Shares of Tesla Motors (TSLA) are down more than 4% to $226.50 in mid-day trading Monday after analysts at Credit Suisse (CS) cut the company’s 2014 EPS outlook by a dime to $0.86 from $0.96 on warranty charges. “We’ve reduced 2014 EPS estimate…to reflect expected drive unit-related warranty charge in Q3,” the investment bank’s Daniel Galves said in a note to investors.

Despite the lower estimate, Galves, who maintained an ‘Outperform’ rating and $325 price target, suggested that [via Benzinga] “the combination of Tesla capability and Electric Vehicle inherent advantages will be a disruptive force, supporting our long-term demand forecasts and enabling pricing power / excess margin.”

Tesla Motors shares are currently priced at 69.47x next year’s forecasted earnings. Ticker has a PEG and forward P/E ratio of 4.64 and 69.51, respectively. Price/sales is 12.12 while EPS is ($1.35). Currently there are 9 analysts that rate TSLA a ‘Buy’, while 7 rate it a ‘Hold’. No analysts rates it a ‘Sell’. TSLA has a median Wall Street price target of $287.50 with a high target of $400.00.

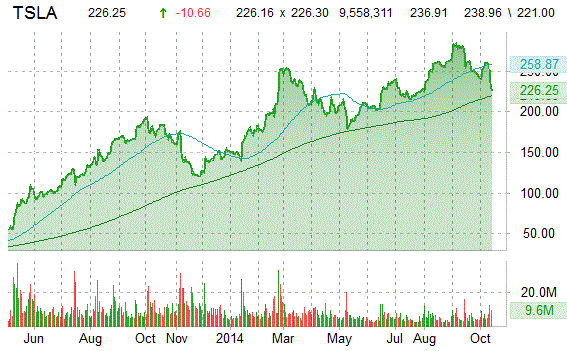

In the past 52 weeks, shares of the electric car maker have traded between a low of $116.10 and a high of $291.42 and are now at $226.54.

Shares are up 37.00% year-over-year and 57.49% year-to-date.

Leave a Reply