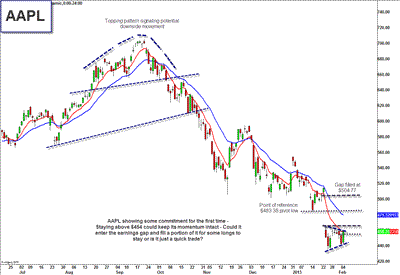

Apple’s (NASDAQ:AAPL) fall from grace has been precipitous and infamous in trading circles over the past few months, but could that narrative finally be starting to change? AAPL has been dead weight since topping out in late September above $700, shedding nearly 40% of its value in that time. The company proved the naysayers right in its January 23rd earnings report. Declining margins and sales growth have spooked investors that piled into AAPL thinking the company could never do wrong.

For traders like me who have watched AAPL everyday for the past five-plus years, it’s hard to condition ourselves to ignore the symbol and focus on the price action. I have tried previously to be early to the AAPL bounce, and each time I have been left frustrated. That is until today.

(click to enlarge)

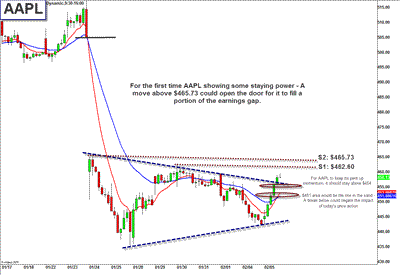

AAPL today for the first time is showing some commitment to a bounce. The stock opened slightly higher with the market this morning, and chopped around for the first half our of the session before getting in gear to the upside. The stock has seen a steady grind higher the whole day, the first time we have seen this type of action since earnings. I believe this could mark a short-term bottom in the stock, but will take it day-by-day until the stock re-proves itself.

(click to enlarge)

The line in the sand for AAPL that I will be watching on this trade is $452. If it violates that level then it is once again showing no commitment to the upside. I believe we could see a move to the beginning of the gap at $465, at which point I will reevaluate my size and expectations for the trade based on speed and composure.

AAPL finished the day up 3.5%.

Disclosure: Scott Redler is long AAPL

Leave a Reply