Wow! Who said this business was easy.

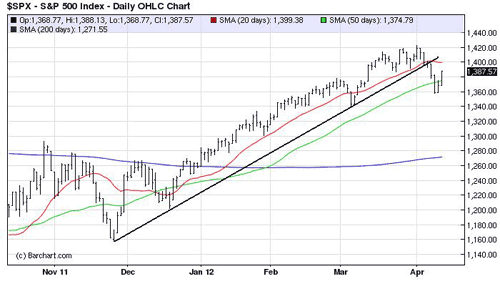

After clear breaks of their short-term uptrend and 50-day moving averages, the major U.S. equity indices have staged a powerful two day rally off their Tuesday intraday lows. Many were caught off guard as almost all indicators were signalling and flashing an intermediate term correction was in the works. Copper’s break was almost made it too easy to sell equities.

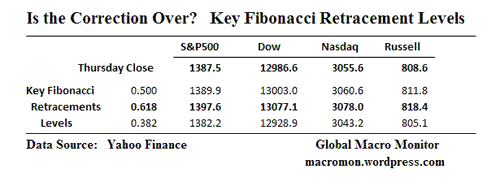

After a nice two day bounce, stocks have retraced almost 50 percent of the correction which began after the April 2nd highs on the S&P500 and Dow; and the March 27th highs on the Nasdaq and Russell 2000. The table below shows that all four indices closed just shy of the key 50 percent retracement level.

So is that it? We, like everyone else, have no idea.

The indices need to close above their .618 retracement level, which is less than a 1 percent move x/ the Russell, before sounding the all clear, in our book. The seasonals are set to deteriorate, the anesthesia from LTRO2 is starting to wear off as European sovereign spreads are blowing out again, French and Greek elections loom, and the nature of China’s landing is still far from certain.

Love to find out who started the rumor that China was going to print 9 + percent GDP growth, which helped get the market all lathered up this morning. Must of had a bad copper position they needed to unload.

Leave a Reply