Cantor on Tuesday raised its price target on Salix Pharmaceuticals Ltd. (SLXP) to $181 from $154 implying 13.24% expected return from ticker’s previous close. Salix shares were 9.15% higher in premarket trade and are up 77.71% in the year to date, while the S&P 500 has gained 17.49%.

In other Salix news ; The Wall Street Journal reports that botox maker Allergan Inc (AGN), which is trying to fend off a $53 billion hostile takeover bid from Valeant Pharmaceuticals International (VRX) and Bill Ackman, plans to reject offer from Actavis plc (ACT) and may now bid for SLXP itself.

Salix Pharmaceuticals Ltd. shares are currently priced at 135.79x this year’s forecasted earnings compared to the industry’s -9.55x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.34 and 22.96, respectively. Price/Sales for the same period is 8.29 while EPS is $1.18. Currently there are 6 analysts that rate SLXP a ‘Strong Buy’, 6 rate it a ‘Buy’ and 5 rate it a ‘Hold’. No analysts rate it a sell. SLXP has a median Wall Street price target of $155.00 with a high target of $195.00.

In the past 52 weeks, shares of Raleigh, North Carolina-based company have traded between a low of $65.38 and a high of $165.32 and are now at $174. Shares are up 136.36% on a year-over-year basis.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Shares of Tekmira Pharmaceuticals Corp (TKMR) were up 10% in pre-market trade following a report from the company that it is collaborating with an international consortium to provide an RNAi based investigational therapeutic for expedited clinical studies in West Africa.

The consortium includes representatives from the WHO, US Centers for Disease Control, Medecins Sans Frontieres — Doctors without Borders, ISARIC, and Fondation Merieux, among others.

The Wellcome Trust has announced it has awarded £3.2 million ($5.2 million) to the consortium to fund this initiative. The award will include funds for the manufacture of investigational therapeutics as well as the establishment of an operational clinical trials platform in two or more Ebola Virus Disease treatment centers in West Africa.

Tekmira said RNAi has been prioritized as an investigational therapeutic and may be selected for clinical trials at these centers.

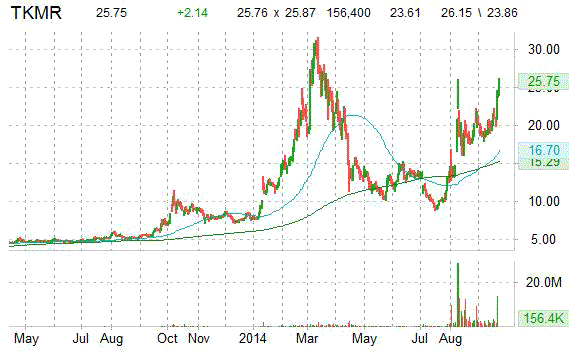

TKMR recently traded to $25.60. In the past 52 weeks, shares of Vancouver, B.C. Canada-based company have traded between a low of $5.93 and a high of $31.48. Currently there are 2 analysts that rate Tekmira a ‘Strong Buy’ and 2 that rate it a ‘Buy’. No analysts rate it a sell. TKMR has a median Wall Street price target of $25.00 with a high target of $31.00. Shares are up 277.16% year-over-year and 196.24% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Shire plc (SHPG), currently valued at $50.10B, is trading down 14 points this morning at $246.32. The stock is under pressure following last night’s announcement from the US Treasury Department which said it is taking its first steps to reduce tax benefits of corporate inversions.

“[T]oday’s action eliminates certain techniques inverted companies currently use to gain tax-free access to the deferred earnings of a foreign subsidiary, significantly diminishing the ability of inverted companies to escape U.S. taxation,” the Treasury said in a statement. “It also makes it more difficult for U.S. entities to invert by strengthening the requirement that the former owners of the U.S. company own less than 80 percent of the new combined entity. For some companies considering mergers, today’s action will mean that inversions no longer make economic sense.”

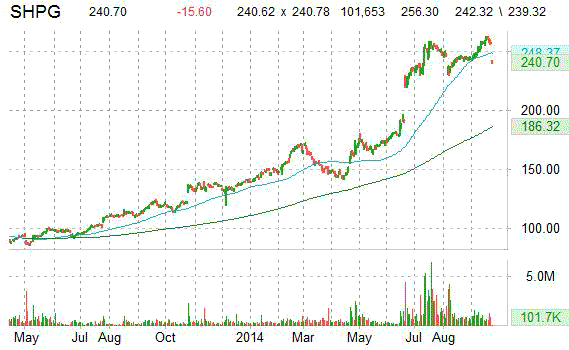

Shire plc shares are currently priced at 59.21x this year’s forecasted earnings compared to the industry’s -9.55x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.67 and 23.51, respectively. Price/Sales for the same period is 9.37 while EPS is $4.33. Currently there is only one analyst that rates SHPG a ‘Strong Buy’, 2 rate it a ‘Buy’ and 9 rate it a ‘Hold’. No analysts rate it a sell. SHPG has a median Wall Street price target of $265.00 with a high target of $275.00.

In the past 52 weeks, shares of Dublin, Ireland-based company have traded between a low of $113.59 and a high of $262.32 and are now at $256.30. Shares are up 107.48% year-over-year and 81.40% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Shares of CF Industries Holdings, Inc. (CF) climbed over 19 points in pre-market trade after Yara International (YARIY) confirmed Tuesday that it is in merger talks with U.S. fertilizer producer, potentially boosting the company’s U.S. footprint.

“Yara International ASA confirms it is in discussions with CF Industries regarding a potential merger of equals transaction,” said Yara. CF Industries also published a similar statement.

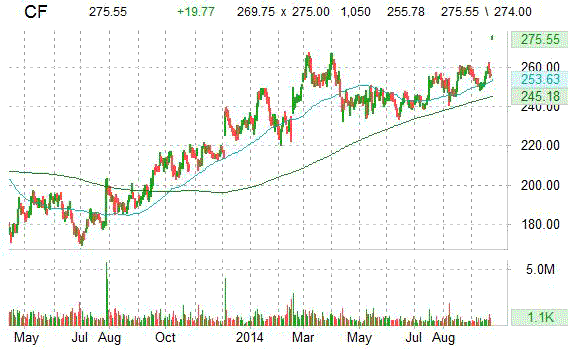

CF Industries Holdings shares are currently priced at 8.29x this year’s forecasted earnings compared to the industry’s 17.73x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.55 and 12.24, respectively. Price/Sales for the same period is 2.55 while EPS is $30.87. Currently there are 2 analysts that rate CF a ‘Strong Buy’, 9 rate it a ‘Buy’ and 11 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. CF has a median Wall Street price target of $261.00 with a high target of $300.00.

In the past 52 weeks, shares of Deerfield, Illinois-based company have traded between a low of $203.04 and a high of $267.76 and are now at $273.50. Shares are up 22.87% year-over-year and 9.76% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply