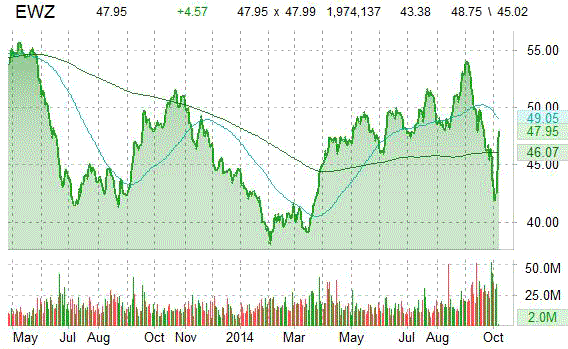

Shares of iShares MSCI Brazil Capped (EWZ) are up almost 11% to $48.00 in pre-market trading Monday following a Bloomberg report that discusses Brazil’s elections where incumbent President Dilma Rousseff was first, but did not win majority and will face Aecio Neves in run off election October 25th.

Te following stocks may see some short covering since the election results are now over until October 25th:

BBD, BAK, PBR, PZE, CBD, ABEV, VALE, GGB, SID, TSU, BRP, VIV, GOL, ERJ, SBS, ELP, CIG, CPL, EBR, BSBR, BRFS, OIBR, GFA.

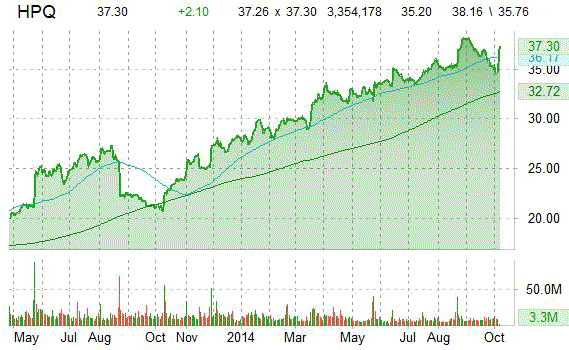

Hewlett-Packard Company (HPQ) is a mover this pre-market session, as its shares are up nearly 6%. The surge came after the company confirmed it will separate into two listed public companies. HP said it plans to split its computer and printer businesses from its enterprise business by the end of FY 2015.

The split “will provide each new company with the independence, focus, financial resources, and flexibility they need to adapt quickly to market and customer dynamics, while generating long-term value for shareholders,” said HP chief executive Meg Whitman in a statement.

“In short, by transitioning now from one HP to two new companies, created out of our successful turnaround efforts, we will be in an even better position to compete in the market, support our customers and partners, and deliver maximum value to our shareholders,” she said.

On valuation-measures, shares of Hewlett-Packard have a trailing-12 and forward P/E of 13.23 and 8.91, respectively. P/E to growth ratio is 1.99, while t-12 profit margin is 4.54%. EPS registers at $2.66. The company has a market cap of $65.69B and a median Wall Street price target of $40.00 with a high target of $45.00.

On trading-measure, HPQ has a beta of 1.42 and a short float of 1.49%. In the past 52 weeks, shares of the multinational information technology have traded between a low of $20.25 and a high of $38.25 with the 50-day MA and 200-day MA located at $36.44 and $34.21 levels, respectively.

HPQ currently prints a one year return of about 71.46% and a year-to-date return of around 27.54%.

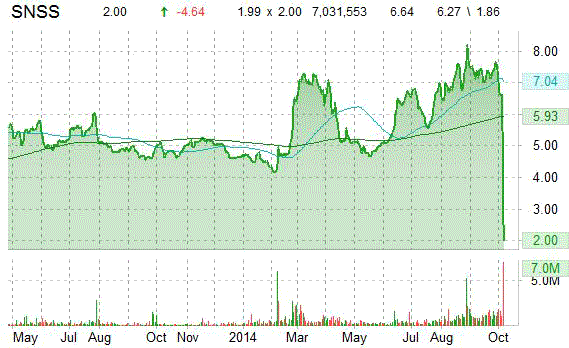

Sunesis Pharmaceuticals, Inc. (SNSS) is one of Monday’s most notable stocks in decline, down 71.84% to $1.88. The nosedive came after the company said results from the pivotal Phase 3 VALOR trial, a randomized, double-blind, placebo-controlled trial of vosaroxin and cytarabine in patients with first relapsed or refractory acute myeloid leukemia (AML), did not meet its primary endpoint of demonstrating a statistically significant improvement in overall survival.

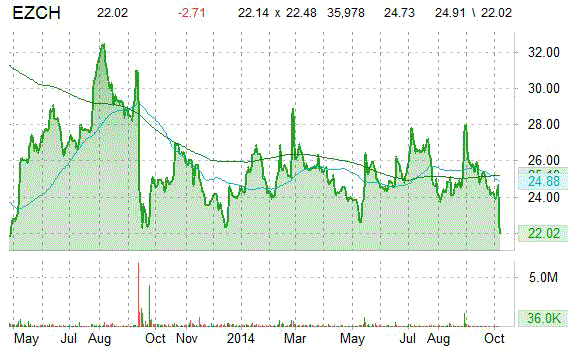

EZchip Semiconductor Ltd. (EZCH) shares are trading 11% lower in pre-market hours in reaction to disappointing earnings/guidance. The network processor reported that it currently expects revenue in Q3 2014 to be in the range of $19 million, approximately 14% lower than the $22 million range guidance previously provided.

EZCH shares are currently priced at 28.79x this year’s forecasted earnings, which makes them expensive compared to the industry’s 10.83x earnings multiple. Ticker has a forward P/E of 14.81 and t-12 price-to-sales ratio of 8.87. EPS for the same period is $0.86.

In the past 52 weeks, shares of Yokneam, Izrael-based firm have traded between a low of $22.02 and a high of $29.12 and are now at $22.02. Shares are down 0.68% year-over-year ; up 0.49% year-to-date.

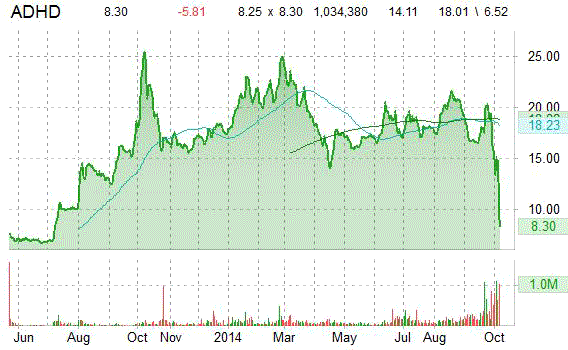

Alcobra Ltd. (ADHD) is another big decliner this pre-market session, as its shares are down 40.40%. The plunge came after the company announced topline results from Phase III study of MDX in adult ADHD.

Leave a Reply