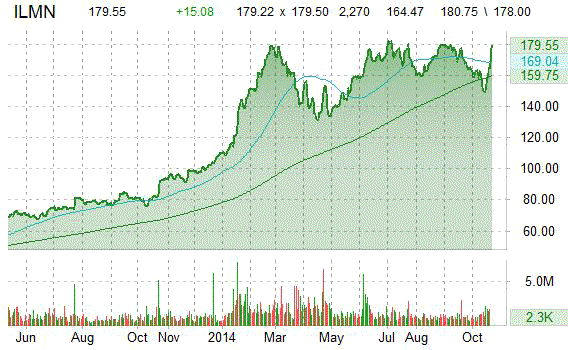

Shares of Illumina Inc. (ILMN) were upgraded to an ‘Overweight’ rating by Piper Jaffray analysts on Tuesday. The firm also raised its 12-month base case estimate to $210 from $192 implying 27.68% expected return from ticker’s current price.

ILMN shares recently gained $15.73 to $180.20. The stock is up more than 101.98% year-over-year and has gained roughly 48.72% year-to-date. In the past 52 weeks, shares of San Diego, California-based company have traded between a low of $80.88 and a high of $185.00.

Illumina Inc., which closed Monday at $164.47, has a total market cap of $22.93B.

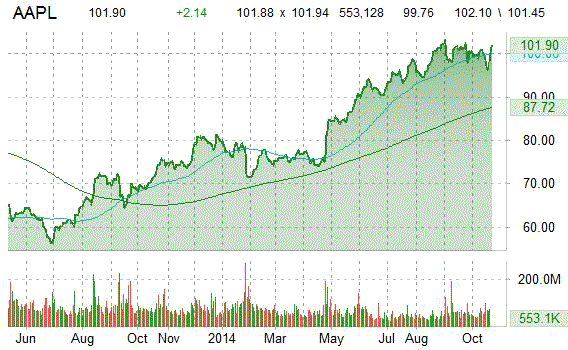

Barclays is out with a report this morning raising Apple (AAPL)’s price target to $120 from $116 and estimates following the company’s solid Q4 report. The firm cited Cupertino’s iPhone 6 cycle as a driving force revenue-wise over the next several quarters before new products become growth drivers. Separately, Apple’s price target was also raised to $115 from $110, and to $143 from $123 at Mizuho and Cantor, respectively.

Apple shares are currently priced at 16.09x this year’s forecasted earnings compared to the industry’s 24.96x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.18 and 12.18, respectively. Price/Sales for the same period is 3.28 while EPS is $6.20. Currently there are 33 analysts that rate AAPL a ‘Buy’, while 10 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. AAPL has a median Wall Street price target of $110.00 with a high target of $135.00.

In the past 52 weeks, shares of the iPhone maker have traded between a low of $70.51 and a high of $103.74 and are now at $101.68. Shares are up 40.33% year-over-year and 26.55% year-to-date.

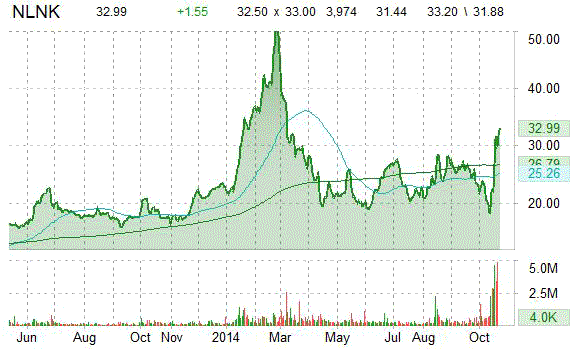

Cantor Fitzgerald reported on Tuesday that they have raised their rating for NewLink Genetics Corporation (NLNK). The firm has upgraded NLNK to a ‘Buy’ and lifted its price target to $41 from $34.

NewLink was a big gainer last session, as its shares rose $2.09, or 7%.12 on the day. Approximately 4,907,260 shares changed hands compared to the stock’s average daily volume of 727,165 shares.

NLNK currently prints a one year return of about 71.80% and a year-to-date return of around 42.84%. Ticker has a market cap of $877.46M and a median Wall Street price target of $38.00 with a high target of $51.00.

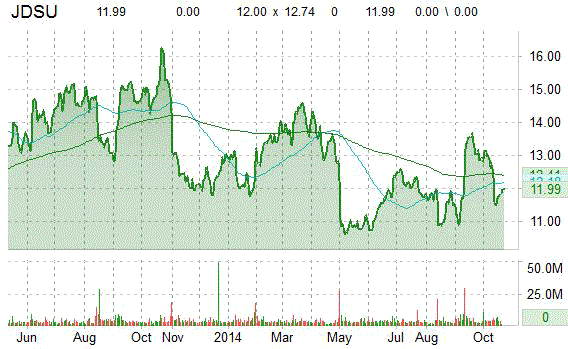

The chart below shows where the equity has traded over the past 52-weeks, with the 50-day and 200-day moving averages includ

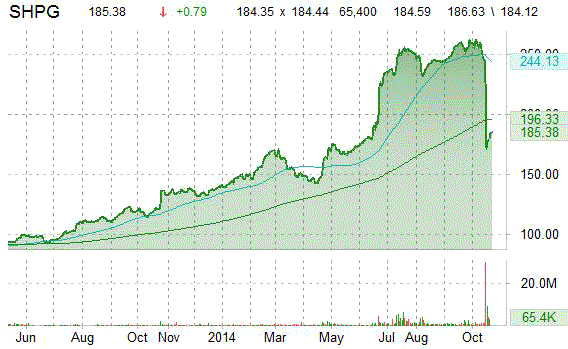

Shire plc (SHPG) coverage was resumed on Tuesday by Deutsche Bank (DB) analysts with a ‘Buy’ rating and a price target of $220.00. The firm’s price objective suggests a potential upside of 18.59% from the stock’s current price.

SHPG shares are currently priced at 32.85x this year’s forecasted earnings, which makes them inexpensive compared to the industry’s (9.67)x earnings multiple. Ticker has a forward P/E of 16.97 and trailing-12 price-to-sales ratio of 6.50. EPS for the same period is $5.62.

In the past 52 weeks, shares of Dublin, Ireland-based firm have traded between a low of $120.60 and a high of $264.98 and are now at $185.51. Shares are up 51.22% year-over-year and 31.09% year-to-date.

Equities research analysts at UBS raised their price target on shares of JDS Uniphase Corporation (JDSU) to $17 from $14 in a research note issued to investors on Tuesday. The firm’s price target would suggest a potential upside of about 42% from the stock’s current pps.

JDS Uniphase has a forward PE of 14.80. Price/Sales for the t-12 period is 1.56 while EPS is ($0.08). The company has a market cap of $2.76 billion and is part of the communication equipments industry. Shares are down 22.82% year-over-year and 7.66% year-to-date as of the close of trading on Monday.

Leave a Reply