According to a Financial Times report, Apple is set to receive a 0.15% cut from each transaction executed on its new Apple Pay system. This equates to 15 cents in every $100 purchase.

The report states [via macworld] that this is an “unprecedented deal, giving Apple a share of the payments’ economics that rivals such as Google do not get for their services.”

The report said that Apple was able to negotiate with so many major banks, including Chase Bank, Bank of America (BAC), Citibank and payment networks and receive choice deals because the industry – for now, at least – doesn’t see Cupertino’s pay model as disruptive to their business. In fact, an unnamed bank executive was quoted as saying in the FT report that Apple’s payment model continued to put banks “at the centre of payments.”

If Apple’s new one-touch mobile payment system, which stores you payment info in an encrypted and secure fashion, catches on, this could be a big deal for the company considering the U.S. alone sees $12 billion worth of transactions per day. According to “Forrester Research”, the mobile payments market could become a $90 billion industry by fiscal 2017.

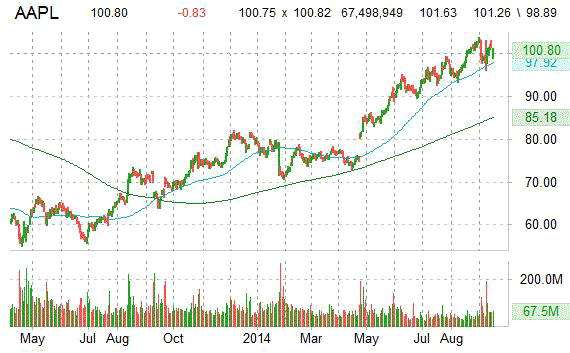

On Tuesday’s Nas session, Apple (AAPL) printed a higher than average trading volume with the issue trading almost 64M shares, compared to the average volume of 51,871,400. The stock began trading this morning at $99.85 to finish the session down $0.77, or 0.76%, from the prior days close of $101.63. On an intraday basis it got as low as $98.89 and as high as $101.26.

Apple shares are currently priced at 16.76x this year’s forecasted earnings, compared to the industry’s 23.40x earnings multiple. Ticker has a trailing-12 and forward P/E ratio of 16.92 and 13.96, respectively. Price/Sales for the same period is 3.42 while EPS is $5.96. Currently there are 15 analysts that rate AAPL a ‘Strong Buy’, 28 rate it a ‘Buy’ and 9 rate it a ‘Hold’. No analysts rate it a sell. AAPL has a median Wall Street price target of $110.00 with a high target of $139.00.

In the past 52 weeks, shares of Cupertino, California-based company have traded between a low of $63.89 and a high of $103.74 and are now at $99.90. Shares are up 55.90% year-over-year and 25.08% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply