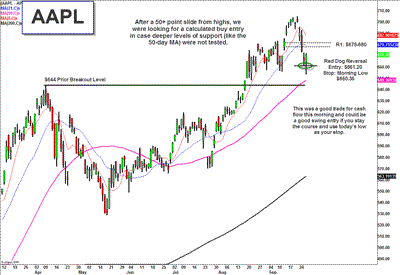

My focus today was my baby Apple (AAPL), which put in a classic Red Dog Reversal. If you aren’t familiar with my Red Dog Reversal, this is a reversal strategy that gives you a calculated entry to buy the dip rather than just trying to catch a falling knife without defined points of reference. I think it’s also important to explain a little bit about the psychology behind the Red Dog Reversal, and today’s AAPL trade provides a perfect case study.

The Red Dog Reversal is a strategy to catch a counter-trend move. A week ago, AAPL was trading above $700, and has pulled in 40+ points. Because of AAPL’s macro strength, we were looking for a calculated long entry. If you sold strength above $700 or got stopped out trailers around $683, the recent selling provided a great opportunity to get back involved. This “discount” was viewed as an opportunity–by active traders, swing traders AND macro investors.

(click to enlarge)

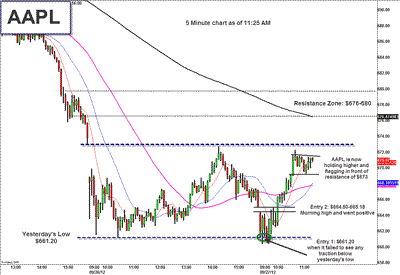

AAPL started off weak and there was a chance for a move to the 50-day down at $655-646 in coming sessions. In order to do that, it would need to trade and hold below yesterday’s low of $661.20 first. That is why I call that prior day’s low the “pivot” or the “action area.”

Any traders who entered AAPL long in the last day or two (too early) would likely use that level of $661.20 as their stop. From a risk management standpoint, a break below that level could have triggered more downside. In addition, some guys that were late trying to short (or didn’t cover shorts yet) become scared because AAPL is oversold, and if it starts to bounce they are forced to cover.

Fast forward to today’s action. AAPL traded below $661.20 and put in a low of $660.30ish. The Red Dog Reversal strategy is as follows: when the stock pushed below the previous day low, and then comes back above it, that is the entry. In this case for AAPL, it was $661.20. The stop is placed at the low of the day, in this case $660.40ish. There was not even a dollar of risk, and AAPL is now trading around $680, up nearly $20 from the buy trigger! We were all over this trade in real-time on the Virtual Trading Floor (R), which is why I think the service pays for itself very quickly.

(click to enlarge)

If you entered on the Red Dog Reversal, you can trail it as a swing trade, hold it as a macro pivot buy, or just pocket the cash for nice day trade, all depending on your time frame.

Disclosure: Scott Redler is long SPY, GS, LVS, AAPL.

Leave a Reply