Nothing like waking up on the West Coast to view the carnage on the East Coast. Two thoughts come to mind. First, I have said it before and I will say it again: If you become either too optimistic or too pessimistic about the path of the US recovery, you will almost certainly be slapped down in a matter of months. Second, this summer is looking like a carbon copy of 2011. The US data is turning softer just while the European saga is heating up. This time, we have some additional icing on the cake, with emerging markets faltering as well. And that black box that is China could be in free fall for all we know – commodity prices and cash outflows are pointing to some real distress.

And, if history serves as a guide, the Fed will eventually step up with another round of easing. But again, if history serves as a guide, they are going to make us wait until the end of a long, hot summer before they get to that point.

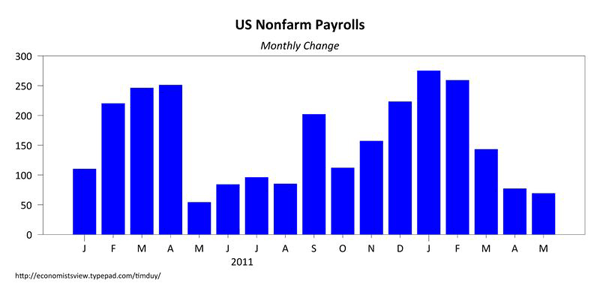

The primary news this morning was the dismal US employment report for May. Firms added just 69k workers for the month, with the private sector total just 82k. Worse yet, the March and April numbers were revised downward. The picture looks similar to last year’s slowdown:

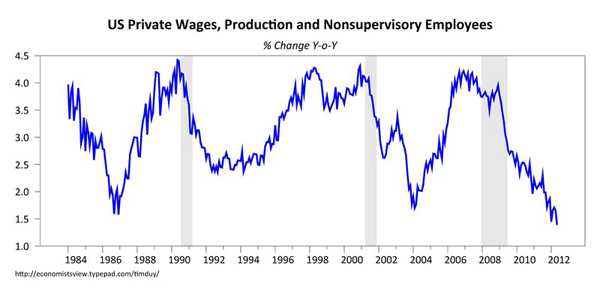

And for those on the Federal Reserve who insist on fretting about inflation at every turn (you know who you are), notice that wage growth continues to trend lower as well:

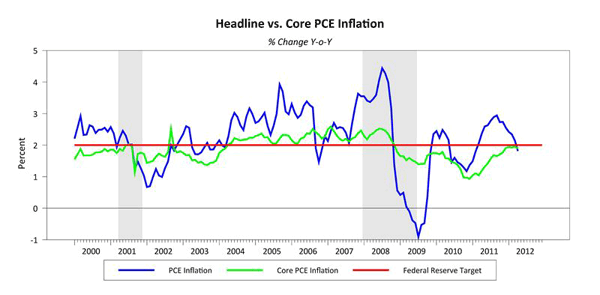

I just don’t see sustained inflationary pressures in this environment. Indeed, note that we also got a read on PCE inflation this morning, and surprise, surprise:

Once again, any panic about the jump in headline inflation could have been avoid if only you were willing to look at what was happening to the core. On that note, recent trends in core inflation are turning south as well:

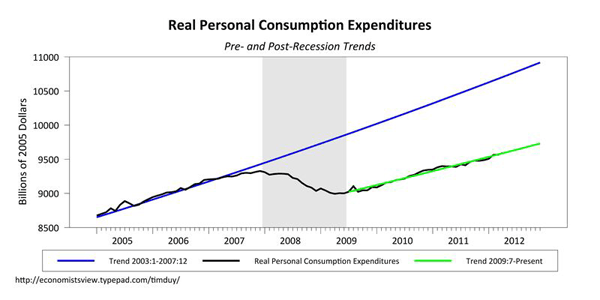

Consumer spending in April was uninspiring, with real spending gaining 0.3 percent after a flat reading in March. Here again, it is helpful to watch the trend:

Getting caught up in the monthly pops and dips misses the bigger picture: Slow and steady. That said, I would be wary that the support from auto sales will fade sooner than anticipated. From Bloomberg today:

General Motors Co. (GM), Toyota (7203) Motor Corp., Chrysler Group LLC and Nissan Motor Co. (7201) reported U.S. sales gains in May that trailed estimates as incentive offers failed to draw enough buyers amid slumping job growth….

…“We’re a little bit disappointed that some of the incentive offers didn’t drive sales a little bit beyond what they did,” Alec Gutierrez, an analyst for Kelley Blue Book in Irvine, California, said in a phone interview. “We wouldn’t be surprised to see” an industry sales rate of less than 14 million.

I don’t deny the sharp rebound in auto sales over the past year. But remember that this is largely a retracement; we have already covered most of the ground from the recession lows to the 16 million unit range prior to the recession. Once we revert to that new steady state – be it 16 million or 15 million units – growth will go to zero. Just a reminder that this source of growth has a limit. And, interestingly, now that some pent-up demand has been satisfied, we can envisage a decline in auto sales.

What does today’s data mean for monetary policy? I think it obviously pushes us in the direction of further easing. But when and of what form? Note this interesting comment from Cleveland Federal Reserve President Sandra Pianalto:

“One month, or even a couple of months, of [weak] job data isn’t changing my outlook that the economy will continue to expand,” she said.

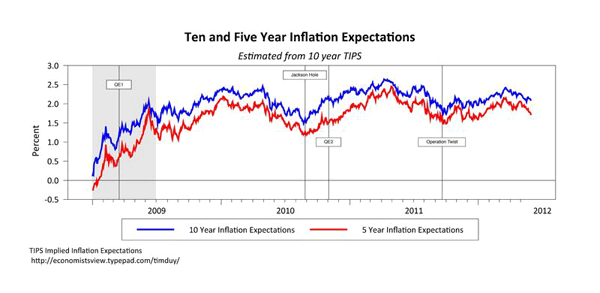

On not one number does monetary policy rest. We can look at the data with disappointment, but a slower improvement in labor markets than what we saw earlier this year is largely what the Federal Reserve expected. Simply put, these numbers fit better with the forecast. They are sufficient to drive the hawks back into their holes, but I think we need to see more before the Fed acts. Moreover, I think the Fed would like to see a clearer deflationary signal. On that front, we are getting even closer than just last week:

That said, I as acknowledged earlier, the history of the last two years suggests it is a matter of time before they act. I can see the Fed delaying until later in the summer. They are not prone to overshooting, as Ryan Avent likes to say.

The second piece of the puzzle is what action will they take. Boston Federal Reserve President Eric Rosengren – one of two Fed presidents that would definitely support immediate action – thinks they should extend operation twist at the next meeting:

Federal Reserve Bank of Boston President Eric Rosengren said the central bank should spur growth and cut unemployment by prolonging a program that lengthens the average duration of bonds on its balance sheet.

Continuing so-called Operation Twist beyond this month would help the Fed meet its congressional mandate to ensure full employment, Rosengren said in an interview with Bloomberg News before a Labor Department report that unemployment in May rose to 8.2 percent.

Continuing the maturity extension is a low-cost policy at this point. But there is a risk here that economic agents do not perceive it as meaningful policy. This is especially the case considering Rosengren’s further comments:

“That would have the impact of helping to reduce longer- term interest rates without expanding our balance sheet,” Rosengren said yesterday. “If you were looking for something that would promote growth but didn’t have an impact on our balance sheet, then certainly extending the maturity extension program would be a viable way forward.”

I guess Rosengren is not seeing the same Bloomberg numbers that the rest of us are getting, but long-term interest rates are already falling rapidly. The ten year rate is holding behold 1.5% as I write. The Fed needs to give up its fetish with low interest rates. Is Rosengren completely ignorant of the situation in Japan? At least I can argue that the Bank of Japan was navigating uncharted territory, which is how they wound up where there are. Sadly, the Federal Reserve has no such excuse. Their leader, Federal Reserve Chairman Ben Bernanke knows what to do, but just won’t do it.

I doubt that by the time the Fed actually moves, another Operation Twist will be sufficient. Instead, it will only be additional evidence that they are intellectually out of bullets. They will need to move back into the realm of quantitative easing (sterilized or not). And I think they it will take more than a month to build support for that kind of shift. Another reason not to expect policy to change until later this summer.

Bottom Line: At this point, the direction of US data, the pathetic state of Europe, and the evolving slowdown across the rest of the world all point toward additional action by the Federal Reserve. Assuming this continues, it is an issue of timing and tools. My baseline is steady policy at the June meeting (depending, of course, on the usual financial turmoil disclaimer), with a possibility of an extension of Operation Twist. The latter option is something of a tough sell for me; it is cheap, but will prove to be ineffective. If the Fed needs to move, they need to reverse course back into quantitative easing. They need time to build internal support for such a move, which argues for action later in the summer or early fall, much as we have seen in the past two years. I just don’t think they have enough to shift policy at this juncture.

Leave a Reply