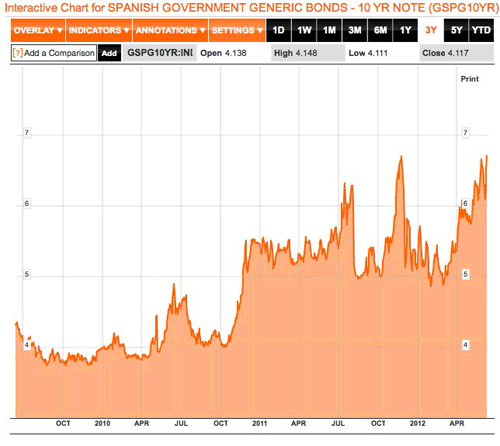

As of today, the Spanish bank bailout remains a phenomenal policy failure. Spanish bond yields continue to rise, with the impact of the ECB’s LTRO operations now effectively negated:

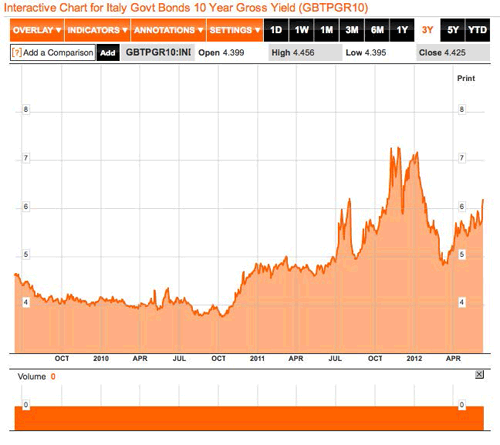

Worse, this policy disaster extends now into Italy, with short term debt now taking a hit:

The Rome-based Treasury sold the one-year bills at 3.972 percent, 1.63 percentage points more than the 2.34 percent at the previous auction on May 11. Investors bid for 1.73 times the amount offered, down from 1.79 times last month.

And long-term yields in Italy are heading higher as well:

The only player left on the field that can move fast enough and with enough firepower to pull Europe back from the brink is the ECB, and the pressure is on them to act. From Bloomberg:

Spanish Prime Minister Mariano Rajoy said today he’ll “battle” central bankers refusing to buy debt from peripheral nations. Rajoy published a letter to European Union leaders calling for the European Central Bank to buy debt from the countries struggling to shore up their finances.

“That is the battle we have to wage in Europe,” Rajoy told the Spanish parliament in Madrid today. “I am waging it.” His Italian counterpart, Mario Monti, told lawmakers in Rome Europe faces a “crucial” moment.

The leaders of southern Europe’s biggest economies went on the offensive as bond yields jumped following the announcement of a bailout for Spanish banks that was intended to quell concern over the countries’ finances. The decline wiped out the effects of 1 trillion euros in ECB loans for euro-region banks that had held yields in check since December.

Truly desperate pleas, but will they fall on deaf ears? For their part, the ECB seems content build upon the policy inaction at the last policy meeting and continue to do nothing:

Bundesbank board member Andreas Dombret this week said the ECB won’t buy more government bonds to ease the market tensions while Swedish central bank governor Stefan Ingves today said it’s hard to see what else the ECB could do for Spanish lenders.

“We have done our part,” Dombret said in a June 11 interview in London. “Now it’s up to the political leaders to deliver on the fiscal and structural policy side.”

It is never a good sign when the monetary authority – the lender of last resort – is no longer willing to buy your bonds. If the ECB sees only risk at these rates, why should private investors jump into the pool?

Honestly, I find it incomprehensible to believe that the ECB will not soon come to the aid of Spain and Italy with additional bond purchases. Only the most irresponsible policy body would take such a risk. To not do so almost guarantees the destruction of the Eurozone and a deepening recession if not depression throughout Europe. They cannot possibly believe that fiscal and structural reforms will bear sufficient fruit in any reasonable time frame. Nor can they possibly believe that Spain and Italy can implement a IMF-type structural reform program in the absence of the competitive boost provided by currency devaluation.

Or can they? If they do believe these things – that they can do no more, the job is entirely on the shoulders of fiscal policymakers – then we all need to be afraid, very afraid. Because when the ECB fully abdicates its role as a provider of financial stability for the Eurozone, all Hell is going to break loose.

Leave a Reply