Sam Peters, who runs the $2.8 billion Clearbridge Value Trust Fund, said in an interview with YF’s Aaron Pressman that while the recovery in Apple’s (AAPL) price-per-share was well deserved over the past year, and particularly over the recent months, mainly helped by the stock split in April, and also on increased buybacks and dividend payouts, further gains could push ticker into overvalued territory.

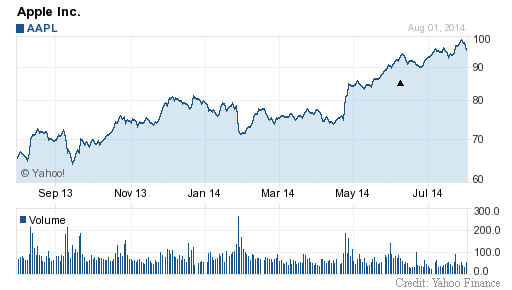

Apple has gained 52.59% over the last 52 weeks, and almost 20% year-to-date. More recently in the last 3 months, the stock has gained 13.76%, trading between $84.50 and $99.02. On Friday the stock traded between $94.81 – $96.62. AAPL currently has a trailing-12 P/E of 16.13, a forward P/E of 13.67 and a P/E to growth ratio of 1.24. The median Wall Street price target on the company’s stock is $106.00 with a high target of $139.00.

At current levels, Peters says AAPL, which was the fund’s top holding as of June 30, is fairly valued. But as the price rises over $100/share, giving the iPhone maker a market cap of more than $600B from $575B currently, the shares “become much less interesting”. That’s because even if new iPhones and other devices sell well, Apple’s days of experiencing hyper-growth are over. In fact, CEO Tim Cook acknowledged as much in April 2013, on the tech giant’s Q2 earnings call, saying “Despite producing results that met or beat our guidance as we have done consistently, we know they didn’t meet everyone’s expectations. And though we’ve achieved incredible scale and financial success, we acknowledge our growth rate has slowed and our margins have decreased from the exceptionally high level we experienced in 2012.”.

During his interview Peters also mentioned NXP Semiconductors NV (NXPI) as a company that could be a big beneficiary of the next iPhone upgrade cycle. NXP makes chips that Peters expects Apple will use in its next flagship phone, widely expected to be called the iPhone 6, to allow for a secure, wireless payment feature.

Shares in the $14.89 billion provider of security and digital processing products gained fractionally on Friday to close at $62.40.

Leave a Reply