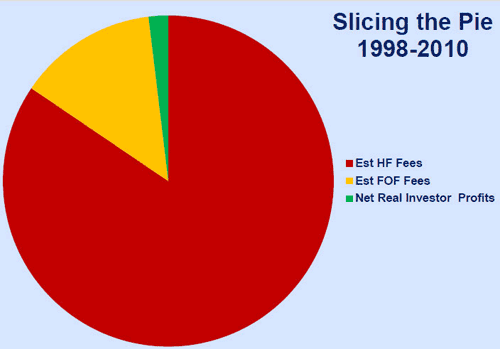

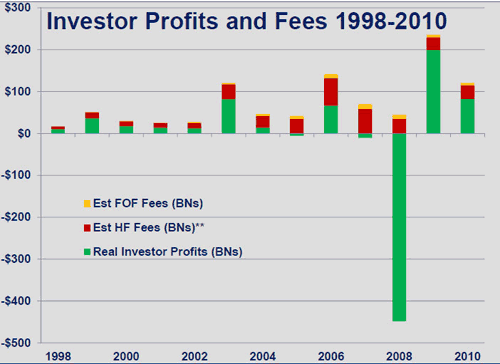

The graph above shows the portion of hedge fund profits that go to the hedge funds, the fund-of-funds, and the investors, using total dollars from 1998-2010. This is from Simon Lack’s presentation, which is derived from his book Hedge Fund Mirage. Notice 97% go to insiders, 3% to investors.

Like most strategies or asset classes, the money made on a percent basis is large because it basically grows until it can’t work, at which point it loses more money than it made and then some more (see above graph, 2008 killed everything). It could be thought of as an endogenous reaction, because how else will you know at what point it stops working? Perhaps this is the essence of all financial cycles.

One good point by Lack was that fund managers inevitably argue they do not fit into clean categories; that they, unlike everyone else, is neither fish nor fowl. I suppose we all think we are unique, and don’t like to be benchmarked, but on the other hand, everyone is riskier without a benchmark.

Leave a Reply