It makes a good headline; but it’s dangerous to say “austerity is dead,” just because new budget projections indicate that the deficit has already been cut by $200 Billion more than in previous projections, and because the Reinhart-Rogoff study has been debunked successfully, and, hopefully, irretrievably. Austerity will only be dead when legislators, Presidents, Prime Ministers, Central Bankers, and international lending organizations stop trying to implement it, whether or not they stop because deficits have already been cut.

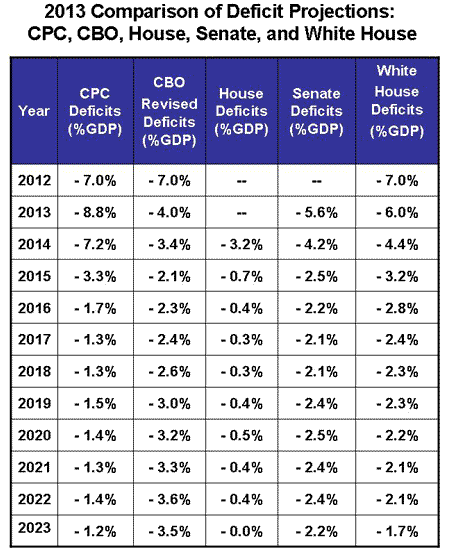

Of course, those claiming austerity is dead, mean by their claim that deficit cutting efforts have already been successful enough in the United States that future projections in all the mainstream budget plans now show only “moderate” deficits (See the Table which now includes CBO revised budget projections.) These don’t signal a debt crisis, and instead suggest that we can now turn to the really serious economic, health, and environmental challenges we face.

In addition, deficit reduction efforts in the rest of the world seem to clearly show that austerity efforts have been unsuccessful nearly always and everywhere in that their costs in economic damage have been far greater than any gains that have been made by nations purposefully pursuing these efforts. In cases, such as Greece, Ireland, Italy, Latvia, Portugal, and Spain, deficit reduction efforts have actually made debt problems worse than they were before harsh austerity measures cutting government spending were taken, because their negative effects on national economies and employment have also reduced tax revenues by more than the savings achieved from cutting government programs.

But Everybody’s Still Doing It

These claims about austerity’s effects seem obviously true, but they also implicitly grant the idea, that, in some cases, such as the United States, there was a debt crisis that was far less serious than most people thought, and that has already been resolved by recent deficit cutting efforts. But, the truth is that the US debt crisis was purely a political crisis, never a fiscal sustainability or fiscal responsibility crisis, and that there is a need right now to continue running much larger deficits than we are running, if we are to support the need to renew our economy, meet the most varied set of challenges we have faced since the second world war, and achieve full employment with price stability.

In their relief that deficits have already been substantially cut, and their accompanying joyous cries that “austerity is dead,” and we must get on with the job of creating full employment, progressives are making the implicit assumption that we will able to “get on with the job” while also maintaining at least some of the mainstream plans underlying budget projections over the period 2013 – 2023. Mostly, of course, they favor the Congressional Progressive Caucus (CPC) budget plan, or at least Patty Murray’s Senate plan, rather than the House or White House plans and projections (See the above table).

But regardless of the specifics, they certainly don’t envision leaving the idea of deficit reduction plans behind entirely, and focusing instead squarely on programs that will create and maintain a healthy, growing economy, characterized by full employment, price stability, and increasing economic equality, regardless of whether such programs may require deficit spending amounting to 10% or more of GDP for many years to come.

Even more, progressives apparently envision that if a “progressive” budget plan such as the CPC’s was passed, then they would try to see to it that it is implemented in the sense that Government tax revenues and spending would be managed over a 10 year period to produce the deficits projected in the CPC or some other progressive deficit reduction plan. But, this is the road to ruin, because whether such a plan is offered by progressives, by conservatives, or by Petersonians such as Erskine Bowles, President Obama, or Jack Lew, it is still austerity that is being offered.

Why Is It Austerity?

I think “austerity” is one of those terms like “fiscal responsibility” and “fiscal sustainability” that are used more as slogans than as tools for illuminating understanding. So, in some quarters, austerity is synonymous with entitlement cuts, high unemployment, lack of government investment, beating up on the poor, the old, women, and the vulnerable and other instruments or consequences of austerity. Clear analysis however, requires separating “austerity” from other things associated with it.

First, it’s important to realize that we are talking about Government-induced austerity involving medium to long-term fiscal policy characterized by a focus on reducing budget deficits, or increasing budget surpluses, and mostly on the former in today’s environment. Second, austerity involves destroying private sector net financial assets by cutting government spending and/or raising taxes in such a way that Government additions of net financial assets to the non-government portions of the economy (government deficits) fall to a level low enough that they are less than the size of the trade balance, whether in deficit or in surplus.

So, in all the mainstream budget plans the majority of annual projections envision Government additions of net financial assets (government deficits) of 3% or much less. Since, we can pretty well anticipate that we will be running a trade deficit of 3% or greater over the next 10 years, that means the private sector taken as a whole will be losing financial wealth to the government in most years covered by the mainstream (whether progressive or conservative) budget projections. And that’s why all the budget plans, the CPC and Senate plans included are embodiments of actual austerity.

Sure the CPC is better than the others in 2013 and 2014 since its Government additions (deficits) are much larger than the others in those years. But the CPC plan quickly settles into less than 2% deficit projections for the remainder of the decade, and even its projected deficits for 2013 and 2014 aren’t large enough since the high levels of unemployment, need to repair household balance sheets, and ongoing import desires suggest that a true full employment policy will require 10% of GDP in government additions (deficits) or more (depending on the private sector’s desired savings rate) for years to come, until we really beat our economic problems and/or our trade balance radically shifts.

The situation is even worse if we consider that, after 2014, even when government deficit projections exceed 3%, they exceed it by less than 1% of GDP, not enough for most of the population to get a share of the government contributed addition, in the face of the economic and political power of the financial elite to see to it that they get whatever meager gains the government is adding to the private sector.

Why is Everyone in the Mainstream Proposing Austerity?

All the mainstream deficit reduction budgets being proposed are austerity budgets. If they, or any compromise among them, were taken seriously, the eventual result would be a constriction in aggregate demand sufficient to cause another major recession in the next few years due to the private sector savings losses that are likely to be associated with these budgets as we try to implement these 10 year plans. So, why is it that everyone, including the CPC, is proposing an austerity/deficit reduction plan for the next decade?

One explanation is that everyone in the political mainstream is on board with the gradual destruction of the American middle class and the creation of a plutocracy where wealth is concentrated in the hands of a few; and that everyone also knows very well that tight budgets lead to gradual private sector financial losses falling much more heavily on the middle class and the poor, and that these, in turn, will increase the wealth gap between the rich and everyone else. In this view, the effects of these budgets are not some overlooked side effects of implementing austerity; but are a great feature of medium and long-term austerity.

I don’t know how many people fit the bill provided by this explanation, but I think that far too many of our elected officials, and, many more than we like to think, embody this explanation. The truth is that the elites are after the American people, and that in the areas that really matter we’ve become a kleptocracy, a lawless oligarchy that continuously extracts more and more financial assets from most Americans by illegal means largely with impunity because authorities will not prosecute them.

A second explanation, and one that most probably applies to progressives like Bernie Sanders, Keith Ellison, and other, but perhaps not all, members of the progressive caucus is their continued adherence to ideas about debts and deficits that may have been appropriate for gold standard economies, but don’t recognize the increased policy space for government additions to the economy (deficit spending) that Governments issuing non-convertible fiat currencies, having floating exchange rates, and no debts denominated in foreign currencies, have. These progressives along with most others who are part of the Washington, New York, “left coast” elite still seem to believe in the idea that levels of government debt and debt-to-GDP ratios matter for fiscal sustainability. They still accept the Keynesian economics orthodoxy they find in the writings of Paul Krugman, Joseph Stieglitz, Robert Kuttner, and the Center for Budget and Policy Priorities, with its doctrine of the government actively expanding deficits in bad economic times and shrinking them in good times.

That orthodoxy, worries about the trends in the debt-to-GDP ratio, and the possible reactions of the bond markets to projected debts and deficits down the road, because it worries about the possibility of hyper-inflation caused by “printing money.” It’s that perspective that informs the CPC budget, and that ensures that even it, provides for long-term austerity.

A third explanation is that a moral perspective that “debt is bad” pervades our culture and is used very successfully by Peter G. Peterson’s long-term propaganda campaign, to maintain the idea that we need to worry about the size of the public debt and the debt-to-GDP ratio, and to keep the issue of debts and deficits on the front burner.

When Will They Ever Learn?

If these explanations have some validity then at least for progressives and people in general, it is important that they understand that one can’t look at issues of government debts and deficits without noting their context in relation to the other sectors of the economy. In particular, any long-term economic plans and projections must incorporate an understanding of the Sector Financial Balances (SFB) model. The model is a simple accounting identity. Accounting identities are always true by definition alone. But, some may not be applicable to real world data and so may not be useful in explaining empirical data. The SFB model is useful, however. It says:

Domestic Private Balance + Domestic Government Balance + Foreign Balance = 0.

The terms refer to flows of financial assets among the three sectors of the economy in any defined period of time. So, for example, when the annual domestic private sector balance is positive more financial assets are flowing to that sector, taken as a whole, than it is sending to the other two sectors. Similarly, when the annual foreign sector balance is positive, more financial assets are being sent to that sector than it is sending to the other two sectors. When the private sector balance is negative, the private sector is sending more to the other two sectors, and so on.

Right now, for the United States, the annual foreign balance is positive: we are sending more financial assets to the foreign sector in trade than they are sending to us (the trade deficit). In recent years the foreign balance has varied from 3% of GDP to over 6% annually, and it is unlikely, over the next decade that it will fall below 3% in any year. So, if the Government adds less than 3% of GDP annually to the domestic private sector through deficit spending, then the private sector will be losing wealth year after year.

Now, the important question is: when will progressives, and Americans more generally, ever learn that they must look at debt/deficit plans and projections from the viewpoint of the SFB model and ask themselves whether forcing deficits of less than 3% of GDP for a number of years is both realistic and sustainable without either a credit bubble, another recession, ending in still greater poverty or inequality, or perhaps both?

Take another look at the Table. See for yourself. When evaluated from the viewpoint of the SFB model, all the mainstream plans are austerity budgets that will result in a stagnating economy to a greater or lesser degree over the next 10 years. Do we really want to condemn our country to increasing stagnation because we lack the will to commit to a fiscal policy for re-building our democracy; for fear of a Government spending-induced runaway inflation that is nowhere on the horizon, but only present in theory whether neoclassical, Keynesian, or Austrian in character?

Let us cross the inflation bridge if and when we come to it, as we did in World War II, and in the years up until the 1970s. Until then, let us put everyone to work, strengthen our safety nets for the vulnerable, educate our young, and rebuild our nation, before we devolve into a sorry third world mess of desperately angry and resentful people, ruled by a very small minority of fabulously wealthy but frightened people who will brutalize us all.

Leave a Reply