The head of the Minneapolis Fed, Narayana Kocherlakota gave a presentation in Marseilles, France on Friday. This was another attempt at convincing the public that the Fed can fix anything provided they are left to their own devices and have unlimited capacity to print money. The presentation was a “No Sale” for me.

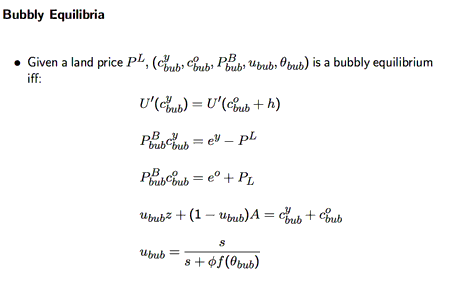

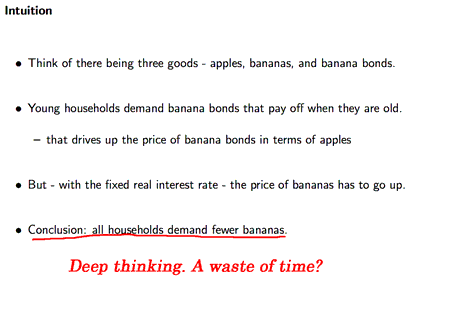

The deep thinkers in Minneapolis have come up with a new formula. Bubbly Equilibria? What does that mean?

I suppose that someone has to create such drivel. The formulas were based on an Apples and Bananas economic model. Unfortunately the real world is a bit more complex.

The bottom line from Mr. K is that bubbles of any kind don’t create a threat to employment provided that the Fed provides the “appropriate” level of monetary stimulus. He does point out the limits of monetary policy due to the limitations of zero interest rates. So really this is just a defense of QE. His words:

“The bubble collapse has no impact on unemployment or output, given sufficiently accommodative monetary policy,”

This suggests that the Fed can “fix” all bubbles. What Mr. K does not seem to get is that the Fed is the one that causes bubbles. They do it with accommodative monetary policy. We are seeing this in ink every day. Look at the S&P, look at the CRB and look at the two-year note. They are all at bubble levels today. It’s cheap money and loose monetary policy that did it. The current bubbles formed by the Fed will pop. And when (not if) they do, guys like Kocherlakota will respond with: “We need more stimulus!!”

We do need some folks at the Fed who are purely academic economists. But they should not be pulling the strings on policy. We need pragmatists. Ones that can look beyond the next six months and say, “We should follow policies that promote long –term stability”. The current policies that create bubbles, and then fight them when they burst with more monetary stimulus, are old school. We need some new leadership. That leadership should not come from academia.

Want some evidence of that? (Reuters)

In one of the paper’s more surprising claims, Kocherlakota suggested that extending unemployment benefits — sometimes seen as adding to the jobless rate because it can discourage those receiving benefits from actively seeking jobs — actually reduces it.

Mr. K. has to get out of ivory tower and talk to the people. He may be able to argue that extending unemployment benefits is countercyclical. But if he bothered to ask around and see what is happening he would understand that extending unemployment just creates more unemployed. I’d be happy to introduce him to a few folks that maxed out unemployment because it was much easier than working. But those people found work as soon as the checks stopped.

I suspect he would hear as much back in Minneapolis (if he bothered to ask). He would also hear that the folks in his district are just sick and tired of bubbles and the Fed that keeps causing them.

Leave a Reply