Almost four years ago, I asked whether the U.S. was in for a labor market slump similar to the slump experience in Canada during the 1990’s. Evidently, the answer turned out to be yes.

How is the U.S. faring relative to Canada back then? American prime-age males seem to be tracking their Canadian counterparts, both in terms of employment-to-population ratios and in labor force participation rates. American females, on the other hand, appear to be lagging behind their Canadian counterparts. Let me show you some data.

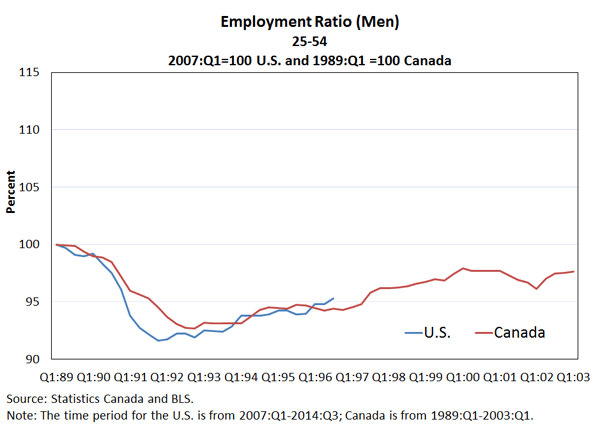

Let’s begin by looking at the employment ratio for prime-age males:

As you can see, the sharp drop and subsequent recovery dynamic for prime-age males is remarkably similar across these two countries and time periods. (The initial E-P ratio was about 87% for both countries; see here).

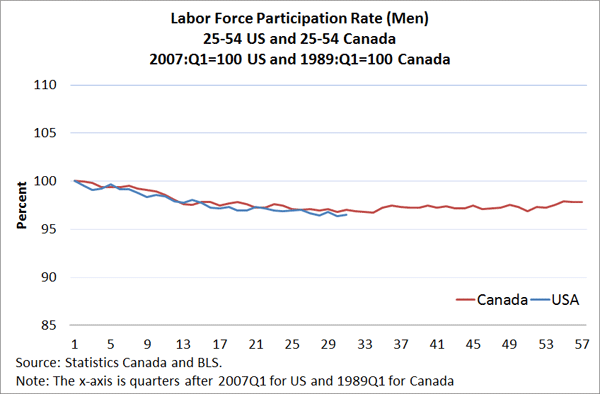

Here is what their labor force participation rates look like:

Again, the recovery dynamic looks almost identical (The initial part rate for Canada was 93%, for the US about 91%; see here).

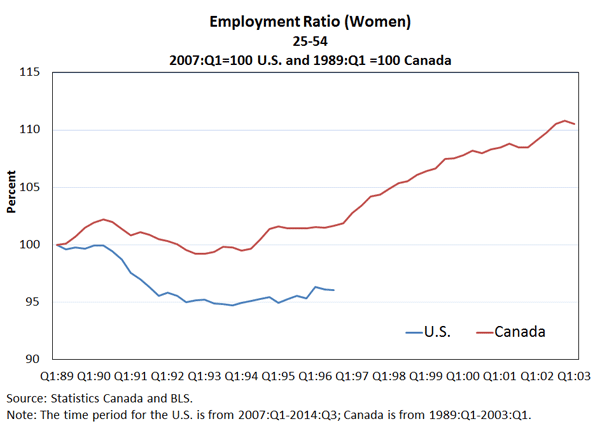

Alright, now let’s take a look at the same statistics for prime-age females. First, the employment ratios:

These dynamics look quite a bit different. The main effect of the recession in Canada was to slow down the growth rate in the employment ratio. In the U.S., the effect has been to reduce the employment ratio, with only a very weak sign of recovering in the past year.

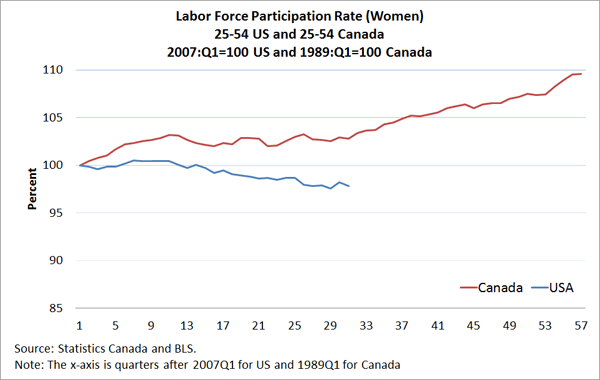

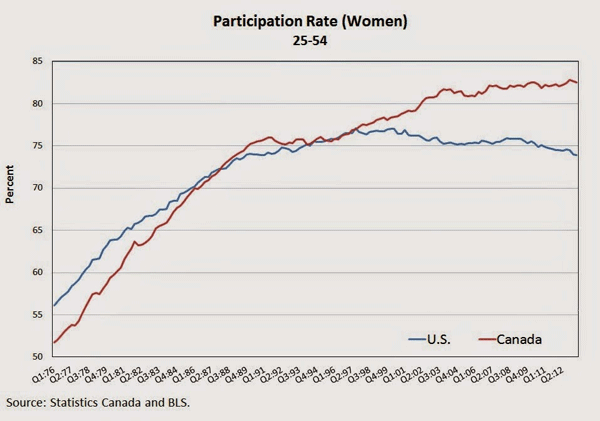

Here is what the labor force participation rate dynamics look like:

Again, two very different recovery dynamics.

A colleague of mine suggested that state-level layoffs in education and government may explain a good part of the lackluster recovery dynamic for U.S. females. This is certainly worth looking into. However, if we take a look at the following diagram, we see that the discrepancy appears to have happened much earlier — around 1997, in fact.

It seems unlikely to me that the divergence between Canadian and American prime-age females is driven by cyclical considerations (although, a small part of the recent gap may be). Work incentives are likely to have changed, although what these changes were, I do not yet know. In any case, I doubt that monetary policy is a tool that can be used to close this gap. I can think of plenty fiscal interventions that might help, however.

Leave a Reply