As has been the case for much of the last two years, the Apple (AAPL) earnings report on April 24, 2013 was a media event, previewed endlessly on investment sites, covered heavily by the media and tweeted about by both Apple fans and foes. While I try to stay away from the hype around earnings reports, this is a good occasion to revisit my earlier posts on Apple, and especially the one I made at the start of this year on its valuation.

The Signal amidst the Noise

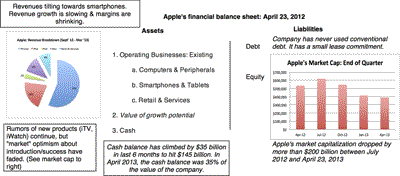

One of the most difficult parts of being an investor in Apple has become dealing with the cacophony of rumors, stories and news releases that seem to permeate the day-to-day coverage of the stock. Not only do we, as investors, have to determine whether there is truth to a story but we also have to evaluate its impact on value (and indirectly on whether to continue holding the stock). To keep my perspective, as I read these stories, I go back to basics and draw on my “financial balance sheet” view of a company. While it resembles an accounting balance sheet in broad terms, it is different on two dimensions. First, it is a forward looking and value based assessment of a company, rather than being backward looking and historical cost based. Second, it is flexible enough to allow me to record the potential for future growth as an asset, thus giving businesses credit for value that they may create in the future from growth. In very broad terms, here is what Apple’s financial balance sheet looked like just before the most recent earnings report:

(click to enlarge)

There is nothing surprising about this balance sheet but it brings together much of what has happened to the company between April 2012 and April 2013. During the year, the company has become increasingly dependent upon its smartphone business, accounting for 60% of revenues and even more of operating income, generating immense amounts of cash for the company (with the cash balance climbing $50 billion over the course of the year to hit $145 billion). During the course of the year, we have seen a slowing of revenue growth and pressure on margins, both of which have contributed to declining stock prices. The other big change over the course of the year is that the value of growth potential (from unspecified future products) has faded, at least in the market’s eyes, and this is reflected in the decline of $200 billion in market value over the last nine months.

The Last Earnings Report (April 23, 2013)

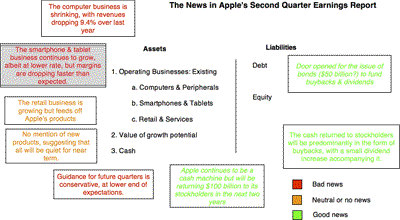

The most recent earnings report contained a mix of good news on the financial front (cash and financing mix) and bad or neutral news on the operating asset front. Using the same framework that I used in the last section, here is how I parsed the news in the report:

(click to enlarge)

First, in the no news category, revenue growth is no longer in the double digits and smartphones continue to increase their share of overall revenues & operating income. Well, we knew that already and the revenue growth was well within the expected bounds. Second, the bad news is that margins are shrinking faster than we expected them to, though I get the sense that Apple is understating its margins (by moving some expenses forward) and its guidance for the future with the intent of getting ahead of the expectations game. Third, in near term bad news, the fact there is no mention of any new products or breakthroughs suggests that there will be no revolutionary product announcement (iWatch, iTV, iWhatever) in the next quarter. However, if you are a long term investor, it is mildly disappointing that it looks like that there will be no blockbuster announcements in the next three months but it is clearly not the end of the world.

On the financial side, there was substantial news, much of which I think is positive.

- Cash return to stockholders: The decision to decision to return about $100 billion more in cash to stockholders in buybacks and dividends by 2015 has to be viewed as vindication for those (like David Einhorn) who have arguing that Apple should be explicit about its future plans for cash and that it should distribute a large chunk cash with stockholders.

- Buybacks versus Dividends: In a bit of a surprise, the cash return will be more in the form of buybacks than dividends. I, for one, am on board with that decision because hiking the dividends further will essentially make this stock a “dividend” play, with an investor base that will put dividend growth in the future ahead of all other considerations. If Apple wants to retain the option of entering a new and perhaps more capital intensive business in the future, it is better positioned as a consequence of this decision.

- Debt coming? In an even bigger surprise, Apple has opened the door to taking on conventional debt. While the details are still fuzzy and the initial bond issue may be for only about $10 billion, it seems likely that the debt issued will grow beyond that amount. To those who would take issue with this decision, arguing that Apple does not need to borrow with all of its cash reserves, you may be missing the reason why this debt will add to value. If the trade off on debt is that you weigh the tax benefits of debt against the bankruptcy cost, there can be no arguing against the fact that borrowing money will add value for stockholders. To those who feel that it is in some way immoral or unethical, based upon the argument that Apple is sheltering its foreign income from additional US taxes while claiming a tax deduction for interest expenses, I would be more inclined to listen to you if you showed me convincing proof that you make mortgage interest payments every year but did not claim the mortgage tax deduction in your tax returns, because you think that it deprives the treasury of much needed revenue. The US tax code is an abomination, with its treatment of foreign income as exhibit 1, but to ask Apple (and its stockholders) to pay the price for the tax code’s failures makes little sense to me.

In summary, the net effect of the earnings report is negative on operating cash flows (with the declining margins) but positive on the financial side (with any discount on cash dissipating, as a result of the cash return announcement, and the tax benefits from debt augmenting value).

Intrinsic value impact

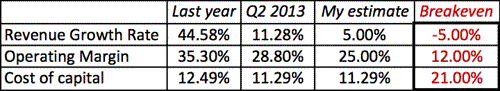

In my post from the end of last year, I had reported on an intrinsic valuation of Apple of $609/share, using data as of December 2012, with a distribution of values in a later post. Given that there have been two earnings reports since, I decided to revisit that valuation. In addition to updating the company’s numbers (all of the numbers except leases) to reflect the trailing 12 months (through March 31, 2013), I also incorporated the information from the most recent earnings reports to update my forecasts on three variables in particular:

- Revenue growth: As the competition in the smartphone business continues to increase, I am inclined to lower my expected revenue growth rate for the next 5 years to 5% from my original estimate of 6%. While this is well below the revenue growth of 11.28% over the last year (even using the last ‘bad” quarter comparison to the same quarter the previous year), it is the prudent call to make, especially in the absence of news about new products in the near term.

- Operating margin: I had projected a target pre-tax operating margin of 30% in my December 31, 2012, valuation, about 5% below the prevailing margin of 35.30% from the last annual report (the 10K in September). The pre-tax operating margin has dropped to 30.92% in the trailing 12 months ending March 31, 2012, and was about 29%, just in the last quarter. Since margins are coming down faster than expected, I lowered my target margin to 25%.

- Cost of capital: The cost of capital that I had used in my December 2012 valuation was 12.49% reflecting my expectation that Apple would stay an all equity funded firm in the foreseeable future. The decision to use debt upends that process and adding $50 billion in debt to the capital structure, while buying back $50 billion in stock raises the debt ratio in the cost of capital calculation to about 13%, while lowering the cost of capital to about 11.29%.

The net effect of these changes is that the value per share that I obtain for Apple is about $588, about 3.5% lower than the value of $609 that I estimated in early January. You can download the spreadsheet with my valuation of Apple. Again, make your own judgments and come to your own conclusions. If you are so inclined, go to the Google shared spreadsheet and enter your estimates of value.

If you are concerned about whether borrowing $50 billion will put Apple in danger of being over levered, I did make an assessment of how much debt Apple could borrow, by looking at the effects of the added debt on the costs of equity, debt and capital, with the objective being a lower cost of capital. I try to be realistic in my estimates of cost of equity (adjusting it upwards as a company borrows more) and the cost of debt (by coming up with a prospective rating at each dollar debt level and cost of debt at each debt ratio). If Apple can maintain its existing operating income, its debt capacity is huge ($200 billion plus) but even allowing for a halving of their operating income, it has debt capacity in excess of $100 billion. As with the valuation spreadsheet, you are welcome to download my capital structure spreadsheet for Apple and play with they numbers.

Clear and present dangers

Given the price collapse over the last few months, it would be foolhardy not to stress test the numbers in this valuation. In the first set of tests, I went back to the discounted cash flow valuation and computed my break even numbers for growth, operating margins and cost of capital, changing each of these variables, holding all else constant. The table below lists the current numbers for Apple for these variables, my estimates and the break even that yields today’s stock price ($420 on April 28, 2013).

Holding all else constant, Apple’s revenues would have to decline 5% a year for the next 5 years to justify a value per share of $420. Similarly, the pre-tax operating margin would have to drop to 12% from 30% today, holding the other variables at base case levels, to get to the same price. As an investor in Apple, there seems to be plenty of buffer built in, at least at current stock prices.

Will Apple go the way of Dell and Microsoft?

As a technology firm, though, your concerns may be about the company hitting a cliff and essentially either losing value or becoming a value trap. In particular, you may be worried that Apple may follow in the footsteps of two technology giants that have had trouble delivering value to stockholders in the last decade. One is Dell Computers, where Michael Dell’s attempts to rediscover growth have failed and the company is now facing a more levered, low growth future. The other is Microsoft, a less dire case, but a stock that hit its peak about a decade ago and has plateaued since. Can Apple be “Delled” or “Microsofted”?

To be Delled: What awaits a company when it’s product/service becomes a commodity and it operates at a cost disadvantage.

Dell was an success story in the growing PC business through much of the late 1990s and the early part of the last decade. As the market for PCs grew, Dell used its cost advantages over Compaq, IBM and HP to make itself the most profitable player in the market. What’s changed? First, the market for PCs hit a growth wall, as consumers turned to tablets and other connected devices. Second, PCs became a commodity, just as Dell lost its cost advantage to Lenovo and other lower cost manufacturers. With Apple, the peril is that their biggest and most profitable business, smartphones, may be heading in that direction. Unlike Dell, though, Apple is more than a hardware manufacturer and it’s success at premium pricing in the PC business is indicative of the pricing power that comes from creating the operating system that runs the hardware. I believe that the risk of Apple being Delled is small.

To be Microsofted: The destiny of a business that has a profitable, cash-cow product(s) but runs low on imagination/creativity.

Riding the success of Windows and Office, Microsoft (MSFT) became the largest market cap company about a decade ago. Like Apple, it seemed unstoppable. So, what happened? From the market’s perspective, the company seemed to run out of imagination and creativity and investors got tired of waiting for the next big hit and moved on. Note, though, that while the stock price and market capitalization have not moved much over the last ten years, the company has returned billions in cash to its stockholders. Could this value stagnation happen to Apple? Yes, but to me (and I have never been shy about my Apple bias), there are is a big difference between the companies. One is that I don’t think that Microsoft lost its imagination and creative impulses a decade ago. I don’t think it ever had any. While Windows nor Office were workmanlike and professional products, neither can ever be called elegant or creative (and I speak as a heavy user of Office products). Apple, on the other hand, has created iconic products through the decades, some less successful than others (remember the Newton), and I find it hard to believe that those creative juices just dried up last September.

Buy or Sell? Hold or Fold?

If Apple was being priced as a high growth stock, with sustained margins and on the expectations of “big” new hits in the future, I would be worried about the last earnings report. It is not. As you can see from the break even table in the last section, it is being priced as a low growth, declining margin company, with no great hits to come. I find it striking that the same investors who have priced the stock on this basis react to incremental news on these items (growth, margins, new products), as if they had not already priced it in.

As I see it, if I have Apple in my portfolio at $420 and the company continues to disappoint on every dimension (growth, margins, new products), I will have a boring stock that delivers billions in earnings and pays a solid dividend. However, if the company surprises by stopping margin leakage and increasing revenue growth in the smartphone market or by introducing the iWatch or the iTV, it will be icing on my investment cake. In a market, where my alternative investments are richly priced, Apple looks like a winner, to me. It stays in my portfolio, the price disappointments of the last few months notwithstanding.

Leave a Reply