There has been so much talk recently about millionaires and billionaires not paying their “fair share” of taxes, I decided to look up exactly how much they end up paying. Tim Carney pointed me to this CBO paper on average effective tax rates for 2007 (published in 2010).

This is unfortunately the latest data I can find, but it is useful to me because it gives data that can be extrapolated. If I know the average pre-tax income, the average after-tax income and the number of people the top 5% and the top 1%, I can extract the top 1% from the top 5% and calculate that data for people in the top 1.1%-5%. This means I can update my Not All Money Is Created Equal chart.

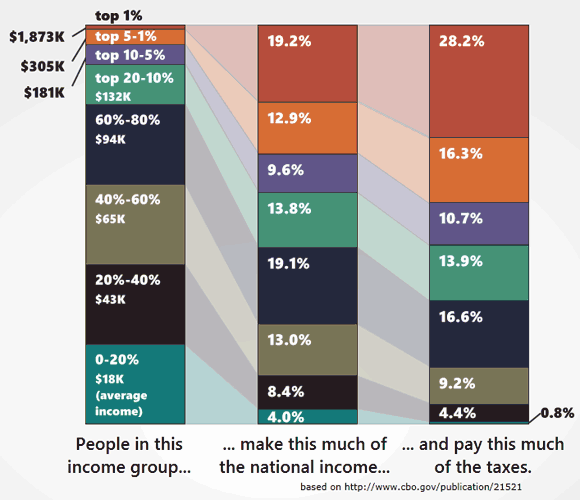

This is a chart of the effective tax rate, so it includes income, payroll, corporate, and excise taxes. It covers all practical sources of income (see the “technical information” at the bottom, since I’m guessing this will be the first objection raised).

I love this chart because I think it summarizes so many important things very easily. We can immediately get the scope of how much the top 1% makes, (it’s a lot) but also easily see that they pay more as a % of the tax burden than they make as a % of the national income. We can see that the US tax system is actually fairly progressive, with the top 20-10% paying the closest to a “fair share” (if by fair you mean every dollar made is taxed at an equal proportion to all income as a whole).

Warren Buffett is an anecdote, but one that has been repeated so often that many people think that the rich, as a whole, don’t pay very much in taxes. This chart shows that this is entirely untrue. When viewed through the lens of effective taxation (which is a very appropriate lens to use) the top 1% of income earners pay a much higher rate on their income than any other income group.

Technical information from the CBO on this data:

Comprehensive household income equals pretax cash income plus income from other sources. Pretax cash income is the sum of wages, salaries, self-employment income, rents, taxable and nontaxable interest, dividends, realized capital gains, cash transfer payments, and retirement benefits plus taxes paid by businesses (corporate income taxes and the employer’s share of Social Security, Medicare, and federal unemployment insurance payroll taxes) and employees’ contributions to 401(k) retirement plans. Other sources of income include all in-kind benefits (Medicare and Medicaid benefits, employer-paid health insurance premiums, food stamps, school lunches and breakfasts, housing assistance, and energy assistance).

Individual income taxes are allocated directly to households paying those taxes. Social insurance, or payroll, taxes are allocated to households paying those taxes directly or paying them indirectly through their employers. Corporate income taxes are allocated to households according to their share of capital income. Federal excise taxes are allocated to them according to their consumption of the taxed good or service.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply