I think tobacco bonds are headed into the crapper. There’s about $56b of them out there. Most of that is either in retail hands or in bond funds that retail owns. This is likely to be a slow motion train wreck rather than something that explodes into the headlines one morning. But it will put a dent into some 401Ks. It already has.

By way of background on this let me diverge a bit and give you my side of the tobacco story. I knew a fellow who was a mover and shaker in one of the big US tobacco companies. Back in 1998 the tobacco companies reached what appeared to be a very harsh settlement with the states. The essence of that deal was that big tobacco would fork over a huge wad of money and the states agreed not to sue for healthcare claims. At the time the deal was inked I had a conversation with the guy. It went something like this:

BK: Man you guys took it in the ear on this one. Good-bye dividends, goodbye profits. You guys got smoked!

Lucky Strike: You have it totally wrong. This is a great deal for us. This is exactly the deal that we hoped to achieve when we started this out. It looks like we are big losers, but in fact, we are big winners.

BK: Huh? That’s not what it says in the papers. They say you will have to fork over ¼ trillion over the next few decades. How’s that such a good deal?

Lucky Strike: You have to understand, there was a real possibility that tobacco would become a controlled substance. If that had been the case we would have folded the tent in the USA. But with this settlement we are guaranteed to be in business forever, and we are shielded from liability. We made a pact with the devil. In this case, the State Treasurers are the devil.

BK: I don’t get it. Sure there is a new source of revenue for the states, but there is also the increased medical cost that goes with it. Where’s the Beef?

Lucky Strike: This deal allows the states to securitize the future revenue from this settlement. That means they can issue new bonds but they don’t have to show it in their debt profile. The tobacco settlement is just a way for the states to get off balance sheet financing. The guys on Walls street are already ginning this up. The states can issue billions of new bonds. The current crop of “Ins” will spend it. We used the State’s greed to get what we wanted.

BK: But this is all going to blow up if the states do that! Ten – Fifteen years from now this is all going to come due. What happens if they hock the future settlement proceeds and then we find that there are no proceeds?

Lucky Strike: If that were to happen it all goes Boom. But I’m retiring in five years and those that inked this deal from the states will be gone before the flameout. In the meantime everyone is fat and happy.

BK: Oh. So that’s how things work.

Note: A lot of readers have said that I dwell on the ‘dark side’. It’s true. Stories like this one are the reason why. It’s not nice on the dark side. But when it comes to politicians, money and Wall Street you’re safer with the dark view. You don’t get surprised as much buy what happens.

Back to June of 2011 and the cracks on all this are starting to appear, Some quotes from a recent Bond Buyer story:

The payments that cigarette manufacturers make to the states are dwindling as people smoke less, posing the latest setback to tobacco bonds.

“We saw a consumption decline that was above and beyond our base-case expectation,” said Aoto Kenmochi, a tobacco bond analyst at Fitch Ratings.

The precipitous decline in payments threatens to leave some tobacco bonds outstanding longer than expected. In the worst cases, the withering payments could eventually push some bonds into default.

Fitch has downgraded dozens of tobacco deals as the fading settlement payments have left tobacco structures with less of a cushion to tolerate further erosions.

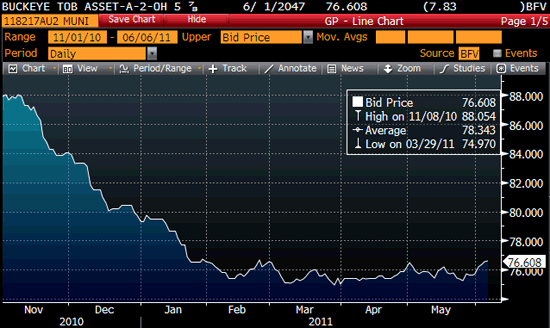

Here a few charts on some outstanding tobacco bonds. If you want a high current yield this is for you. But beware; you may never get your principal back.

You can see from the pricing that these dogs have already been hit hard. More bad news is in front of these bonds.

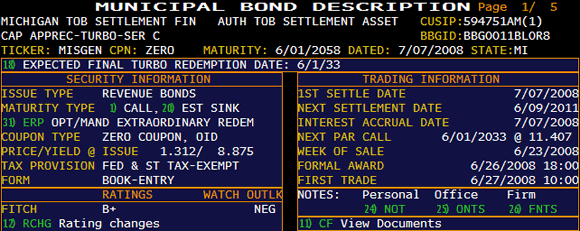

The worst of the worst is the following. I have this on my Piece of S#*! list. Consider the insanity of this. Back in 2008 the State of Michigan borrowed $58 million. They spent this money the very next day. This is a zero coupon bond so Michigan doesn’t have to pay a penny until the maturity. The maturity was FIFTY YEARS!!!! The principal due at maturity? An unbelievable $4.4 BILLION. And there is not sufficient revenue to cover it. Note: This piece of crap is in pension fund hands. Talk about kicking a can down the road.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply