As much I criticize the Fed for its shortcomings, it pales in comparison to the failures of the ECB. Under its watch, aggregate nominal income and broad money growth has faltered in the Eurozone. This, in turn, has created an economic crisis. Note that causality runs from a weakened economy allowed by the ECB to a debt and financial crisis in the Eurozone, not the other way around. This is a point Ramesh Ponnuru and I have stressed before:

[Observers] tend to think of Europe’s current crisis as the result of overspending welfare states. And these states would indeed be better off with lower spending levels and less regulated labor markets. But many of the nations swept up in the euro-zone crisis, such as Spain and France, had spending and tax revenues well aligned before it hit. The true problem has again been monetary. Europe has for a decade had a monetary policy well suited to the circumstances of Germany but not to those of the rest of the euro zone and especially its periphery. Nominal income in Germany has stayed on a fairly steady trend line. In the periphery, however, it first went way up and then crashed. For the euro zone as a whole, nominal spending has fallen far below its previous trend—and has been continuing to fall farther away from it. Monetary policy therefore remains very tight in the euro zone overall. One effect of that drop-off, in Europe and in the U.S., has been to make debt burdens more onerous.

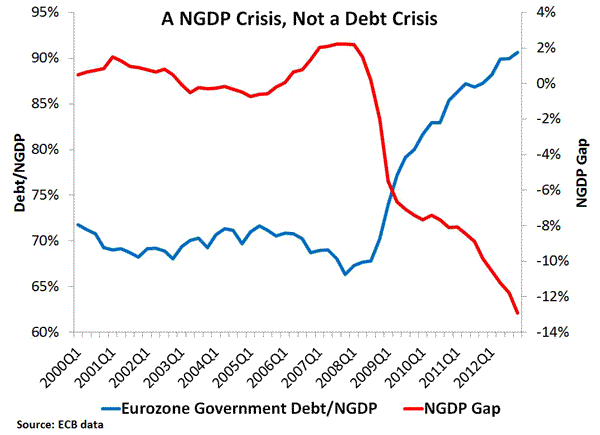

The graph below underscores this point. It shows that below-trend growth in Eurozone NGDP–the NGDP gap–has been matched by a rise in Eurozone government debt. The Eurozone crisis, then, is a nominal GDP crisis, not a debt crisis:

I bring this up because today we learn just how bad conditions are becoming in the Eurozone: unemployment hit 12.1% in March, 2013! Michael Darda of MKM Partners observes that this is the highest unemployment rate in the Eurozone over the past few decades. And on a country-by-country basis the unemployment numbers are even more harrowing, as shown by Ryan Avent. What more will it take for the ECB to act more aggressively? Apparently, intense human suffering is not enough. Maybe the advent of Abenomics in Japan in conjunction with the Fed’s ongoing QE3 program will spur the ECB into action out of fear of losing external competitiveness. How ironic it would be if Europe’s periphery became the main beneficiary of Abenomics.

Leave a Reply