A relatively unforeseen implosion in housing markets figured prominently in the 2007 meltdown in capital markets and the subsequent downturn in the global economy. This column presents new research on the political geography of subprime lending. Congressional leaders – as well as other recipients of campaign contributions – may have benefited from gains to trade in the direction, pricing, and sizing of subprime mortgage loans.

An implosion in housing markets figured prominently in the 2007 meltdown in capital markets and the downturn in the global economy. Neither analysts on Wall Street nor regulators in Washington anticipated the depth of the crisis, its geographic and asset-class contagion, or its adverse effects on household balance sheets. What was emblematic was the pervasive failure of subprime mortgages. The loans that were provided substantially eased credit qualification and homeownership opportunity to low credit-quality borrowers. By 2008, in the wake of downward spiral in house prices, a full 45% of subprime borrowers were underwater. Two years later, a similar share of outstanding subprime mortgages were in default.

Early on, and prior to the deterioration in subprime loan performance, lenders appeared to understand the controversial nature of their product and the related importance of Congressional support. To that end, lenders may have sought to direct campaign contributions to elected Representatives to generate support for subprime loan products and to assist in easing regulatory oversight. As documented by Mian, Sufi, and Trebbi (2012), lenders became politically sophisticated in making campaign contributions to elected Representatives in the years leading up to the crisis in the 2000s.

A second potentially complementary strategy for capturing political support was for lenders to offer more credit and at better terms to borrowers in Districts represented by targeted Congressional Representatives. As further suggested by Mian, Sufi, and Trebbi (forthcoming), such strategic interactions and related side-payments could be important in a world in which explicit ‘quid pro quo’ was not politically feasible. To the extent that interests aligned, both direct campaign contributions as well as District-level direction and pricing of mortgage credit could serve the political economic interests of both the lender and the elected official. District-level expansion of mortgage and housing opportunity could be viewed as a political return to Representatives in exchange for expanded subprime-lending opportunities.

New research

This study uses the universe of first-time homebuyer residential home loans issued by a major subprime lender to study the role of Congressional political influence in the access to and pricing of subprime mortgage credit. It provides a political economy explanation for the geography of subprime lending. By merging several data sets, we seek to implement the following thought experiment. Consider two identical marginal borrowers called ‘A’ and ‘B’ who live in the same local labour market at the same point in time. Assume that the two borrowers live in comparable but different residential communities. If A’s Congressional Representative is liberal, is a member of the Finance Committee, is a leader of the House of Representatives, or if this Representative receives direct campaign contributions from the subprime lending institution, do these Congressional attributes influence the probability that the institution makes a loan to A versus B? Further, are these same attributes associated with higher or lower loan amounts or loan pricing to A versus B?

The loan-level data in our study come from the servicing database of the now defunct New Century Financial Corporation (New Century) and the Home Mortgage Disclosure Act (HMDA). Like other studies, we control for the borrower, loan, or locational attributes that influence the allocation and risk-based pricing of mortgage credit. Unlike other studies, those controls are not the focus of this study. Instead, while controlling for a rich set of household attributes, our goal is to assess how attributes of the local Congressional Representative influenced access to and pricing of subprime mortgage credit. The ‘politics’ hypothesis posits that these attributes mattered because New Century had specific political goals in mind and used implicit subsidies to achieve those objectives.

The eased qualification requirements associated with subprime lending also may have been important to policymakers seeking to attain federally mandated lending goals related to minority homeownership. We test whether minority borrowers had a greater probability of receiving subprime loans as a function of their Congressional Representative’s attributes. Also, conditional on receipt of a subprime loan, we test whether minority borrowers received more favourable loan terms (as evidenced in loan size or loan pricing) as a function of their Representative’s attributes.

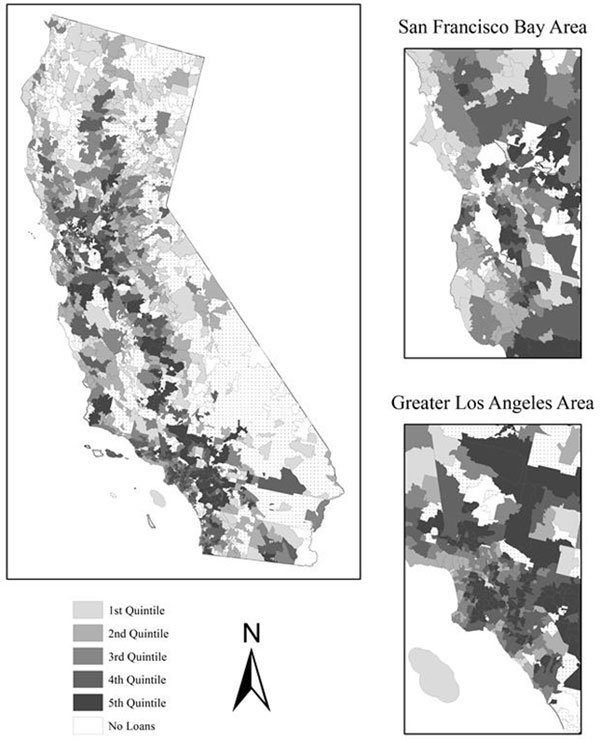

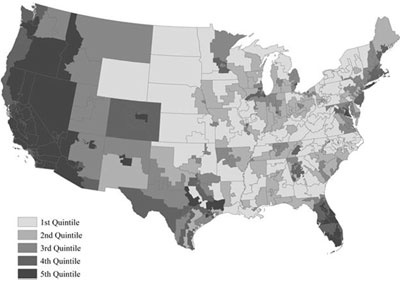

Assessment of New Century Financial Corporation loan-level data from 2003 to 2006 reveals a new political geography of subprime lending. Figures 1 and 2 display the spatial distribution of New Century’s loans during the 2003 to 2006 period both across the US (at the Congressional District level) and within California (at the zip-code level).

Figure 1. National distribution of New Century loans

(click to enlarge)

Figure 2. California distribution of New Century loans

Our findings highlight that New Century was especially active in offering differential treatment to borrowers represented by the Democratic and Republican leadership of Congress. In the case of borrowers residing in the districts of the Speaker of the House and the Majority and Minority Leaders and whips, subprime lenders were less likely to reject loans; further, New Century offered lower mortgage-interest rates and larger loan amounts, all things equal, to residents of those areas. This fact is especially true for African American borrowers in these districts. Also, borrowers received rate discounts in districts where New Century donated to the local Congressional Representative’s election campaign.

Conclusions

Together with results of Mian et al. (2010), our findings suggest a consistent pattern of Congressional Representative political geography in subprime lending. New Century may have viewed direction of campaign contributions to particular Representatives as well as enhancement of subprime-credit access in those or other Congressional Districts as consistent with profit maximisation, to the extent it helped to buy Congressional support for widespread proliferation of this controversial lending instrument among less qualified borrowers.

At the same time, local direction of mortgage capital may have served to elevate Representative political capital among constituents, given provision of mortgage finance to constituent households previously excluded from homeownership attainment. As boom turned to bust, Congressional proponents of the mortgage-credit boom likely rushed to support legislation aimed at foreclosure relief for those same constituents. Political factors, including direction of campaign contributions and Representative-specific allocation of mortgage finance, provide important new insights as regards the political geography of subprime lending.

Findings suggest that Congressional leaders as well as recipients of New Century campaign contributions may have benefited from gains to trade in the direction, pricing, and sizing of subprime mortgage loans.

References

•Gabriel, Stuart, Matthew E Kahn and Ryan K Vaughn (2013), “Congressional Influence as a Determinant of Subprime Lending”, NBER Working Paper #18965.

•Mian, Atif R, Amir Sufi and Francesco Trebbi (2012), “Political constraints in the aftermath of financial crises”, VoxEU.org, 21 February.

•Mian, Atif R, Amir Sufi, and Francesco Trebbi (2010), “The Political Economy of the US Mortgage Default Crisis”, The American Economic Review 100, December.

•Mian, Atif R Amir Sufi, and Francesco Trebbi (forthcoming), “The Political Economy of Subprime Mortgage Expansion”, Quarterly Journal of Political Science.

Leave a Reply