Shares of Clorox Co. (CLX) are down by 1.50% to $95.57 in pre-market trading on Tuesday, following two downgrade ratings to “Neutral” from “Buy” and to ‘Sell’ from ‘Neutral’ at Citigroup (C) and B. Riley, respectively.

On valuation-measures, The Clorox Company shares have a trailing-12 and forward P/E of 22.59 and 20.64, respectively. P/E to growth ratio is 3.14, while T-12 profit margin is 9.98%. EPS registers at $4.30. The company has a market cap of $12.53B and a median Wall Street price target of $87.00 with a high target of $101.00.

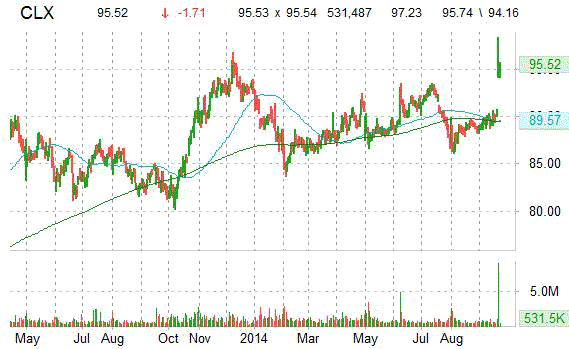

On trading-measure, CLX has a beta of 0.53 and a short float of 9.98%. In the past 52 weeks, shares of the the consumer and professional products manufacturer have traded between a low of $80.20 and a high of $98.31 with its 50-day MA and 200-day MA located at $89.14 and $89.44 levels, respectively.

CLX currently prints a one year return of about 17.71% and a year-to-date return of around 5%.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

Shares of Bed Bath & Beyond Inc (BBBY) were downgraded to a ‘Market Perform’ rating from ‘Outperform’ by William Blair on Tuesday.

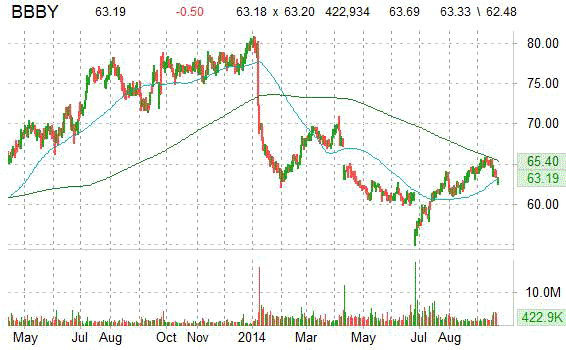

BBBY shares have plunged 15.61% over the past 52 weeks, while the S&P 500 index has gained 17.49% in the same period.

On valuation-measures, shares of Bed Bath & Beyond Inc. have a trailing-12 and forward P/E of 13.30 and 11.71, respectively. P/E to growth ratio is 1.37, while t-12 profit margin is 8.72%. EPS registers at $4.79. The company has a market cap of $12.63B and a median Wall Street price target of $64.50 with a high target of $80.00.

On trading-measure, BBBY has a beta of 0.62 and a short float of 12.43%. In the past 52 weeks, shares of the retailer have traded between a low of $54.96 and a high of $80.82 with its 50-day MA and 200-day MA located at $63.72 and $63.19 levels, respectively.

BBBY currently prints a year-to-date return of 20.68%.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

ON Semiconductor Corp (ONNN), a manufacturer of semiconductor components for electronic systems worldwide, was downgraded by JPMorgan (JPM) analysts to a ‘Neutral’ from a ‘Overweight’ rating Tuesday. ON Semiconductor Corp, shares were down 2.60% at $9.36 in early trade, moving within a 52-week range of $6.80 to $10.07.

ONNN shares are currently priced at 23.07x this year’s forecasted earnings compared to the industry’s 18.44x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.50 and 9.60, respectively. Price/Sales for the same period is 1.46 while EPS is $0.41. Currently there are 4 analysts that rate ONNN a ‘Strong Buy’, 10 rate it a ‘Buy’ and 4 rate it a ‘Hold’. 1 analysts rate it a sell. ONNN has a median Wall Street price target of $11.50 with a high target of $15.00. Shares are up 28.49% year-over-year and 13.83% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Canaccord reported on Tuesday that they have lowered their rating for Viasystems Group, Inc. (VIAS). The firm has downgraded VIAS from a ‘Buy’ to a ‘Hold’.

Viasystems Group, Inc. shares are currently priced at 23.94x next year’s forecasted earnings. Ticker has a PEG and forward P/E ratio of -6.20 and 23.94, respectively. Price/Sales for the same period is 0.27 while EPS is ($1.21). Currently, VIAS has a median Wall Street price target of $16.50 with a high target of $16.50.

In the past 52 weeks, shares of St. Louis, Missouri-based company have traded between a low of $9.52 and a high of $16.79 and are now at $15.69. Shares are up 10.98% year-over-year and 14.55% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply