As readers of this blog know, one of my pet peeves is all of the tea party demonstrators who are outraged by the high level of taxation in America, but who in fact know virtually nothing about taxation and grossly overestimate its burden. Further evidence of this fact come from a CBS News/New York Times poll released earlier today.

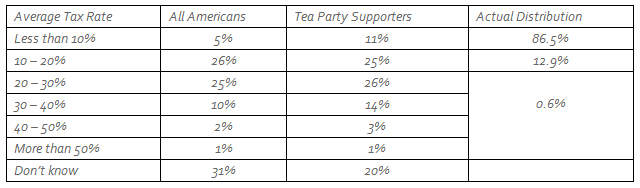

This poll sampled all Americans for their views on taxation and oversampled those who claim to be tea party supporters. Question 54 (page 25) is reproduced below. As one can see, five percent of all respondents and 11 percent of tea party supporters think that most Americans pay less than 10 percent of their income in federal income taxes each year. In fact, according to the Joint Committee on Taxation of the U.S. Congress, more than 86 percent of tax filers this year have an effective rate less than 10 percent (page 45).

About a fourth of all respondents and tea party supporters think most Americans pay 10 percent to 20 percent in federal income taxes. In fact, only 13 percent of Americans pay that much. Finally, 38 percent of all respondents and 44 percent of tea party supporters think most Americans pay more than 20 percent of their income in federal income taxes. The actual figure is less than one percent.

“On average, about what percentage of their household incomes would you guess most Americans pay in federal income taxes each year – less than 10 percent, between 10 and 20 percent, between 20 and 30 percent, between 30 and 40 percent, between 40 and 50 percent, or more than 50 percent, or don’t you know enough to say?”

Even though the question was quite clear is referring to average tax rates (taxes as a share of income), some people will undoubtedly respond that people were thinking about marginal tax rates. According to the JCT (page 36), this year 37 percent of taxpayers face a marginal federal income tax rate of zero, 16 percent will pay 10 percent on each additional dollar earned, 30 percent are in the 15 percent bracket, 14 percent are in the 25 percent bracket, and 4 percent of taxpayers face marginal rates above 25 percent. About one half of one percent of taxpayers paid any taxes at the 35 percent top statutory rate.

I’m not going to waste my time with those who will insist that people were thinking about payroll taxes, estate and gift taxes, property taxes and all the other taxes that exist at the federal, state and local level. Today is the day we pay federal income taxes and that’s what people were out protesting. And there is no getting around the fact that the vast majority of people think that the federal income tax burden is very considerably higher than it actually is.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply