date. In the past 52 weeks, shares of San Diego, California-based company have traded between a low of $5.40 and a high of $11.88.

Regulus Therapeutics, which closed Tuesday at $6.77, has a total market cap of $293.76M.

Leave a Reply